News / National

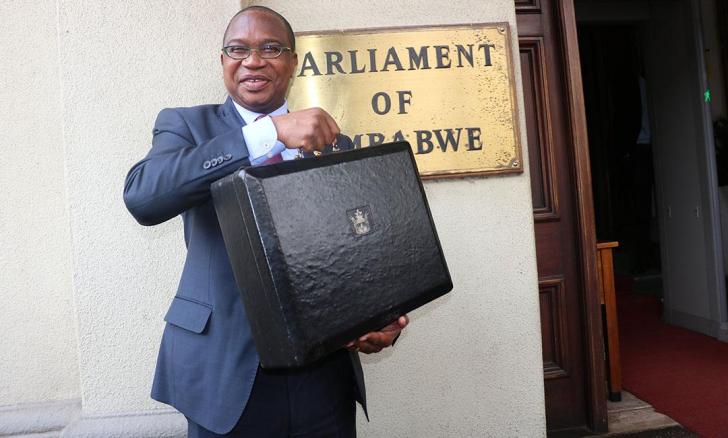

All eyes on Professor Mthuli Ncube

27 Nov 2024 at 08:13hrs |

0 Views

As Zimbabwe prepares for the presentation of the 2025 National Budget, all eyes are on Finance, Economic Development, and Investment Promotion Minister, Professor Mthuli Ncube. The Budget, which serves as a financial blueprint for the government's programs in the coming year, is expected to address several key economic challenges while striving to foster sustainable growth and attract investment.

With global commodity prices fluctuating and regional electricity shortages weighing on the economy, Zimbabwe remains resilient. The government is focused on leveraging the country's vast resources in mining, agriculture, and tourism to unlock new economic opportunities and support long-term development.

Economic analysts have called for a cautious yet proactive approach to fiscal policy, emphasizing the importance of balancing immediate financial constraints with strategic investments in key sectors. Tafara Mtutu, an economic analyst, believes that the government's efforts to bolster the mining sector are crucial. While commodity price volatility presents challenges, he sees an opportunity for the government to strengthen support for the industry by considering tax adjustments to enhance competitiveness and maintain production momentum.

"Through considering reduced royalties during times of depressed commodity prices, the Government demonstrates its commitment to fostering a business-friendly environment that ensures both sustainability and growth," Mtutu said.

The mining sector remains a cornerstone of Zimbabwe's economy, while other areas such as manufacturing and tourism are poised for strategic investment. Economic diversification has been a focal point of Minister Ncube's past economic plans, and analysts are hopeful that the 2025 Budget will continue to prioritize policies that enhance resilience and improve global competitiveness.

Meanwhile, Zimbabwean businesses like Delta Corporation are proving that innovation can thrive even in challenging economic conditions. This spirit of resilience is reflective of the broader determination to overcome economic hurdles and chart a path toward prosperity.

The Zimbabwe National Chamber of Commerce (ZNCC) President, Mr. Tapiwa Karoro, stressed the importance of the Budget in shaping the nation's fiscal priorities and revenue-generating strategies for the year ahead. He also highlighted recent changes, such as the introduction of an excise duty on e-cigarettes, which has sparked debate among industry players and economists alike.

"There is a concern that the new excise duty on e-cigarettes does not align with scientific evidence, as studies show that vapor products are less harmful than traditional cigarettes. The current rate is also higher than in comparable regions," Karoro noted.

Economist Enoch Rukarwa echoed the sentiment, urging the government to focus on formalizing the informal sector and enhancing the tax base. He stressed the need for strategic reforms in presumptive taxes to bring informal businesses into the fold, thereby broadening the tax net.

"The Zimbabwean tax framework, while sometimes perceived as burdensome, aligns with regional standards. Strategic enhancements, such as enforcing collection of presumptive taxes, can broaden the tax base and foster inclusivity," Rukarwa said.

The Bankers Association of Zimbabwe (BAZ) has called for fiscal efficiency and the promotion of financial inclusion. They have advocated for a reduction in the 2 percent Intermediated Money Transfer Tax (IMTT), which they believe will drive formal transactions, reduce cash dependency, and strengthen revenue collection mechanisms.

"Lowering the IMTT will not only drive more transactions through formal banking channels but also support broader economic stability by addressing risks associated with cash handling," BAZ stated in its submission.

In addition, Mr. Karoro from ZNCC raised concerns about the negative impact of high taxes on bank transactions, such as the IMTT and withdrawal levies, which discourage the use of digital payment systems and exacerbate the informal economy. This, he argued, undermines the effectiveness of the government's monetary policy and hampers Zimbabwe's international competitiveness.

"Taxes on transactions add to the cost of doing business, negatively impacting the country's international competitiveness," Karoro said.

Financial markets analyst George Nhepera called for pro-business policies aimed at boosting the confidence of economic players. He suggested targeted tax cuts for key growth sectors and advocated for deregulation to ease the burden on businesses.

"Tax cuts and deregulation, if carefully executed, could significantly increase growth in key sectors of the economy," Nhepera said.

Economic analyst Malone Gwadu stressed the importance of exchange rate stability and inflation control, suggesting that fiscal policies should prioritize long-term growth and economic diversification. He pointed to manufacturing and tourism as key sectors with high growth potential.

