News / Local

RBZ assures bonus payments will not disrupt economic stability

2 hrs ago | Views

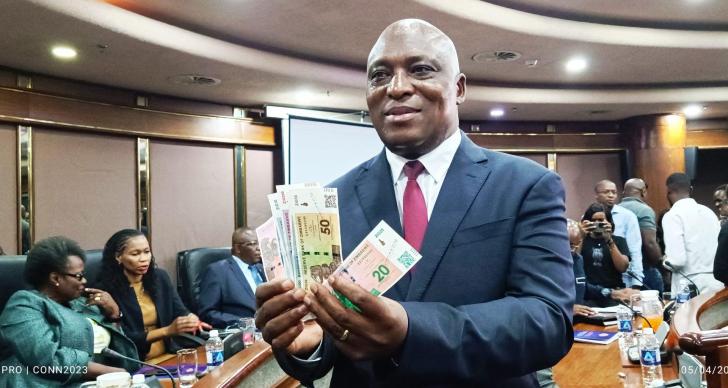

Reserve Bank of Zimbabwe (RBZ) Governor Dr. John Mushayavanhu has assured that the payment of civil servant bonuses ahead of the festive season will not affect price stability or the exchange rate.

Speaking to The Sunday Mail, Dr. Mushayavanhu attributed this stability to recent policy measures that have curtailed excess liquidity and speculative demand for foreign currency.

This year, civil servants' bonuses are being paid in both US dollars and Zimbabwe Gold (ZiG), with a larger portion in hard currency. Dr. Mushayavanhu stated that the payments had been planned and budgeted for, ensuring no undue pressure on the economy.

"The Government has already budgeted for civil service bonuses, which are accommodated within Government revenues, implying no significant impact on the exchange rate and prices," he said.

He also highlighted that the Government expects substantial revenue inflows from fourth-quarter payment dates, which will further support fiscal stability.

Dr. Mushayavanhu noted that the festive season typically sees a rise in economic activity and consumption. Retailers often introduce discounts, while diaspora remittances increase as Zimbabweans abroad return home for the holidays.

"The net effect on exchange rate and prices is likely to be minimal," he said, citing these factors as mitigating risks of market disruptions.

Recent monetary policy adjustments have significantly contributed to exchange rate stability and reduced parallel market activity. Key measures include: Raising the bank policy rate from 20% to 35%. Increasing statutory reserve requirements to 30%. Enhancing the flexibility of the willing-buyer, willing-seller foreign exchange market.

Dr. Mushayavanhu explained that these steps had improved foreign currency supply while reducing the parallel market premium, leading to greater stability in currency and prices.

"The Reserve Bank's tight monetary policy stance will continue to have a positive impact and result in further narrowing," he said.

The Liquidity Management Committee (LMC), a joint initiative between the central bank and Treasury, has played a pivotal role in managing liquidity and mitigating risks.

"To complement the LMC, the RBZ has re-established the Open Market Operations Committee, which meets regularly to manage liquidity in the economy," Dr. Mushayavanhu added.

Reserves and Economic Stability

Zimbabwe's total reserves, including gold, have grown to approximately US$540 million, more than triple the reserve money of ZiG4 billion (US$155 million).

This marks a significant improvement from the US$285 million in reserves when the ZiG was introduced in April 2024. The reserves now exceed total banking sector deposits, currently standing at approximately ZiG12 billion (US$467 million).

This robust reserve position underpins the stability of the economy and strengthens the RBZ's ability to maintain price and currency stability as the country heads into the festive season.

Speaking to The Sunday Mail, Dr. Mushayavanhu attributed this stability to recent policy measures that have curtailed excess liquidity and speculative demand for foreign currency.

This year, civil servants' bonuses are being paid in both US dollars and Zimbabwe Gold (ZiG), with a larger portion in hard currency. Dr. Mushayavanhu stated that the payments had been planned and budgeted for, ensuring no undue pressure on the economy.

"The Government has already budgeted for civil service bonuses, which are accommodated within Government revenues, implying no significant impact on the exchange rate and prices," he said.

He also highlighted that the Government expects substantial revenue inflows from fourth-quarter payment dates, which will further support fiscal stability.

Dr. Mushayavanhu noted that the festive season typically sees a rise in economic activity and consumption. Retailers often introduce discounts, while diaspora remittances increase as Zimbabweans abroad return home for the holidays.

"The net effect on exchange rate and prices is likely to be minimal," he said, citing these factors as mitigating risks of market disruptions.

Recent monetary policy adjustments have significantly contributed to exchange rate stability and reduced parallel market activity. Key measures include: Raising the bank policy rate from 20% to 35%. Increasing statutory reserve requirements to 30%. Enhancing the flexibility of the willing-buyer, willing-seller foreign exchange market.

Dr. Mushayavanhu explained that these steps had improved foreign currency supply while reducing the parallel market premium, leading to greater stability in currency and prices.

"The Reserve Bank's tight monetary policy stance will continue to have a positive impact and result in further narrowing," he said.

The Liquidity Management Committee (LMC), a joint initiative between the central bank and Treasury, has played a pivotal role in managing liquidity and mitigating risks.

"To complement the LMC, the RBZ has re-established the Open Market Operations Committee, which meets regularly to manage liquidity in the economy," Dr. Mushayavanhu added.

Reserves and Economic Stability

Zimbabwe's total reserves, including gold, have grown to approximately US$540 million, more than triple the reserve money of ZiG4 billion (US$155 million).

This marks a significant improvement from the US$285 million in reserves when the ZiG was introduced in April 2024. The reserves now exceed total banking sector deposits, currently standing at approximately ZiG12 billion (US$467 million).

This robust reserve position underpins the stability of the economy and strengthens the RBZ's ability to maintain price and currency stability as the country heads into the festive season.

Source - The Sunday Mail