Opinion / Columnist

Critical evaluation of the South Africa's 2025 Budget effect on the property market

14 Mar 2025 at 06:43hrs | Views

The 2025 Budget presents a multifaceted impact on South Africa's property market, balancing fiscal stability, infrastructure development, and housing affordability with rising taxation, debt-servicing pressures, and economic headwinds. While certain policy measures incentivize homeownership, urban densification, and commercial property investment, challenges such as higher municipal levies, stagnant wage growth, and increased borrowing costs introduce structural risks.

This analysis conducts a comparative assessment of the 2024/25 budget against 2025/26, while also protecting the impact through the 2027/28 Medium-Term Expenditure Framework (MTEF). The evaluation considers residential, commercial, and industrial property market dynamics, providing insights into both investment opportunities and emerging constraints.

Opportunities in the 2025 Budget for the Property Market

1. Expansion of Affordable Housing Finance Encouraging Homeownership

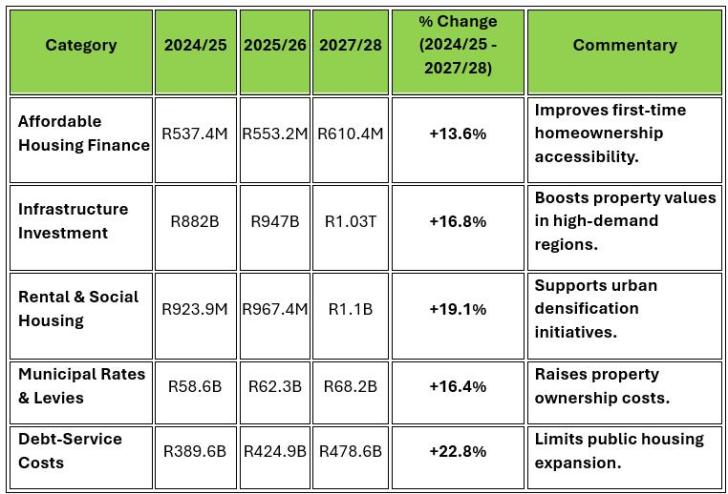

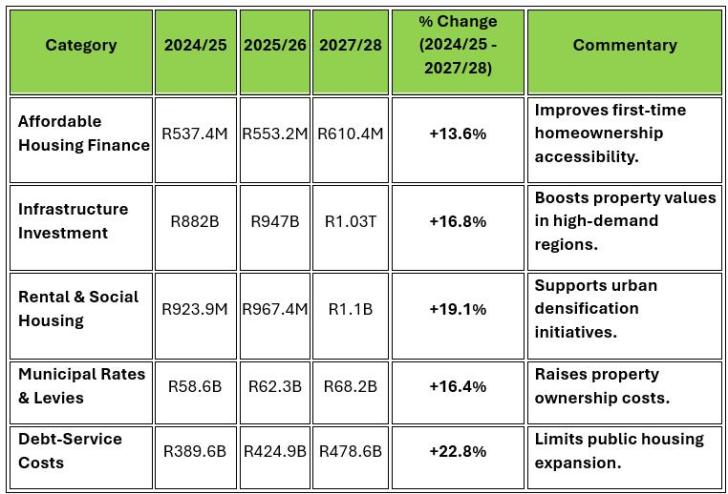

• 2024/25: R537.4 million → 2025/26: R553.2 million (+2.9%) → 2027/28: R610.4 million

Significance: The expansion of affordable housing subsidies and state-backed mortgage assistance supports homeownership among middle- and low-income households. This policy shift aligns with broader financial inclusion objectives by reducing barriers to home loan accessibility.

Example: A first-time buyer eligible for FLISP (Finance-Linked Individual Subsidy Programme) may receive a subsidy that reduces their monthly bond repayments, thereby increasing affordability.

2. Infrastructure Investments Enhancing Property Value and Development Potential

• 2025/26: R1.03 trillion allocated to infrastructure, including R402 billion for transport and R156.3 billion for water and sanitation

Significance: Infrastructure investment is a key driver of property market expansion, improving urban connectivity, municipal service reliability, and long-term valuation growth. This directly benefits residential and commercial real estate in high-growth corridors.

Example: Rail and road expansion in Johannesburg, Cape Town, and Durban enhances demand for mixed-use developments, attracting investors seeking prime real estate in transit-oriented districts.

3. Growth in Social and Rental Housing Encouraging Urban Densification

• 2024/25: R923.9 million → 2025/26: R967.4 million (+4.7%) → 2027/28: R1.1 billion

Significance: The increase in rental and social housing investments aligns with urban densification policies, reducing reliance on informal settlements while maximizing land use efficiency.

