News / National

'Zimbabwe banks have robust cybersecurity systems'

6 hrs ago | Views

The Reserve Bank of Zimbabwe (RBZ) has prioritized cybersecurity and artificial intelligence (AI) as critical pillars for the financial sector's growth and stability, according to its 2025 Monetary Policy Statement (MPS).

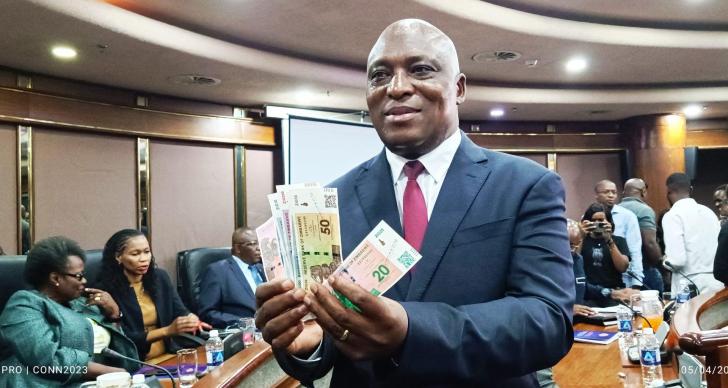

RBZ Governor Dr. John Mushayavanhu revealed that an assessment conducted in 2024 showed that the majority of financial institutions in Zimbabwe had achieved satisfactory levels of cybersecurity resilience. This progress has been underpinned by robust risk management frameworks and effective systems for detecting and responding to cyber threats.

"The assessment indicated satisfactory cyber maturity across most institutions, with well-established risk management systems safeguarding critical data and supporting effective threat detection and response," Dr. Mushayavanhu stated.

While most financial institutions have already developed cyber resilience strategies, the RBZ noted ongoing efforts to enhance these frameworks. Dr. Mushayavanhu stressed the importance of raising awareness to strengthen cybersecurity further.

"It was also noted that the majority of the financial institutions are carrying out cyber awareness programmes," he added.

The central bank pledged to continue monitoring the sector's resilience and sharing insights through detailed reports to promote best practices.

The RBZ also spotlighted the growing role of artificial intelligence in shaping the future of banking and financial services. Preliminary findings from the 2024 survey highlighted increasing adoption of AI-driven solutions, including automated report generation and real-time compliance tracking.

"Preliminary survey results depicted a growing AI maturity, with many institutions establishing foundational risk management and reporting systems," Dr. Mushayavanhu said.

However, advanced AI tools like predictive compliance modelling remain underutilized, signaling that the sector is still in the early stages of AI integration.

Banking veteran Mr. Raymond Madziva underscored the importance of cybersecurity as a cornerstone of financial stability.

"In today's digital age, where cyber threats are increasingly sophisticated, robust cybersecurity measures are not just a necessity but a competitive advantage," he remarked.

Technology expert Mr. Morris Shumba echoed these sentiments, emphasizing the need for structured AI implementation to ensure responsible innovation.

"Clear policies and strategies are crucial to harnessing AI's full potential while mitigating associated risks," he advised, adding that investments in AI education and infrastructure are essential.

Looking ahead, the RBZ remains committed to fostering a secure, innovative, and technologically advanced financial sector. Its focus on cybersecurity and AI adoption positions Zimbabwe's banking and microfinance sectors to meet the challenges of an increasingly digital world.

As financial institutions refine their resilience strategies and expand their AI capabilities, the stage is set for a transformative era in Zimbabwe's financial services landscape.

RBZ Governor Dr. John Mushayavanhu revealed that an assessment conducted in 2024 showed that the majority of financial institutions in Zimbabwe had achieved satisfactory levels of cybersecurity resilience. This progress has been underpinned by robust risk management frameworks and effective systems for detecting and responding to cyber threats.

"The assessment indicated satisfactory cyber maturity across most institutions, with well-established risk management systems safeguarding critical data and supporting effective threat detection and response," Dr. Mushayavanhu stated.

While most financial institutions have already developed cyber resilience strategies, the RBZ noted ongoing efforts to enhance these frameworks. Dr. Mushayavanhu stressed the importance of raising awareness to strengthen cybersecurity further.

"It was also noted that the majority of the financial institutions are carrying out cyber awareness programmes," he added.

The central bank pledged to continue monitoring the sector's resilience and sharing insights through detailed reports to promote best practices.

The RBZ also spotlighted the growing role of artificial intelligence in shaping the future of banking and financial services. Preliminary findings from the 2024 survey highlighted increasing adoption of AI-driven solutions, including automated report generation and real-time compliance tracking.

However, advanced AI tools like predictive compliance modelling remain underutilized, signaling that the sector is still in the early stages of AI integration.

Banking veteran Mr. Raymond Madziva underscored the importance of cybersecurity as a cornerstone of financial stability.

"In today's digital age, where cyber threats are increasingly sophisticated, robust cybersecurity measures are not just a necessity but a competitive advantage," he remarked.

Technology expert Mr. Morris Shumba echoed these sentiments, emphasizing the need for structured AI implementation to ensure responsible innovation.

"Clear policies and strategies are crucial to harnessing AI's full potential while mitigating associated risks," he advised, adding that investments in AI education and infrastructure are essential.

Looking ahead, the RBZ remains committed to fostering a secure, innovative, and technologically advanced financial sector. Its focus on cybersecurity and AI adoption positions Zimbabwe's banking and microfinance sectors to meet the challenges of an increasingly digital world.

As financial institutions refine their resilience strategies and expand their AI capabilities, the stage is set for a transformative era in Zimbabwe's financial services landscape.

Source - The Herald