News / National

Mukuru advocates for cashless economy

09 Feb 2025 at 17:13hrs | Views

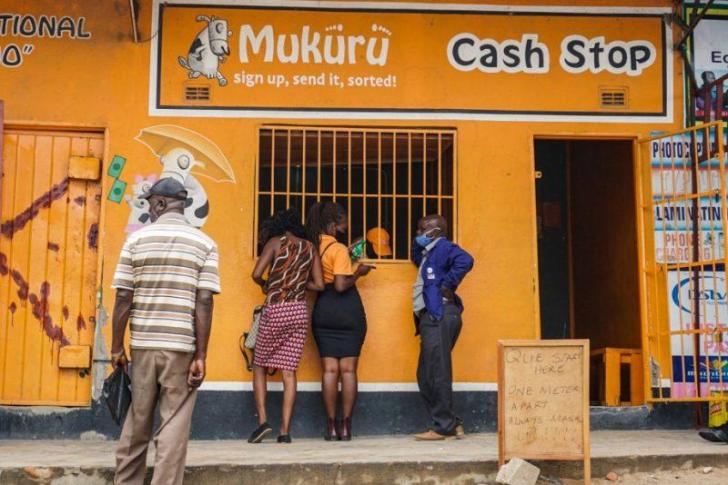

The logistics of handling cash in Zimbabwe present significant obstacles, but Doug Tait-Knight, the Chief Executive Officer of Mukuru Zimbabwe Financial Services, believes that embracing digital payments is essential for a more efficient and competitive economy.

"Working with cash is a challenge due to the logistics involved and the risk landscape, which, although manageable in Zimbabwe, requires considerable personnel, logistical costs, and administrative efforts," Tait-Knight explained. "However, by transitioning to a digital world, we can avoid these challenges."

Tait-Knight recognized that the shift to a fully digital economy would not happen overnight, but he emphasized Zimbabwe's existing familiarity with digital platforms. Despite this, he noted that many Zimbabweans are still not fully aware of the benefits that a digital economy can offer. His company, Mukuru, aims to increase awareness and boost competitiveness in the digital space.

One of the key advantages of digital operations, according to Tait-Knight, is the ability to provide 24/7 accessibility. Unlike physical locations, which are constrained by operating hours, digital platforms enable round-the-clock service availability, making it far more convenient for users.

Tait-Knight also addressed the impact of currency fluctuations on supply and demand. He noted that while the local currency's volatility can affect domestic markets, it does not directly influence external economies or the decisions of the Zimbabwean diaspora unless individuals choose to operate in the parallel market instead of formal channels.

A significant challenge in promoting digital payments, Tait-Knight acknowledged, has been persuading people to opt for formal, digital methods over informal cash-based channels. Concerns about safety, efficiency, and reliability have been key barriers. However, he emphasized that Mukuru's commitment to cash guarantees sets it apart from competitors, highlighting that the company has always maintained this feature, even during cash shortages.

"Our cash guarantee is a big difference; we have always maintained that over the years, and we have always had healthy competition," he said.

Mukuru has built a reputation for reliability, particularly in times of cash shortages, thanks to its secure and efficient digital services. Tait-Knight underlined the importance of coexisting with competitors in both the formal and informal financial sectors.

"The safety, the security, the reliability of our technology, I think, is unmatched. So, I am very confident that this is something that will benefit users. We have multi-channel access to our wallet," Tait-Knight said.

The company's wallet service is designed to be accessible through various channels, including USSD and WhatsApp, ensuring that even users without smartphones can access services. This flexibility, according to Tait-Knight, is a significant advantage that sets Mukuru apart in the market.

"This flexibility is a significant differentiator, and our network is uniquely positioned to capitalize on this advantage," Tait-Knight said.

As Zimbabwe continues to grapple with cash-related challenges, the push toward digital payments seems poised to become a central part of the country's economic future, with Mukuru leading the charge in promoting this shift.

"Working with cash is a challenge due to the logistics involved and the risk landscape, which, although manageable in Zimbabwe, requires considerable personnel, logistical costs, and administrative efforts," Tait-Knight explained. "However, by transitioning to a digital world, we can avoid these challenges."

Tait-Knight recognized that the shift to a fully digital economy would not happen overnight, but he emphasized Zimbabwe's existing familiarity with digital platforms. Despite this, he noted that many Zimbabweans are still not fully aware of the benefits that a digital economy can offer. His company, Mukuru, aims to increase awareness and boost competitiveness in the digital space.

One of the key advantages of digital operations, according to Tait-Knight, is the ability to provide 24/7 accessibility. Unlike physical locations, which are constrained by operating hours, digital platforms enable round-the-clock service availability, making it far more convenient for users.

Tait-Knight also addressed the impact of currency fluctuations on supply and demand. He noted that while the local currency's volatility can affect domestic markets, it does not directly influence external economies or the decisions of the Zimbabwean diaspora unless individuals choose to operate in the parallel market instead of formal channels.

A significant challenge in promoting digital payments, Tait-Knight acknowledged, has been persuading people to opt for formal, digital methods over informal cash-based channels. Concerns about safety, efficiency, and reliability have been key barriers. However, he emphasized that Mukuru's commitment to cash guarantees sets it apart from competitors, highlighting that the company has always maintained this feature, even during cash shortages.

Mukuru has built a reputation for reliability, particularly in times of cash shortages, thanks to its secure and efficient digital services. Tait-Knight underlined the importance of coexisting with competitors in both the formal and informal financial sectors.

"The safety, the security, the reliability of our technology, I think, is unmatched. So, I am very confident that this is something that will benefit users. We have multi-channel access to our wallet," Tait-Knight said.

The company's wallet service is designed to be accessible through various channels, including USSD and WhatsApp, ensuring that even users without smartphones can access services. This flexibility, according to Tait-Knight, is a significant advantage that sets Mukuru apart in the market.

"This flexibility is a significant differentiator, and our network is uniquely positioned to capitalize on this advantage," Tait-Knight said.

As Zimbabwe continues to grapple with cash-related challenges, the push toward digital payments seems poised to become a central part of the country's economic future, with Mukuru leading the charge in promoting this shift.

Source - the standard