News / National

Zimbabwe central bank goes after informal traders forex, exporters' proceeds

3 hrs ago | Views

The Reserve Bank of Zimbabwe (RBZ) has announced a further reduction in export retention proceeds, cutting them by an additional 5%, as part of measures aimed at boosting foreign currency reserves and stabilizing the economy. The new directive, which will see the retention level drop from 75% to 70%, comes amid growing concerns over foreign currency circulation and exchange rate volatility.

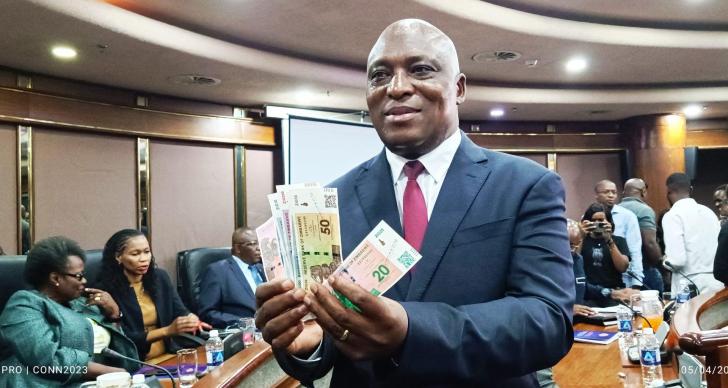

The move was detailed by RBZ Governor John Mushayavanhu in the 2025 Monetary Policy Statement released on Wednesday. The governor cited the struggling Zimbabwe Gold (ZiG), which remains the country's functional and reporting currency despite the increasing dollarization of the economy, as a primary factor contributing to the volatility.

In his address, Mushayavanhu explained that the reduction in export retention proceeds was necessary to augment the supply of foreign currency in the market, thereby stabilizing the interbank foreign exchange market and building the critical reserves needed to anchor the ZiG.

“The foreign currency retention level for exporters has been reduced from 75% to 70%, with immediate effect," Mushayavanhu said. “This implies that the effective surrender portion of export proceeds has been increased from 25% to 30%."

He added that this change was aligned with the increased use of ZiG in the economy, stressing that the additional 5% would help exporters mobilize sufficient ZiG to meet local currency obligations, including tax payments.

For exporters who do not immediately need the additional 5% of their export proceeds in ZiG, the RBZ will offer an option to invest those funds in a US dollar-denominated deposit facility, which will be controlled by the central bank.

Further tightening measures included directives for banks and payment systems providers to ensure that all businesses, whether new or existing, are issued a point-of-sale (POS) machine or another approved digital mechanism to facilitate transactions in both ZiG and US dollars. The RBZ is keen on promoting the use of non-banking channels for domestic trading and has instructed licensing authorities to ensure that all applicants for trading licenses possess both a bank account and a functional POS machine. Failure to comply will result in non-renewal of business licenses.

“If you don't have a bank account and you don't have a POS machine, your license will not be renewed," Mushayavanhu stated, emphasizing that this policy would apply to all types of businesses, from traders to bottle store owners.

The central bank also addressed the issue of the informal sector, which it estimates generates an annual turnover of US$14.2 billion, with approximately US$2.5 billion circulating at any given time. To encourage more formal transactions, POS transactions for amounts less than US$5 or its equivalent in ZiG will be exempt from transaction charges.

Mushayavanhu's announcement comes as the RBZ reported an increase in foreign currency reserves, which have risen by approximately 90% to around US$550 million (ZiG14.3 billion) as of the end of January 2025, compared to US$285 million in April 2024. Despite this growth, the central bank acknowledged that the amounts circulating in the informal sector remain significantly higher than those in the formal economy.

With Zimbabwe's economy grappling with inflationary pressures and currency instability, the RBZ's latest measures are aimed at increasing foreign currency liquidity and ensuring a more stable economic environment as the country seeks to manage its dollarized economy while maintaining the viability of the ZiG.

The move was detailed by RBZ Governor John Mushayavanhu in the 2025 Monetary Policy Statement released on Wednesday. The governor cited the struggling Zimbabwe Gold (ZiG), which remains the country's functional and reporting currency despite the increasing dollarization of the economy, as a primary factor contributing to the volatility.

In his address, Mushayavanhu explained that the reduction in export retention proceeds was necessary to augment the supply of foreign currency in the market, thereby stabilizing the interbank foreign exchange market and building the critical reserves needed to anchor the ZiG.

“The foreign currency retention level for exporters has been reduced from 75% to 70%, with immediate effect," Mushayavanhu said. “This implies that the effective surrender portion of export proceeds has been increased from 25% to 30%."

He added that this change was aligned with the increased use of ZiG in the economy, stressing that the additional 5% would help exporters mobilize sufficient ZiG to meet local currency obligations, including tax payments.

For exporters who do not immediately need the additional 5% of their export proceeds in ZiG, the RBZ will offer an option to invest those funds in a US dollar-denominated deposit facility, which will be controlled by the central bank.

Further tightening measures included directives for banks and payment systems providers to ensure that all businesses, whether new or existing, are issued a point-of-sale (POS) machine or another approved digital mechanism to facilitate transactions in both ZiG and US dollars. The RBZ is keen on promoting the use of non-banking channels for domestic trading and has instructed licensing authorities to ensure that all applicants for trading licenses possess both a bank account and a functional POS machine. Failure to comply will result in non-renewal of business licenses.

“If you don't have a bank account and you don't have a POS machine, your license will not be renewed," Mushayavanhu stated, emphasizing that this policy would apply to all types of businesses, from traders to bottle store owners.

The central bank also addressed the issue of the informal sector, which it estimates generates an annual turnover of US$14.2 billion, with approximately US$2.5 billion circulating at any given time. To encourage more formal transactions, POS transactions for amounts less than US$5 or its equivalent in ZiG will be exempt from transaction charges.

Mushayavanhu's announcement comes as the RBZ reported an increase in foreign currency reserves, which have risen by approximately 90% to around US$550 million (ZiG14.3 billion) as of the end of January 2025, compared to US$285 million in April 2024. Despite this growth, the central bank acknowledged that the amounts circulating in the informal sector remain significantly higher than those in the formal economy.

With Zimbabwe's economy grappling with inflationary pressures and currency instability, the RBZ's latest measures are aimed at increasing foreign currency liquidity and ensuring a more stable economic environment as the country seeks to manage its dollarized economy while maintaining the viability of the ZiG.

Source - newsday