Sports / Soccer

2030: Zimbabwe will be using domestic currency

2 hrs ago | Views

THE Reserve Bank of Zimbabwe (RBZ) has announced plans for a structured transition from the current multicurrency system to a domestic monetary framework, aimed at ensuring business continuity and economic certainty by 2030.

Zimbabwe currently operates under a multicurrency regime dominated by the US dollar and the Zimbabwe Gold (ZiG), which is legally provisioned to remain in use until 2030. The country adopted a US dollar-based system in 2009 following hyperinflation that eroded the value of the local currency. While the US dollar has provided stability and low inflation, it has also limited competitiveness for local producers and constrained government control over economic growth.

Efforts to establish a domestic mono-currency have historically faced challenges from episodes of high inflation. However, the RBZ reports that ZiG inflation has remained low and stable at less than 1 percent month-on-month for the past three months, with an average of 0.6 percent since February. The central bank forecasts that monthly inflation will remain below 3 percent throughout 2025, while the annual rate, elevated by last year's currency devaluation, is expected to moderate to around 30 percent by year-end.

The October devaluation addressed pricing distortions caused by a wide gap between official and parallel market exchange rates, with the premium narrowing from 100 percent early last year to below 30 percent, reflecting the effectiveness of tight monetary and fiscal policies. The introduction of the gold-backed local currency in April 2024 has contributed to durable stability and a marked decline in monthly inflation.

The RBZ highlighted increased adoption of ZiG in the economy, with its share in National Payment System electronic transactions rising from 26 percent in April 2024 to over 40 percent in June 2025. Cash usage in ZiG has also grown, demonstrating broader public acceptance of the domestic unit.

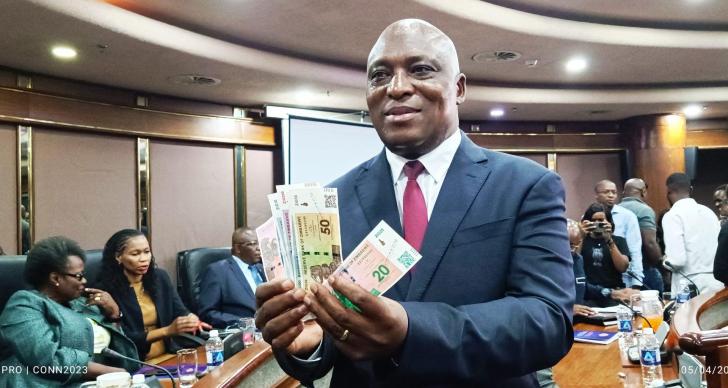

Governor Dr John Mushayavanhu said the central bank is confident that by 2030, Zimbabwe will have all key fundamentals in place to support a domestic mono-currency, including stable currency, low inflation, and highly productive sectors. The bank plans to formalise a "de-dollarisation roadmap" within the upcoming National Development Strategy 2 (NDS2), which will replace NDS1, the initial medium-term plan guiding the country toward Vision 2030 as an upper-middle-income economy.

According to the RBZ, adopting a domestic currency like ZiG is essential for regaining control over monetary policy, managing inflation, and enabling long-term economic planning. While the current multicurrency system has offered stability, it constrains policy flexibility and limits export competitiveness.

The roadmap, first outlined in the RBZ's 2025 Mid-Term Monetary Policy Review and reinforced at a stakeholder breakfast in Harare, comes amid calls from industry leaders for clarity and assurances to maintain economic stability during the transition. Since ZiG's introduction, monthly inflation has remained largely within policy targets, and the parallel market rate has narrowed significantly, improving business and public confidence and creating conditions for sustainable growth.

Treasury forecasts Zimbabwe's economy to grow by 6 percent in 2025, up from a predicted 2 percent expansion in 2024, which was constrained by an El Niño-induced drought affecting agriculture, a key sector. Dr Mushayavanhu emphasised that NDS2, under RBZ stewardship, will ensure that the de-dollarisation process preserves current stability, protects foreign currency accounts, and respects existing USD-denominated contracts, while maintaining business continuity.

