News / National

Mukuru expanding into deposit-taking microfinance institution

19 Dec 2024 at 16:56hrs |

0 Views

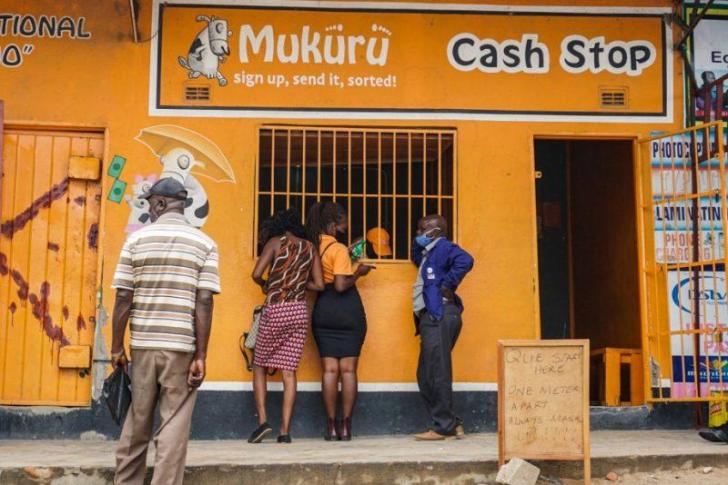

Zimbabwe's rapidly growing remittance sector has prompted several money transfer platforms to diversify their services, with Mukuru Financial Services Zimbabwe Limited becoming the latest to be licensed as a deposit-taking microfinance institution.

Licensed in October 2024, Mukuru Financial Services joins a wave of money transfer businesses seeking to tap into the booming remittance market by offering deposit-taking services. A source at the Reserve Bank of Zimbabwe revealed that several other money transfer platforms have already applied for similar licenses to enter the sector.

The country's diaspora remittance inflows have experienced impressive growth, increasing by 16.5% from US$1.6 billion in the first nine months of 2023 to US$1.9 billion during the same period in 2024. Projections indicate that remittances will reach US$2.49 billion by the end of 2024, with expectations to rise further to US$2.51 billion in 2025.

This growth in remittance inflows is contributing to the expansion of Zimbabwe's financial services sector. As of September 30, 2024, the banking sector included 14 commercial banks, four building societies, and one savings bank. The sector also had 259 credit-only microfinance institutions, eight deposit-taking microfinance institutions, and four development financial institutions.

The expansion of money transfer services into deposit-taking institutions is seen as a positive development, as it provides the growing diaspora community with more options to manage their financial transactions and savings back home. With the remittance sector continuing to thrive, it is anticipated that these new services will play a crucial role in supporting Zimbabwe's financial inclusion efforts and economic recovery.

Licensed in October 2024, Mukuru Financial Services joins a wave of money transfer businesses seeking to tap into the booming remittance market by offering deposit-taking services. A source at the Reserve Bank of Zimbabwe revealed that several other money transfer platforms have already applied for similar licenses to enter the sector.

This growth in remittance inflows is contributing to the expansion of Zimbabwe's financial services sector. As of September 30, 2024, the banking sector included 14 commercial banks, four building societies, and one savings bank. The sector also had 259 credit-only microfinance institutions, eight deposit-taking microfinance institutions, and four development financial institutions.

The expansion of money transfer services into deposit-taking institutions is seen as a positive development, as it provides the growing diaspora community with more options to manage their financial transactions and savings back home. With the remittance sector continuing to thrive, it is anticipated that these new services will play a crucial role in supporting Zimbabwe's financial inclusion efforts and economic recovery.

Source - online

Join the discussion

Loading comments…