News / National

Zimbabwe central bank cracks down on cash hoarding

16 hrs ago | Views

The Reserve Bank of Zimbabwe (RBZ) has expressed concern over millions of dollars lying idle in cash deposit boxes across the country, warning that the growing trend is stifling economic growth by depriving the economy of much-needed liquidity.

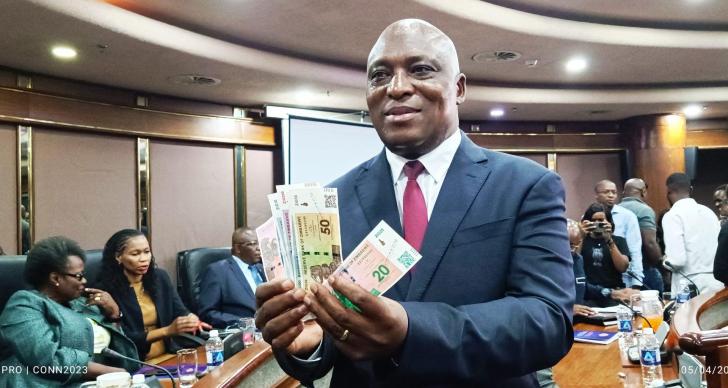

Announcing the 2025 Monetary Policy Statement, RBZ Governor Dr. John Mushayavanhu condemned the practice, describing it as financial disintermediation that harms economic activity. He emphasized that the Financial Intelligence Unit (FIU) would take decisive action to address the malpractice.

"There are manufacturers who are supplying goods to the informal market but are not banking their proceeds. They are keeping these monies in their cash boxes, which is not in line with the Anti-Money Laundering Act. The FIU will not just watch but will dismantle this practice," Dr. Mushayavanhu said.

Dr. Mushayavanhu highlighted the risks associated with keeping large sums of cash, including susceptibility to theft. He pointed out that updated banking policies now offer safer and more attractive alternatives for handling money.

"We have seen cases of cross-border traders being robbed of cash while traveling. This is unnecessary given that individuals can upload their money onto prepaid cards, with limits now increased to US$1 million," he explained.

He also noted that the RBZ has introduced higher interest rates on savings accounts to encourage a culture of saving and to make banking a more appealing option.

The RBZ is implementing measures aimed at building public confidence in the banking sector. These include incremental increases in interest rates on savings accounts and the upward review of transaction limits on prepaid credit.

"We believe these adjustments make banking more sensible and reduce the need to keep cash. Banking one's earnings not only ensures safety but also strengthens the economy by boosting liquidity," Dr. Mushayavanhu said.

The governor emphasized that hoarding cash undermines the economy by restricting the flow of money needed to fuel economic growth. Liquidity is a critical element for businesses, households, and government operations, and withholding funds from the formal banking system hinders investment and development efforts.

Dr. Mushayavanhu encouraged manufacturers, traders, and individuals to embrace formal banking channels and warned that the FIU would monitor compliance closely.

The RBZ's stance underscores the importance of aligning financial practices with national economic goals as the country strives to achieve greater stability and growth.

Announcing the 2025 Monetary Policy Statement, RBZ Governor Dr. John Mushayavanhu condemned the practice, describing it as financial disintermediation that harms economic activity. He emphasized that the Financial Intelligence Unit (FIU) would take decisive action to address the malpractice.

"There are manufacturers who are supplying goods to the informal market but are not banking their proceeds. They are keeping these monies in their cash boxes, which is not in line with the Anti-Money Laundering Act. The FIU will not just watch but will dismantle this practice," Dr. Mushayavanhu said.

Dr. Mushayavanhu highlighted the risks associated with keeping large sums of cash, including susceptibility to theft. He pointed out that updated banking policies now offer safer and more attractive alternatives for handling money.

"We have seen cases of cross-border traders being robbed of cash while traveling. This is unnecessary given that individuals can upload their money onto prepaid cards, with limits now increased to US$1 million," he explained.

He also noted that the RBZ has introduced higher interest rates on savings accounts to encourage a culture of saving and to make banking a more appealing option.

The RBZ is implementing measures aimed at building public confidence in the banking sector. These include incremental increases in interest rates on savings accounts and the upward review of transaction limits on prepaid credit.

"We believe these adjustments make banking more sensible and reduce the need to keep cash. Banking one's earnings not only ensures safety but also strengthens the economy by boosting liquidity," Dr. Mushayavanhu said.

The governor emphasized that hoarding cash undermines the economy by restricting the flow of money needed to fuel economic growth. Liquidity is a critical element for businesses, households, and government operations, and withholding funds from the formal banking system hinders investment and development efforts.

Dr. Mushayavanhu encouraged manufacturers, traders, and individuals to embrace formal banking channels and warned that the FIU would monitor compliance closely.

The RBZ's stance underscores the importance of aligning financial practices with national economic goals as the country strives to achieve greater stability and growth.

Source - zbc