Business / Local

ZIMRA Introduces PAYE Employee Management Module

3 hrs ago | Views

Harare, Zimbabwe - The Zimbabwe Revenue Authority (ZIMRA) has announced the launch of an Employee Management Module, under its popular TaRMS platform set to come into effect with the

January 2025 PAYE Return.This new module aims to streamline the registration of employees and the declaration of their earnings, making the tax process more efficient for employers.

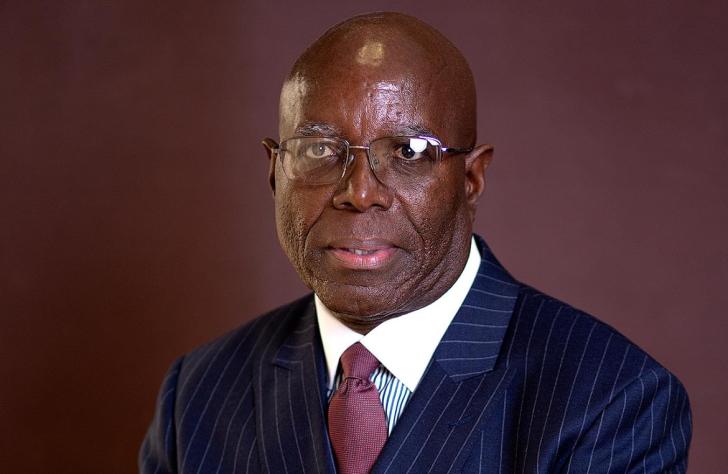

"The Employee Management Module will provide a platform for entities to register their employees and declare their earnings, allowing for automatic tax computation by the system. Each registered employee will be allocated a Tax Identification Number (TIN), and those who are already registered will retain their existing TINs," explained Mr Misheck Govha, ZIMRA Domestic Taxes Commissioner.

The new Employee Management Module will include several features with the most notable being the Comprehensive Employee Registration, Flexible Registration Options, Additional Tax Credits, Auto-filling of PAYE and AIDS Levy.

"Under the Employee Management Module, employers will be able to auto-fill PAYE and AIDS levy. After generating earnings for all employees, the PAYE and AIDS Levy will automatically populate on the PAYE return within the Tax Returns Management module.

"Additionally, Employers can choose to register employees individually or utilize the Employee Upload Function to register multiple employees at once," explained Commissioner Govha.

In order to fully benefit from the system's Comprehensive Employee Registration, Employers must declare essential information when registering employees, including marital status, blindness, physical disabilities (for both employees and their children), and the date of birth. This data will enable the system to automatically grant applicable tax credits.

"ZIMRA encourages all taxpayers and employers to familiarize themselves with the new Employee Management Module to ensure compliance and a smooth transition," emphasised Mr Govha.

The new Module also provides for Additional Tax Credits under which employers will also have the opportunity to declare other tax credits, such as Medical Aid Contributions and Medical Expenses Credits, during the earnings declaration process.

January 2025 PAYE Return.This new module aims to streamline the registration of employees and the declaration of their earnings, making the tax process more efficient for employers.

"The Employee Management Module will provide a platform for entities to register their employees and declare their earnings, allowing for automatic tax computation by the system. Each registered employee will be allocated a Tax Identification Number (TIN), and those who are already registered will retain their existing TINs," explained Mr Misheck Govha, ZIMRA Domestic Taxes Commissioner.

The new Employee Management Module will include several features with the most notable being the Comprehensive Employee Registration, Flexible Registration Options, Additional Tax Credits, Auto-filling of PAYE and AIDS Levy.

"Under the Employee Management Module, employers will be able to auto-fill PAYE and AIDS levy. After generating earnings for all employees, the PAYE and AIDS Levy will automatically populate on the PAYE return within the Tax Returns Management module.

"Additionally, Employers can choose to register employees individually or utilize the Employee Upload Function to register multiple employees at once," explained Commissioner Govha.

In order to fully benefit from the system's Comprehensive Employee Registration, Employers must declare essential information when registering employees, including marital status, blindness, physical disabilities (for both employees and their children), and the date of birth. This data will enable the system to automatically grant applicable tax credits.

"ZIMRA encourages all taxpayers and employers to familiarize themselves with the new Employee Management Module to ensure compliance and a smooth transition," emphasised Mr Govha.

The new Module also provides for Additional Tax Credits under which employers will also have the opportunity to declare other tax credits, such as Medical Aid Contributions and Medical Expenses Credits, during the earnings declaration process.

Source - Agencies