News / National

Zimbabwe records strong forex surplus

01 Jun 2025 at 14:35hrs | Views

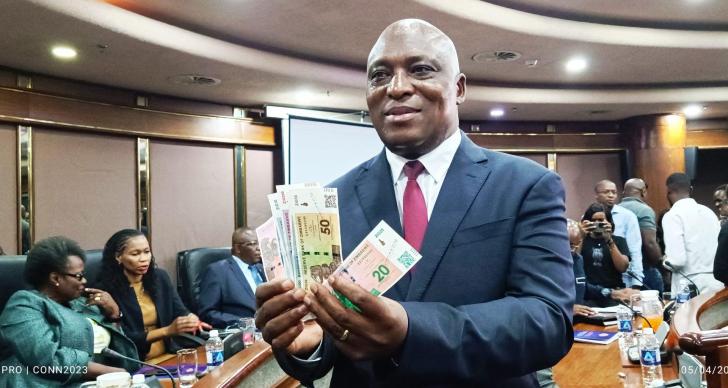

Zimbabwe has experienced sustained foreign currency inflows that not only meet its external payment obligations but have generated a substantial surplus averaging US$400 million per month over the 14-month period from January 2024 to February 2025. This was revealed by Reserve Bank of Zimbabwe (RBZ) Governor Dr. John Mushayavanhu.

According to Dr. Mushayavanhu, foreign currency receipts during this period averaged US$1.1 billion monthly, while external payment obligations stood at an average of US$784 million per month. The resulting buffer has provided critical liquidity support to businesses and households across the country.

Banking sector expert Ms. Tariro Chikomo noted that this surplus could create conditions for banks to offer more competitive lending terms. "When banks know that foreign currency obligations are met and exceeded, a potential easing of lending rates can stabilise, and we can offer more competitive terms to borrowers," she said.

The RBZ also reported a moderation in the growth of Zimbabwean Dollar (ZiG) loans. Since October 2024, ZiG loans have grown at an average weekly rate of 1 percent, a significant slowdown from the 6.9 percent weekly growth recorded prior to September 27, 2024.

By March 2025, total ZiG loans stood at ZiG50.7 billion, with 12 percent denominated in local currency, while local currency deposits accounted for 15.9 percent of the total deposit base.

Senior economist Dr. Prosper Chitambara of the Zimbabwe Economic Research Institute linked this moderation in credit growth to the healthy external surplus. "With US$400 million extra each month, the central bank can afford to be selective in domestic credit creation. This ensures that lending is not merely chasing short-term profit but supporting sustainable ventures. The surplus underpins confidence in ZiG, enabling a responsible expansion of loans," he said.

Economist Mrs. Gladys Shumbambiri-Mutsopotsi said disciplined loan growth positively impacts the economy. "The moderation in ZiG credit growth, aligned with the external surplus, signals that monetary authorities are balancing the need for credit with the imperative of exchange rate and price stability," she explained. "Depositors and borrowers alike benefit when policy frameworks link external strength with domestic lending practices."

Dr. Mushayavanhu attributed these positive developments to the RBZ's "tight monetary policy stance." He highlighted that monthly growth in the ZiG component of money supply has stabilized at just under 1 percent as of March 2025, down sharply from over 100 percent prior to the introduction of ZiG.

"These measures have succeeded in curtailing the pass-through effects of money supply on the exchange rate and inflation, contributing to a reduction in the illegal parallel exchange rate premium from over 100 percent to below 20 percent," he said. "This has resulted in the current price and currency stability."

Foreign currency and gold reserves have played a critical role in supporting the local currency. Since August 2024, these reserves have covered ZiG reserve money by more than three times, while also being sufficient to cover the entire ZiG deposit base in the banking sector.

This over 100 percent coverage provides the Reserve Bank with significant leverage to intervene in the foreign exchange market to stabilize volatile conditions and maintain exchange rate stability.

Dr. Mushayavanhu reiterated the RBZ's commitment to prudent monetary policy management to sustain price, currency, and financial stability, while remaining vigilant to emerging domestic and external inflation risks.

Inflation expectations remain well anchored, with month-on-month inflation projected to average below 3 percent in 2025. However, due to base effects from a spike in inflation in October 2024, annual inflation is expected to start higher between April and September before moderating significantly.

"Inflation is expected to moderate to less than 30 percent by the end of 2025, supporting the envisaged economic growth of 6 percent GDP in 2025," the RBZ said.

These developments underscore Zimbabwe's progress towards macroeconomic stability, setting a positive foundation for sustainable growth in the coming years.

According to Dr. Mushayavanhu, foreign currency receipts during this period averaged US$1.1 billion monthly, while external payment obligations stood at an average of US$784 million per month. The resulting buffer has provided critical liquidity support to businesses and households across the country.

Banking sector expert Ms. Tariro Chikomo noted that this surplus could create conditions for banks to offer more competitive lending terms. "When banks know that foreign currency obligations are met and exceeded, a potential easing of lending rates can stabilise, and we can offer more competitive terms to borrowers," she said.

The RBZ also reported a moderation in the growth of Zimbabwean Dollar (ZiG) loans. Since October 2024, ZiG loans have grown at an average weekly rate of 1 percent, a significant slowdown from the 6.9 percent weekly growth recorded prior to September 27, 2024.

By March 2025, total ZiG loans stood at ZiG50.7 billion, with 12 percent denominated in local currency, while local currency deposits accounted for 15.9 percent of the total deposit base.

Senior economist Dr. Prosper Chitambara of the Zimbabwe Economic Research Institute linked this moderation in credit growth to the healthy external surplus. "With US$400 million extra each month, the central bank can afford to be selective in domestic credit creation. This ensures that lending is not merely chasing short-term profit but supporting sustainable ventures. The surplus underpins confidence in ZiG, enabling a responsible expansion of loans," he said.

Economist Mrs. Gladys Shumbambiri-Mutsopotsi said disciplined loan growth positively impacts the economy. "The moderation in ZiG credit growth, aligned with the external surplus, signals that monetary authorities are balancing the need for credit with the imperative of exchange rate and price stability," she explained. "Depositors and borrowers alike benefit when policy frameworks link external strength with domestic lending practices."

"These measures have succeeded in curtailing the pass-through effects of money supply on the exchange rate and inflation, contributing to a reduction in the illegal parallel exchange rate premium from over 100 percent to below 20 percent," he said. "This has resulted in the current price and currency stability."

Foreign currency and gold reserves have played a critical role in supporting the local currency. Since August 2024, these reserves have covered ZiG reserve money by more than three times, while also being sufficient to cover the entire ZiG deposit base in the banking sector.

This over 100 percent coverage provides the Reserve Bank with significant leverage to intervene in the foreign exchange market to stabilize volatile conditions and maintain exchange rate stability.

Dr. Mushayavanhu reiterated the RBZ's commitment to prudent monetary policy management to sustain price, currency, and financial stability, while remaining vigilant to emerging domestic and external inflation risks.

Inflation expectations remain well anchored, with month-on-month inflation projected to average below 3 percent in 2025. However, due to base effects from a spike in inflation in October 2024, annual inflation is expected to start higher between April and September before moderating significantly.

"Inflation is expected to moderate to less than 30 percent by the end of 2025, supporting the envisaged economic growth of 6 percent GDP in 2025," the RBZ said.

These developments underscore Zimbabwe's progress towards macroeconomic stability, setting a positive foundation for sustainable growth in the coming years.

Source - Sunday News