Example: State-backed rental housing projects in key metros (e.g., Midrand, Bellville, and Umhlanga) will improve affordability for working-class professionals while stimulating mixed-income developments.

4. VAT Increase May Stimulate Short-Term Property Purchases

• VAT Increase: 15% → 15.5% (2025/26); 16% (2026/27)

Significance: The anticipated VAT hikes on property transactions and development costs may drive accelerated purchases before tax adjustments take effect, leading to short-term market activity surges.

Example: Developers and buyers may rush to finalize transactions before VAT increases, temporarily boosting house sales and commercial real estate transactions in early 2025.

5. Incentives for Green Building Development and Energy Efficiency Upgrades

• Green Building Tax Deductions: R1.2 billion allocated for energy-efficient property developments

Significance: Tax incentives for energy-efficient buildings, solar-powered real estate projects, and water-saving developments reduce long-term operational costs and improve investment attractiveness.

Example: Property developers incorporating renewable energy solutions in office parks, mixed-use buildings, and industrial estates will benefit from accelerated depreciation and tax deductions.

Constraints in the 2025 Budget for the Property Market

1. Rising Property Taxes and Municipal Levies Increasing Cost Burdens

• Municipal Rates and Property Levies: Estimated 6.2% increase across major metros

Significance: Higher municipal rates and service charges will raise ownership costs, reduce net rental yields, and deter investor participation in the property market.

Example: A residential property valued at R2 million in Johannesburg could see its annual rates increase from R18,500 to R19,900, affecting affordability.

2. Higher Interest Rates Elevating Mortgage Costs and Dampening Demand

• Prime Lending Rate: Expected to remain at 11.75% in 2025/26

Significance: Elevated borrowing costs limit affordability for homebuyers and commercial property investors, reducing transaction volumes and slowing property appreciation rates.

Example: A R1.5 million home loan at 9% requires monthly repayments of R13,400, but at 11.75%, the repayment increases to R15,500, pushing buyers out of the market.

3. Stagnant Real Wage Growth Reducing Homebuyer Affordability

• Real Wage Growth: 1.5% annually vs. CPI inflation of 5.5%

Significance: Limited wage growth relative to inflation diminishes mortgage qualification rates, restricting homeownership accessibility for middle-income buyers.

Example: A salaried professional earning R25,000 per month in 2024 may no longer qualify for a home loan in 2025 due to rising interest rates and stagnant wage adjustments.

4. Debt-Servicing Costs Reducing Government Capacity for Housing Initiatives

• Debt-Service Costs: R424.9 billion in 2025/26, rising to R478.6 billion in 2027/28

Significance: Increased debt repayment obligations divert resources from affordable housing and municipal development projects, slowing down new public housing developments.

Example: The Informal Settlement Upgrading Grant has been cut from R3.3 billion to R2.1 billion, delaying service improvements in low-income communities.

5. Commercial Real Estate Struggles Amidst Economic Uncertainty

• Office Vacancy Rates: Expected to remain above 16% in major metros

Significance: Hybrid work models and corporate downsizing suppress office space demand, reducing rental yields and long-term capital appreciation for commercial properties.

Example: An office space in Sandton that previously attracted R250/m² in rental income may now only achieve R185/m², discouraging further investments.

Comparative Summary of Key Property Market Budgetary Impacts

Conclusion

The 2025 Budget introduces a dual-impact framework for the property market, fostering homeownership and rental housing growth while increasing cost burdens for investors, developers, and municipalities. While infrastructure investment and tax incentives support market expansion, rising municipal levies, debt costs, and constrained affordability create downside risks. The long-term trajectory hinges on fiscal execution and economic resilience.

This analysis conducts a comparative assessment of the 2024/25 budget against 2025/26, while also protecting the impact through the 2027/28 Medium-Term Expenditure Framework (MTEF). The evaluation considers residential, commercial, and industrial property market dynamics, providing insights into both investment opportunities and emerging constraints.

Opportunities in the 2025 Budget for the Property Market

1. Expansion of Affordable Housing Finance Encouraging Homeownership

• 2024/25: R537.4 million → 2025/26: R553.2 million (+2.9%) → 2027/28: R610.4 million

Significance: The expansion of affordable housing subsidies and state-backed mortgage assistance supports homeownership among middle- and low-income households. This policy shift aligns with broader financial inclusion objectives by reducing barriers to home loan accessibility.

Example: A first-time buyer eligible for FLISP (Finance-Linked Individual Subsidy Programme) may receive a subsidy that reduces their monthly bond repayments, thereby increasing affordability.

