News / Local

Zimbabwe central bank bites back

20 Sep 2024 at 08:35hrs |

0 Views

This year, authorities in Zimbabwe have recorded over 1,100 cases of debit card abuse linked to backstage black market dealers, highlighting the ongoing challenges of a protracted currency crisis. The revelations come as the government intensifies efforts to curb illegal currency trading and stabilize the local economy.

In statements to the Zimbabwe Independent, Reserve Bank of Zimbabwe (RBZ) governor John Mushayavanhu emphasized the seriousness of the crackdown, indicating that no political figures or well-connected individuals have been exempt from scrutiny. The RBZ has recommended the suspension of several government suppliers implicated in these operations.

Despite these efforts, the campaign has not yet succeeded in stemming currency volatility, presenting a significant challenge for Mushayavanhu, who had pledged to restore order upon his appointment at the RBZ earlier this year.

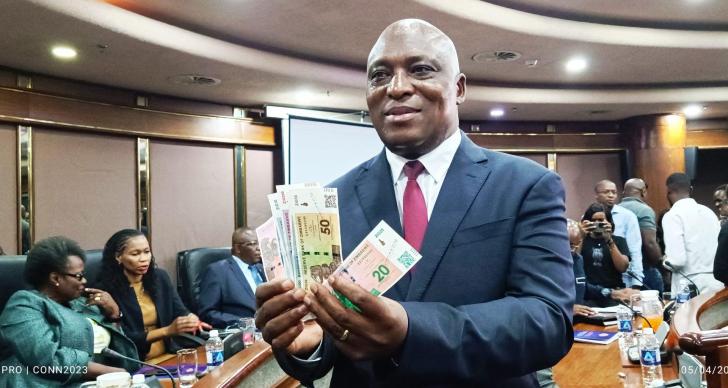

The introduction of the Zimbabwe Gold (ZWG) currency on April 5, intended as a structured currency backed by gold and other commodities, initially raised hopes for economic recovery. However, the ZWG has faced mounting pressure, dropping from an exchange rate of US$1

.56 at launch to approximately US$1

in the official market this week. In the black market, the currency has depreciated significantly, falling to around US$1, a steep decline of about 50%.

"The Financial Intelligence Unit (FIU) continuously monitors the abuse of debit cards, and as of Monday, 1,123 debit cards have been frozen," Mushayavanhu reported. "Some offenders have been penalized, while others have been blacklisted from accessing financial services."

The RBZ governor indicated that over 80 companies and 154 traders have been implicated in illicit currency trading. Additional statistics revealed that 912 individuals have been caught in the crackdown, with illegal internal fund transfers detected in 67 transactions. Notably, 25 cases involving high-value government payments related to currency abuse have also been uncovered.

Analysts, however, have expressed skepticism about the efficacy of the current measures, arguing that the reported figures seem low given the open nature of black market trading in Zimbabwe.

"The FIU has been monitoring traders on various fronts, including their banking trends, daily sales, and compliance with official trading rates," Mushayavanhu explained. Joint operations with the Zimbabwe Republic Police have been conducted to apprehend illegal foreign currency dealers and entities manipulating currency.

The FIU continues to monitor debit card usage among individuals and companies engaged in parallel market dealings across various sectors, including wholesale shops, supermarkets, government institutions, and others accepting Zimbabwe Gold currency. As the economic situation remains precarious, the focus on stabilizing the currency and combating illegal trading continues to intensify.

In statements to the Zimbabwe Independent, Reserve Bank of Zimbabwe (RBZ) governor John Mushayavanhu emphasized the seriousness of the crackdown, indicating that no political figures or well-connected individuals have been exempt from scrutiny. The RBZ has recommended the suspension of several government suppliers implicated in these operations.

Despite these efforts, the campaign has not yet succeeded in stemming currency volatility, presenting a significant challenge for Mushayavanhu, who had pledged to restore order upon his appointment at the RBZ earlier this year.

The introduction of the Zimbabwe Gold (ZWG) currency on April 5, intended as a structured currency backed by gold and other commodities, initially raised hopes for economic recovery. However, the ZWG has faced mounting pressure, dropping from an exchange rate of US$1

.56 at launch to approximately US$1

in the official market this week. In the black market, the currency has depreciated significantly, falling to around US$1, a steep decline of about 50%.

"The Financial Intelligence Unit (FIU) continuously monitors the abuse of debit cards, and as of Monday, 1,123 debit cards have been frozen," Mushayavanhu reported. "Some offenders have been penalized, while others have been blacklisted from accessing financial services."

The RBZ governor indicated that over 80 companies and 154 traders have been implicated in illicit currency trading. Additional statistics revealed that 912 individuals have been caught in the crackdown, with illegal internal fund transfers detected in 67 transactions. Notably, 25 cases involving high-value government payments related to currency abuse have also been uncovered.

Analysts, however, have expressed skepticism about the efficacy of the current measures, arguing that the reported figures seem low given the open nature of black market trading in Zimbabwe.

"The FIU has been monitoring traders on various fronts, including their banking trends, daily sales, and compliance with official trading rates," Mushayavanhu explained. Joint operations with the Zimbabwe Republic Police have been conducted to apprehend illegal foreign currency dealers and entities manipulating currency.

The FIU continues to monitor debit card usage among individuals and companies engaged in parallel market dealings across various sectors, including wholesale shops, supermarkets, government institutions, and others accepting Zimbabwe Gold currency. As the economic situation remains precarious, the focus on stabilizing the currency and combating illegal trading continues to intensify.

Source - the independent

Join the discussion

Loading comments…