News / National

Zulu lithium production might start this week

30 Mar 2023 at 05:34hrs |

1 Views

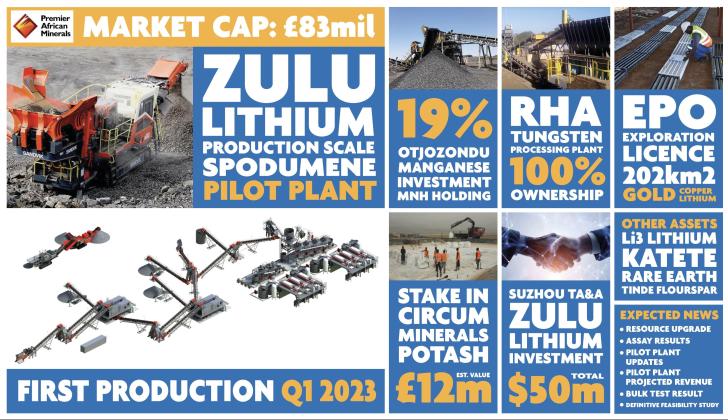

MULTI-COMMODITY mining and natural resource development company, Premier African Minerals, on Tuesday completed the plant assembly, construction and final instrumentation connections at the mine plant in Fort Rixon in readiness for lithium production anytime this week.

Key plant tests such as plant to point mill feed have been run, crusher settling in pre-production runs are underway and the wet section (floatation part of the plant) has water on and is pressurised.

The mining firm said the first live production runs to produce spodumene is expected this week provided final approvals from authorities are received on time.

In an update yesterday, chief executive officer Mr George Roach said they expect to produce spodumene, a lepidolite mica rich concentrate and a tantalum rich concentrate late this week provided that final formal outstanding approvals from certain Zimbabwean authorities are received.

"It should also be noted that an error on the part of the plant designers led to a late change in reagent dosing and reagent requirements," he said.

"This and a combination of late delivery of certain components of the floatation system of the plant, a severe wet season in Zimbabwe and the continued issues of slow import clearance of essential plant at Beitbridge, have all combined to cause Premier's self-imposed internal commissioning target of 14 February 2023 to be missed."

Last year, Premier African Minerals secured US$35 million pre-funding to enable the construction and commissioning of a large-scale pilot plant at the project.

Upon the signing of the agreement, US$3 450 000 has been availed to secure the pilot plant, Premier African Minerals said in a latest update.

Suzhou TA&A Ultra Clean Technology company, a China-based company principally engaged in the research, development, production, and sale of anti-static ultra-clean products provided the funding.

Mr Roach said Premier African Minerals was adequately funded to that projected date and remains in funds at this time.

"It may be necessary to either increase the prepayment amount under current Marketing and Pre-Payment Agreement or accept a short-term loan facility secured against spodumene to be produced to meet operating costs at Zulu in the coming weeks.

Should that arise, it will be announced at that time."

He noted that the mining firm has received a number of requests from other mining companies already well established in Zimbabwe to discuss intentions in regard to the future of Zulu for either future offtake and/or direct equity investment into Zulu.

Speaking during a StockBox chat, a media platform for listed companies to connect with investors last week, Mr Roach said he would be surprised if their project was not generating interest from potential investors.

Prospective investors are focusing on energy supply relating to setting up of solar plants and lining the massive plant on the national electricity grid, he noted.

"At the same time, Premier is in discussions intended to see a quick increase in production and a broadening of the product base as the focus of production at the Zulu plant has only been the production of spodumene.

" This is likely to take the form of fully funded extensions and modifications to the existing plant. In that regard, I remind shareholders that the existing plant will only process approximately 60 percent of the ore feed through to the floatation circuits and the first upgrades will be targeted at increasing floatation capacity to increase concentrate production," said Mr Roach yesterday.

The Zulu project is generally regarded as potentially the largest undeveloped lithium bearing pegmatite in Zimbabwe, covering a surface of about 3,5 square kilometres, which are prospectively for lithium and tantalum mineralisation.

It produces a rare high value spodumene, a rock that has very high mineralisation of lithium. Spodumene is a battery grade product, which is key for the future of electric cars.

Due to the emerging electric motor vehicle industry, there is increased international demand for the lithium mineral known as "white oil", which is used for manufacturing batteries.

Zimbabwe has the largest lithium reserves in Africa and the fifth-largest worldwide.

Key plant tests such as plant to point mill feed have been run, crusher settling in pre-production runs are underway and the wet section (floatation part of the plant) has water on and is pressurised.

The mining firm said the first live production runs to produce spodumene is expected this week provided final approvals from authorities are received on time.

In an update yesterday, chief executive officer Mr George Roach said they expect to produce spodumene, a lepidolite mica rich concentrate and a tantalum rich concentrate late this week provided that final formal outstanding approvals from certain Zimbabwean authorities are received.

"It should also be noted that an error on the part of the plant designers led to a late change in reagent dosing and reagent requirements," he said.

"This and a combination of late delivery of certain components of the floatation system of the plant, a severe wet season in Zimbabwe and the continued issues of slow import clearance of essential plant at Beitbridge, have all combined to cause Premier's self-imposed internal commissioning target of 14 February 2023 to be missed."

Last year, Premier African Minerals secured US$35 million pre-funding to enable the construction and commissioning of a large-scale pilot plant at the project.

Upon the signing of the agreement, US$3 450 000 has been availed to secure the pilot plant, Premier African Minerals said in a latest update.

Suzhou TA&A Ultra Clean Technology company, a China-based company principally engaged in the research, development, production, and sale of anti-static ultra-clean products provided the funding.

Mr Roach said Premier African Minerals was adequately funded to that projected date and remains in funds at this time.

"It may be necessary to either increase the prepayment amount under current Marketing and Pre-Payment Agreement or accept a short-term loan facility secured against spodumene to be produced to meet operating costs at Zulu in the coming weeks.

Should that arise, it will be announced at that time."

He noted that the mining firm has received a number of requests from other mining companies already well established in Zimbabwe to discuss intentions in regard to the future of Zulu for either future offtake and/or direct equity investment into Zulu.

Speaking during a StockBox chat, a media platform for listed companies to connect with investors last week, Mr Roach said he would be surprised if their project was not generating interest from potential investors.

Prospective investors are focusing on energy supply relating to setting up of solar plants and lining the massive plant on the national electricity grid, he noted.

"At the same time, Premier is in discussions intended to see a quick increase in production and a broadening of the product base as the focus of production at the Zulu plant has only been the production of spodumene.

" This is likely to take the form of fully funded extensions and modifications to the existing plant. In that regard, I remind shareholders that the existing plant will only process approximately 60 percent of the ore feed through to the floatation circuits and the first upgrades will be targeted at increasing floatation capacity to increase concentrate production," said Mr Roach yesterday.

The Zulu project is generally regarded as potentially the largest undeveloped lithium bearing pegmatite in Zimbabwe, covering a surface of about 3,5 square kilometres, which are prospectively for lithium and tantalum mineralisation.

It produces a rare high value spodumene, a rock that has very high mineralisation of lithium. Spodumene is a battery grade product, which is key for the future of electric cars.

Due to the emerging electric motor vehicle industry, there is increased international demand for the lithium mineral known as "white oil", which is used for manufacturing batteries.

Zimbabwe has the largest lithium reserves in Africa and the fifth-largest worldwide.

Source - The Chronicle

Join the discussion

Loading comments…