"With deliberate fiscal tools that prioritize long-term growth, Zimbabwe can achieve a more competitive and inclusive economy," Gwadu said.

While there is optimism surrounding the upcoming budget, economist Enoch Rukarwa cautioned that austerity may be on the horizon as the government seeks to align its fiscal policies with contractionary monetary measures.

"Overall, to accommodate a contractionary monetary policy, the Government is likely to maintain austerity on the fiscal side of the economy," Rukarwa concluded.

As Zimbabweans await Minister Ncube's Budget speech, the focus remains on how the government will balance short-term fiscal needs with long-term economic transformation. Stakeholders are hopeful that the 2025 National Budget will reinforce the government's commitment to economic stability, inclusivity, and prosperity, laying the foundation for a brighter economic future for the nation.

With global commodity prices fluctuating and regional electricity shortages weighing on the economy, Zimbabwe remains resilient. The government is focused on leveraging the country's vast resources in mining, agriculture, and tourism to unlock new economic opportunities and support long-term development.

Economic analysts have called for a cautious yet proactive approach to fiscal policy, emphasizing the importance of balancing immediate financial constraints with strategic investments in key sectors. Tafara Mtutu, an economic analyst, believes that the government's efforts to bolster the mining sector are crucial. While commodity price volatility presents challenges, he sees an opportunity for the government to strengthen support for the industry by considering tax adjustments to enhance competitiveness and maintain production momentum.

"Through considering reduced royalties during times of depressed commodity prices, the Government demonstrates its commitment to fostering a business-friendly environment that ensures both sustainability and growth," Mtutu said.

The mining sector remains a cornerstone of Zimbabwe's economy, while other areas such as manufacturing and tourism are poised for strategic investment. Economic diversification has been a focal point of Minister Ncube's past economic plans, and analysts are hopeful that the 2025 Budget will continue to prioritize policies that enhance resilience and improve global competitiveness.

Meanwhile, Zimbabwean businesses like Delta Corporation are proving that innovation can thrive even in challenging economic conditions. This spirit of resilience is reflective of the broader determination to overcome economic hurdles and chart a path toward prosperity.

The Zimbabwe National Chamber of Commerce (ZNCC) President, Mr. Tapiwa Karoro, stressed the importance of the Budget in shaping the nation's fiscal priorities and revenue-generating strategies for the year ahead. He also highlighted recent changes, such as the introduction of an excise duty on e-cigarettes, which has sparked debate among industry players and economists alike.

"There is a concern that the new excise duty on e-cigarettes does not align with scientific evidence, as studies show that vapor products are less harmful than traditional cigarettes. The current rate is also higher than in comparable regions," Karoro noted.

Economist Enoch Rukarwa echoed the sentiment, urging the government to focus on formalizing the informal sector and enhancing the tax base. He stressed the need for strategic reforms in presumptive taxes to bring informal businesses into the fold, thereby broadening the tax net.

"The Zimbabwean tax framework, while sometimes perceived as burdensome, aligns with regional standards. Strategic enhancements, such as enforcing collection of presumptive taxes, can broaden the tax base and foster inclusivity," Rukarwa said.

The Bankers Association of Zimbabwe (BAZ) has called for fiscal efficiency and the promotion of financial inclusion. They have advocated for a reduction in the 2 percent Intermediated Money Transfer Tax (IMTT), which they believe will drive formal transactions, reduce cash dependency, and strengthen revenue collection mechanisms.

"Lowering the IMTT will not only drive more transactions through formal banking channels but also support broader economic stability by addressing risks associated with cash handling," BAZ stated in its submission.

In addition, Mr. Karoro from ZNCC raised concerns about the negative impact of high taxes on bank transactions, such as the IMTT and withdrawal levies, which discourage the use of digital payment systems and exacerbate the informal economy. This, he argued, undermines the effectiveness of the government's monetary policy and hampers Zimbabwe's international competitiveness.

"Taxes on transactions add to the cost of doing business, negatively impacting the country's international competitiveness," Karoro said.

Financial markets analyst George Nhepera called for pro-business policies aimed at boosting the confidence of economic players. He suggested targeted tax cuts for key growth sectors and advocated for deregulation to ease the burden on businesses.

"Tax cuts and deregulation, if carefully executed, could significantly increase growth in key sectors of the economy," Nhepera said.

Economic analyst Malone Gwadu stressed the importance of exchange rate stability and inflation control, suggesting that fiscal policies should prioritize long-term growth and economic diversification. He pointed to manufacturing and tourism as key sectors with high growth potential.

"With deliberate fiscal tools that prioritize long-term growth, Zimbabwe can achieve a more competitive and inclusive economy," Gwadu said.

While there is optimism surrounding the upcoming budget, economist Enoch Rukarwa cautioned that austerity may be on the horizon as the government seeks to align its fiscal policies with contractionary monetary measures.

"Overall, to accommodate a contractionary monetary policy, the Government is likely to maintain austerity on the fiscal side of the economy," Rukarwa concluded.

As Zimbabweans await Minister Ncube's Budget speech, the focus remains on how the government will balance short-term fiscal needs with long-term economic transformation. Stakeholders are hopeful that the 2025 National Budget will reinforce the government's commitment to economic stability, inclusivity, and prosperity, laying the foundation for a brighter economic future for the nation.

Source - The Herald

Join the discussion

Loading comments…