Business / Companies

African Sun CEO axed as dispute over rentals escalates

07 Aug 2011 at 04:31hrs |

1889 Views

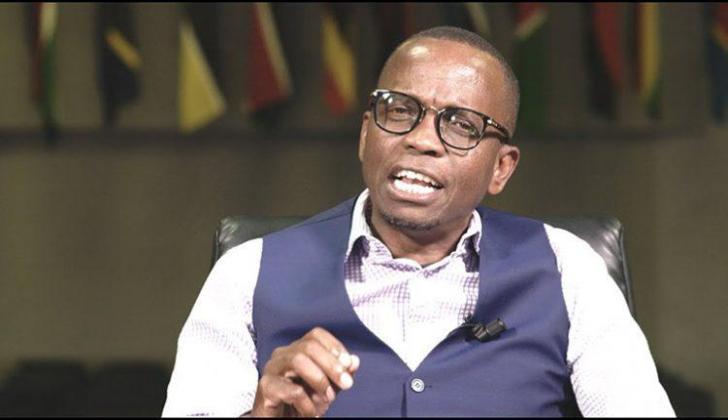

AFRICAN SUN chief executive officer Dr Shingi Munyeza has been axed from the Dawn Properties Limited board after his scheme to ease out Dawn chairman Mr Tendayi Chimuriwo boomeranged, The Sunday Mail revealed.

Dr Munyeza's ouster is a culmination of his strained relationship with some members of the Dawn board after a bond was "illegally" registered over Crowne Plaza with South Africa's Industrial Development Corporation (IDC) in return for a US$11 million for refurbishments.

Tensions are also simmering between Dawn Properties Limited, the lessor, and African Sun Limited, the lessee, over the methodology of charging rentals, with the latter insisting that it is much more comfortable with charging turnover rentals as opposed to fixed rentals.

Correspondence mainly between Dr Munyeza, Mr Tim Chiganze, the chairman of African Sun, and Mr Chimuriwo, the chairman of Dawn Properties Limited, indicates that Dr Munyeza was pressured to resign as "his continued stay on the board has clearly become untenable".

On May 30 this year African Sun wrote a letter to Dawn Properties calling for the convening of an extraordinary general meeting (EGM) expressly for the purpose of removing Mr Chimuriwo, who had earlier openly criticised Dr Munyeza for registering a leased property, Crowne Plaza Hotel, without Dawn Property's board approval.

After caucusing with fellow directors Mr Jim Worsfold and Mr Charles Mataure, Mr Chimuriwo then wrote a letter on June 3 to Dr Munyeza indicating that directors had decided to follow procedure and accede to the holding of an EGM.

However, Mr Chimuriwo also wrote to African Sun chairman Mr Chiganze on June 6 inquiring whether the decision to request an EGM was endorsed by the board and the reasons why he was to be discharged "as per provisions of the Companies Act".

In turn, Mr Chiganze informed Mr Chimuriwo in a letter dated June 9 that a committee of the board of African Sun had decided to withdraw the request for the EGM.

Subsequently, the Dawn Properties chairman then requested the ouster of Dr Munyeza from the properties' group board.

"Thank you for the letter dated 9 June 2011 withdrawing the request for an EGM. As requested we will no longer convene an EGM. However, owing to the events over the last year or so and this recent incident, we are left with no option but to request that you withdraw Dr Shingi Munyeza from the Dawn Board.

"His continued stay on the board has clearly become untenable. We are happy for you to propose a replacement to be considered by the Dawn Board, but the person must not be an African Sun executive. The matters that Dawn deals with on a regular basis makes it inappropriate for an African Sun executive to sit on the Dawn board," advised Mr Chimuriwo in a letter written on June 13.

Dr Munyeza resultantly tendered his resignation on July 15.

The decision by the Dawn Properties Limited board to specifically demand an African Sun representative that was not a member of the executive seems to have been informed by the previous run-ins between Dr Munyeza and some directors at Dawn over both strategy and procedure.

It is alleged that some time last year when Dawn chief executive Mr Mike Manyika travelled to South Africa for medical treatment, Dr Munyeza pressured some employees of Dawn to sign the necessary legal papers for the bond.

When Mr Manyika found out, he urged Dr Munyeza to cancel the bond "without delay".