2. Infrastructure Investments Enhancing Property Value and Development Potential

• 2025/26: R1.03 trillion allocated to infrastructure, including R402 billion for transport and R156.3 billion for water and sanitation

Significance: Infrastructure investment is a key driver of property market expansion, improving urban connectivity, municipal service reliability, and long-term valuation growth. This directly benefits residential and commercial real estate in high-growth corridors.

Example: Rail and road expansion in Johannesburg, Cape Town, and Durban enhances demand for mixed-use developments, attracting investors seeking prime real estate in transit-oriented districts.

3. Growth in Social and Rental Housing Encouraging Urban Densification

• 2024/25: R923.9 million → 2025/26: R967.4 million (+4.7%) → 2027/28: R1.1 billion

Significance: The increase in rental and social housing investments aligns with urban densification policies, reducing reliance on informal settlements while maximizing land use efficiency.

Example: State-backed rental housing projects in key metros (e.g., Midrand, Bellville, and Umhlanga) will improve affordability for working-class professionals while stimulating mixed-income developments.

4. VAT Increase May Stimulate Short-Term Property Purchases

• VAT Increase: 15% → 15.5% (2025/26); 16% (2026/27)

Significance: The anticipated VAT hikes on property transactions and development costs may drive accelerated purchases before tax adjustments take effect, leading to short-term market activity surges.

Example: Developers and buyers may rush to finalize transactions before VAT increases, temporarily boosting house sales and commercial real estate transactions in early 2025.

5. Incentives for Green Building Development and Energy Efficiency Upgrades

• Green Building Tax Deductions: R1.2 billion allocated for energy-efficient property developments

Significance: Tax incentives for energy-efficient buildings, solar-powered real estate projects, and water-saving developments reduce long-term operational costs and improve investment attractiveness.

Example: Property developers incorporating renewable energy solutions in office parks, mixed-use buildings, and industrial estates will benefit from accelerated depreciation and tax deductions.

Constraints in the 2025 Budget for the Property Market

1. Rising Property Taxes and Municipal Levies Increasing Cost Burdens

• Municipal Rates and Property Levies: Estimated 6.2% increase across major metros

Significance: Higher municipal rates and service charges will raise ownership costs, reduce net rental yields, and deter investor participation in the property market.

Example: A residential property valued at R2 million in Johannesburg could see its annual rates increase from R18,500 to R19,900, affecting affordability.

2. Higher Interest Rates Elevating Mortgage Costs and Dampening Demand

• Prime Lending Rate: Expected to remain at 11.75% in 2025/26

Significance: Elevated borrowing costs limit affordability for homebuyers and commercial property investors, reducing transaction volumes and slowing property appreciation rates.

Example: A R1.5 million home loan at 9% requires monthly repayments of R13,400, but at 11.75%, the repayment increases to R15,500, pushing buyers out of the market.

3. Stagnant Real Wage Growth Reducing Homebuyer Affordability

• Real Wage Growth: 1.5% annually vs. CPI inflation of 5.5%

Significance: Limited wage growth relative to inflation diminishes mortgage qualification rates, restricting homeownership accessibility for middle-income buyers.

Example: A salaried professional earning R25,000 per month in 2024 may no longer qualify for a home loan in 2025 due to rising interest rates and stagnant wage adjustments.

4. Debt-Servicing Costs Reducing Government Capacity for Housing Initiatives

• Debt-Service Costs: R424.9 billion in 2025/26, rising to R478.6 billion in 2027/28

Significance: Increased debt repayment obligations divert resources from affordable housing and municipal development projects, slowing down new public housing developments.

Example: The Informal Settlement Upgrading Grant has been cut from R3.3 billion to R2.1 billion, delaying service improvements in low-income communities.

5. Commercial Real Estate Struggles Amidst Economic Uncertainty

• Office Vacancy Rates: Expected to remain above 16% in major metros

Significance: Hybrid work models and corporate downsizing suppress office space demand, reducing rental yields and long-term capital appreciation for commercial properties.

Example: An office space in Sandton that previously attracted R250/m² in rental income may now only achieve R185/m², discouraging further investments.

Comparative Summary of Key Property Market Budgetary Impacts

Conclusion

The 2025 Budget introduces a dual-impact framework for the property market, fostering homeownership and rental housing growth while increasing cost burdens for investors, developers, and municipalities. While infrastructure investment and tax incentives support market expansion, rising municipal levies, debt costs, and constrained affordability create downside risks. The long-term trajectory hinges on fiscal execution and economic resilience.

Source - Dr Bekithemba Mpofu

All articles and letters published on Bulawayo24 have been independently written by members of Bulawayo24's community. The views of users published on Bulawayo24 are therefore their own and do not necessarily represent the views of Bulawayo24. Bulawayo24 editors also reserve the right to edit or delete any and all comments received.