News / National

Manyere, Nyengedza at centre of SA company collapse

2 hrs ago | Views

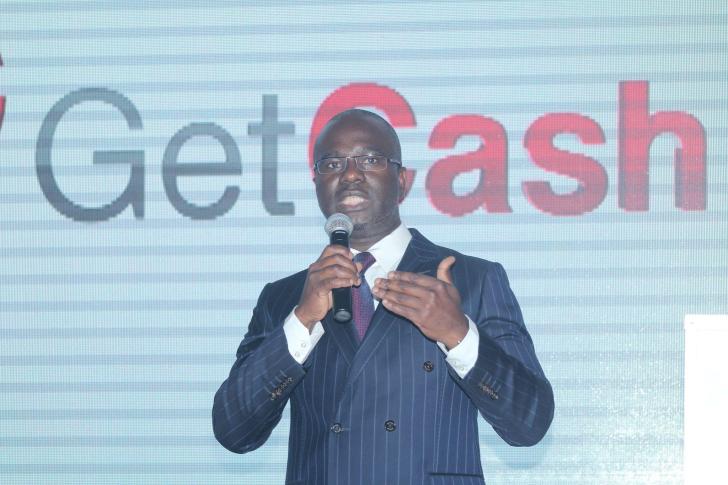

Two prominent Zimbabwean businessmen, George Manyere and Godwin Nyengedza, are at the heart of the dramatic collapse of Afristrat Investment Holdings - a South African financial services firm formerly listed on the Johannesburg Stock Exchange (JSE) under the name Ecsponent.

Afristrat, which raised more than R2.3 billion through preference share investments, is now facing liquidation after its board admitted the company is commercially insolvent and unable to settle its debts. Manyere, who served as both CEO and board chair, confirmed last week that a fresh voluntary liquidation application has been filed with the South African High Court.

Nyengedza, also a director of Afristrat, is listed as one of the applicants alongside fellow board member Roger Pitt.

In court papers, Manyere cited "irreparable harm" caused by what he described as fraudulent transactions - most notably a disastrous investment in MyBucks SA (Luxembourg), a microfinance business co-founded by South African entrepreneur Dave van Niekerk.

Between 2014 and 2019, Afristrat pumped more than US$100 million into MyBucks and related companies. Manyere now concedes the strategy was a "bona fide error in judgment". The company later converted its debt into equity, only for MyBucks to be declared bankrupt by Luxembourg authorities in February 2022 - effectively wiping out Afristrat's investment.

By May 2022, Afristrat announced a staggering R1.5 billion loss linked to MyBucks, pushing total investor fund losses to R1.9 billion, according to unaudited financial statements seen by ZimLive. The company has not published audited financial statements since, leading to its suspension from the JSE. Its external auditors resigned in August 2022.

As part of a last-ditch recovery bid, Afristrat initiated several forensic investigations, the results of which have been handed to the court-appointed liquidator. Manyere hinted that the findings contain sensitive details that could lead to criminal charges.

Van Niekerk has rejected suggestions that he was responsible for Afristrat's collapse, instead pointing the finger at Manyere.

"I was never a director of Ecsponent or any of its subsidiaries. To the contrary, I was one of the many parties financially prejudiced by the actions of Mr Manyere," Van Niekerk told MoneyWeb.

He further claimed that assets once owned by MyBucks and Afristrat have since been transferred to MHMK Group, a Mauritian entity controlled by the George Manyere Family Trust, allegedly leaving ordinary shareholders empty-handed.

The Afristrat debacle has triggered scrutiny in both South Africa and Zimbabwe, where Manyere is a high-profile financier with cross-border investments. Nyengedza, a lawyer by profession, is also a known figure in Zimbabwean business circles.

The High Court in South Africa will now decide on Afristrat's liquidation, a ruling that could determine whether shareholders recover anything from the wreckage of the once-promising investment group.

Afristrat, which raised more than R2.3 billion through preference share investments, is now facing liquidation after its board admitted the company is commercially insolvent and unable to settle its debts. Manyere, who served as both CEO and board chair, confirmed last week that a fresh voluntary liquidation application has been filed with the South African High Court.

Nyengedza, also a director of Afristrat, is listed as one of the applicants alongside fellow board member Roger Pitt.

In court papers, Manyere cited "irreparable harm" caused by what he described as fraudulent transactions - most notably a disastrous investment in MyBucks SA (Luxembourg), a microfinance business co-founded by South African entrepreneur Dave van Niekerk.

Between 2014 and 2019, Afristrat pumped more than US$100 million into MyBucks and related companies. Manyere now concedes the strategy was a "bona fide error in judgment". The company later converted its debt into equity, only for MyBucks to be declared bankrupt by Luxembourg authorities in February 2022 - effectively wiping out Afristrat's investment.

By May 2022, Afristrat announced a staggering R1.5 billion loss linked to MyBucks, pushing total investor fund losses to R1.9 billion, according to unaudited financial statements seen by ZimLive. The company has not published audited financial statements since, leading to its suspension from the JSE. Its external auditors resigned in August 2022.

As part of a last-ditch recovery bid, Afristrat initiated several forensic investigations, the results of which have been handed to the court-appointed liquidator. Manyere hinted that the findings contain sensitive details that could lead to criminal charges.

Van Niekerk has rejected suggestions that he was responsible for Afristrat's collapse, instead pointing the finger at Manyere.

"I was never a director of Ecsponent or any of its subsidiaries. To the contrary, I was one of the many parties financially prejudiced by the actions of Mr Manyere," Van Niekerk told MoneyWeb.

He further claimed that assets once owned by MyBucks and Afristrat have since been transferred to MHMK Group, a Mauritian entity controlled by the George Manyere Family Trust, allegedly leaving ordinary shareholders empty-handed.

The Afristrat debacle has triggered scrutiny in both South Africa and Zimbabwe, where Manyere is a high-profile financier with cross-border investments. Nyengedza, a lawyer by profession, is also a known figure in Zimbabwean business circles.

The High Court in South Africa will now decide on Afristrat's liquidation, a ruling that could determine whether shareholders recover anything from the wreckage of the once-promising investment group.

Source - zimlive