Said Mr Manyika in a letter dated September 20: "Only this morning I discovered that a surety mortgage bond over Crowne Plaza has been registered in favour of IDC. Apparently the necessary legal papers were signed while I was in South Africa on medical treatment. I must say that I am deeply disturbed by this development as all this happened without the requisite board approvals and certainly without my approval.

"I would like to assume that you appreciate the magnitude of the risk of having such a document in place without obtaining the requisite approvals from stakeholders.

"Consequently, I am asking that the bond be cancelled without delay. Please advise me when I can expect to get the notification of the cancellation. In any event the bond is voidable and its validity will be challenged unless you move to rectify the anomaly."

Dr Munyeza sought to distance himself from the bond, blaming his management team instead.

African Sun is currently feeling the discomfort of a challenging financial environment and recently some directors lost a 9,4 percent stake in the company after failing to repay US$4 million that was borrowed from Ecobank through a consortium called Burypast to follow their rights.

Burypast failed to repay within the stipulated time, resulting in Ecobank releasing the security that was in the form of African Sun shares.

-

However, the Dr Munyeza hospitality-led group has of late been facing a plethora of challenges after pulling out of the South African market recently, citing reduction in overseas and domestic travellers, coupled with the continued pressure of the global recession and rapidly escalating running costs as making the business unsustainable.

It will withdraw from its operating agreement for The Grace in Rosebank and the hotel will cease to operate on August 31. The lease agreement for The Lakes Hotel and Conference Centre came to an end on July 31.

Besides having its fingers burnt in the South African market, the company is also engaged in serious negotiations with its landlords over rentals charged on the leased properties.

Whilst African Sun insists that it would prefer variable lease rentals, Dawn Properties on the other hand maintains that it would prefer fixed rentals.

"African Sun has elected not to renew its operating agreements for the properties that it operates in Johannesburg.

"The company's business model is anchored around variable lease rentals and management contracts. There is an ongoing engagement with the company's various landlords on how best to unlock value for both parties and lease renewals are negotiated with this in mind," said African Sun in statement last week.

This position is, however, contradictory to Dawn's position as stated in the 2010 annual report. In the report, the company noted that it had agreed with its tenant to migrate to fixed rentals in line with regional trends, with a targeted yield of 10 percent expected to be achieved in the fourth year.

In the interim, however, it was agreed that rental income will be the higher of 10 percent of the tenants' turnover or the guaranteed rental.

Presently, African Sun leases 10 properties from Dawn, namely: Caribbea Bay Sun; Caribbea Bay Marina; Crowne Plaza Monomotapa; Elephant Hills Resort and Conference Centre; Express by Holiday Inn; Great Zimbabwe Hotel; Holiday Inn Mutare; Hwange Safari Lodge; Troutbeck Sun and Brondesbury Park in Juliasdale.

Dr Munyeza's ouster is a culmination of his strained relationship with some members of the Dawn board after a bond was "illegally" registered over Crowne Plaza with South Africa's Industrial Development Corporation (IDC) in return for a US$11 million for refurbishments.

Tensions are also simmering between Dawn Properties Limited, the lessor, and African Sun Limited, the lessee, over the methodology of charging rentals, with the latter insisting that it is much more comfortable with charging turnover rentals as opposed to fixed rentals.

Correspondence mainly between Dr Munyeza, Mr Tim Chiganze, the chairman of African Sun, and Mr Chimuriwo, the chairman of Dawn Properties Limited, indicates that Dr Munyeza was pressured to resign as "his continued stay on the board has clearly become untenable".

On May 30 this year African Sun wrote a letter to Dawn Properties calling for the convening of an extraordinary general meeting (EGM) expressly for the purpose of removing Mr Chimuriwo, who had earlier openly criticised Dr Munyeza for registering a leased property, Crowne Plaza Hotel, without Dawn Property's board approval.

After caucusing with fellow directors Mr Jim Worsfold and Mr Charles Mataure, Mr Chimuriwo then wrote a letter on June 3 to Dr Munyeza indicating that directors had decided to follow procedure and accede to the holding of an EGM.

However, Mr Chimuriwo also wrote to African Sun chairman Mr Chiganze on June 6 inquiring whether the decision to request an EGM was endorsed by the board and the reasons why he was to be discharged "as per provisions of the Companies Act".