Stakeholders have broadly welcomed the de-dollarisation principle but called for refined timelines and implementation details. Dr Mushayavanhu noted that consultations in July 2025 acknowledged current stability and urged consistent implementation of prudent monetary policy.

Once a stabilisation tool, the multicurrency system has become a limiting factor for long-term planning. Concerns remain among foreign-currency depositors about the fate of their savings after 2030. RBZ Deputy Governor Dr Innocent Matshe reiterated that de-dollarisation will allow the central bank to regain full control over monetary policy and drive sustainable economic growth.

Local consumption advocates have linked de-dollarisation to broader government objectives, noting that prioritising domestic procurement will reduce imports and support the transition to a domestic currency.

Zimbabwe currently operates under a multicurrency regime dominated by the US dollar and the Zimbabwe Gold (ZiG), which is legally provisioned to remain in use until 2030. The country adopted a US dollar-based system in 2009 following hyperinflation that eroded the value of the local currency. While the US dollar has provided stability and low inflation, it has also limited competitiveness for local producers and constrained government control over economic growth.

Efforts to establish a domestic mono-currency have historically faced challenges from episodes of high inflation. However, the RBZ reports that ZiG inflation has remained low and stable at less than 1 percent month-on-month for the past three months, with an average of 0.6 percent since February. The central bank forecasts that monthly inflation will remain below 3 percent throughout 2025, while the annual rate, elevated by last year's currency devaluation, is expected to moderate to around 30 percent by year-end.

The October devaluation addressed pricing distortions caused by a wide gap between official and parallel market exchange rates, with the premium narrowing from 100 percent early last year to below 30 percent, reflecting the effectiveness of tight monetary and fiscal policies. The introduction of the gold-backed local currency in April 2024 has contributed to durable stability and a marked decline in monthly inflation.

The RBZ highlighted increased adoption of ZiG in the economy, with its share in National Payment System electronic transactions rising from 26 percent in April 2024 to over 40 percent in June 2025. Cash usage in ZiG has also grown, demonstrating broader public acceptance of the domestic unit.

Governor Dr John Mushayavanhu said the central bank is confident that by 2030, Zimbabwe will have all key fundamentals in place to support a domestic mono-currency, including stable currency, low inflation, and highly productive sectors. The bank plans to formalise a "de-dollarisation roadmap" within the upcoming National Development Strategy 2 (NDS2), which will replace NDS1, the initial medium-term plan guiding the country toward Vision 2030 as an upper-middle-income economy.

According to the RBZ, adopting a domestic currency like ZiG is essential for regaining control over monetary policy, managing inflation, and enabling long-term economic planning. While the current multicurrency system has offered stability, it constrains policy flexibility and limits export competitiveness.

The roadmap, first outlined in the RBZ's 2025 Mid-Term Monetary Policy Review and reinforced at a stakeholder breakfast in Harare, comes amid calls from industry leaders for clarity and assurances to maintain economic stability during the transition. Since ZiG's introduction, monthly inflation has remained largely within policy targets, and the parallel market rate has narrowed significantly, improving business and public confidence and creating conditions for sustainable growth.

Treasury forecasts Zimbabwe's economy to grow by 6 percent in 2025, up from a predicted 2 percent expansion in 2024, which was constrained by an El Niño-induced drought affecting agriculture, a key sector. Dr Mushayavanhu emphasised that NDS2, under RBZ stewardship, will ensure that the de-dollarisation process preserves current stability, protects foreign currency accounts, and respects existing USD-denominated contracts, while maintaining business continuity.

Stakeholders have broadly welcomed the de-dollarisation principle but called for refined timelines and implementation details. Dr Mushayavanhu noted that consultations in July 2025 acknowledged current stability and urged consistent implementation of prudent monetary policy.

Once a stabilisation tool, the multicurrency system has become a limiting factor for long-term planning. Concerns remain among foreign-currency depositors about the fate of their savings after 2030. RBZ Deputy Governor Dr Innocent Matshe reiterated that de-dollarisation will allow the central bank to regain full control over monetary policy and drive sustainable economic growth.

Local consumption advocates have linked de-dollarisation to broader government objectives, noting that prioritising domestic procurement will reduce imports and support the transition to a domestic currency.

Source - the chronicle