In turn, Mr Chiganze informed Mr Chimuriwo in a letter dated June 9 that a committee of the board of African Sun had decided to withdraw the request for the EGM.

Subsequently, the Dawn Properties chairman then requested the ouster of Dr Munyeza from the properties' group board.

"Thank you for the letter dated 9 June 2011 withdrawing the request for an EGM. As requested we will no longer convene an EGM. However, owing to the events over the last year or so and this recent incident, we are left with no option but to request that you withdraw Dr Shingi Munyeza from the Dawn Board.

"His continued stay on the board has clearly become untenable. We are happy for you to propose a replacement to be considered by the Dawn Board, but the person must not be an African Sun executive. The matters that Dawn deals with on a regular basis makes it inappropriate for an African Sun executive to sit on the Dawn board," advised Mr Chimuriwo in a letter written on June 13.

Dr Munyeza resultantly tendered his resignation on July 15.

The decision by the Dawn Properties Limited board to specifically demand an African Sun representative that was not a member of the executive seems to have been informed by the previous run-ins between Dr Munyeza and some directors at Dawn over both strategy and procedure.

It is alleged that some time last year when Dawn chief executive Mr Mike Manyika travelled to South Africa for medical treatment, Dr Munyeza pressured some employees of Dawn to sign the necessary legal papers for the bond.

When Mr Manyika found out, he urged Dr Munyeza to cancel the bond "without delay".

Said Mr Manyika in a letter dated September 20: "Only this morning I discovered that a surety mortgage bond over Crowne Plaza has been registered in favour of IDC. Apparently the necessary legal papers were signed while I was in South Africa on medical treatment. I must say that I am deeply disturbed by this development as all this happened without the requisite board approvals and certainly without my approval.

"Consequently, I am asking that the bond be cancelled without delay. Please advise me when I can expect to get the notification of the cancellation. In any event the bond is voidable and its validity will be challenged unless you move to rectify the anomaly."

Dr Munyeza sought to distance himself from the bond, blaming his management team instead.

African Sun is currently feeling the discomfort of a challenging financial environment and recently some directors lost a 9,4 percent stake in the company after failing to repay US$4 million that was borrowed from Ecobank through a consortium called Burypast to follow their rights.

Burypast failed to repay within the stipulated time, resulting in Ecobank releasing the security that was in the form of African Sun shares.

-

However, the Dr Munyeza hospitality-led group has of late been facing a plethora of challenges after pulling out of the South African market recently, citing reduction in overseas and domestic travellers, coupled with the continued pressure of the global recession and rapidly escalating running costs as making the business unsustainable.

It will withdraw from its operating agreement for The Grace in Rosebank and the hotel will cease to operate on August 31. The lease agreement for The Lakes Hotel and Conference Centre came to an end on July 31.

Besides having its fingers burnt in the South African market, the company is also engaged in serious negotiations with its landlords over rentals charged on the leased properties.

Whilst African Sun insists that it would prefer variable lease rentals, Dawn Properties on the other hand maintains that it would prefer fixed rentals.

"African Sun has elected not to renew its operating agreements for the properties that it operates in Johannesburg.

"The company's business model is anchored around variable lease rentals and management contracts. There is an ongoing engagement with the company's various landlords on how best to unlock value for both parties and lease renewals are negotiated with this in mind," said African Sun in statement last week.

This position is, however, contradictory to Dawn's position as stated in the 2010 annual report. In the report, the company noted that it had agreed with its tenant to migrate to fixed rentals in line with regional trends, with a targeted yield of 10 percent expected to be achieved in the fourth year.

In the interim, however, it was agreed that rental income will be the higher of 10 percent of the tenants' turnover or the guaranteed rental.

Presently, African Sun leases 10 properties from Dawn, namely: Caribbea Bay Sun; Caribbea Bay Marina; Crowne Plaza Monomotapa; Elephant Hills Resort and Conference Centre; Express by Holiday Inn; Great Zimbabwe Hotel; Holiday Inn Mutare; Hwange Safari Lodge; Troutbeck Sun and Brondesbury Park in Juliasdale.

Source - The Sunday Mail

Join the discussion

Loading comments…