News / National

RBZ predicts inflation to trend down in 2025

10 Feb 2025 at 06:31hrs |

14 Views

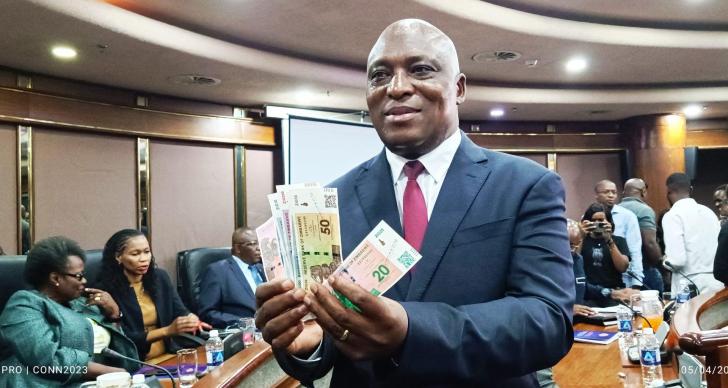

The Reserve Bank of Zimbabwe (RBZ) is optimistic about continued inflation moderation, forecasting the monthly inflation rate to average 3% or less in 2025. The central bank expects the annual inflation rate for the local currency to end the year between 20% and 30%, bolstered by sustained exchange rate stability.

In its 2025 Monetary Policy Statement, RBZ Governor Dr. John Mushayavanhu attributed the projected decline in inflation to tight monetary policies, including prudent reserve money targeting, which limits excessive money supply. He emphasized that stabilizing the exchange rate is critical for controlling price movements within Zimbabwe's multi-currency framework.

"The commitment by the reserve bank to pursue optimal monetary policies through prudent reserve money targeting and strategic interventions in the foreign exchange market will stabilize the exchange rate, which is a key driver of price dynamics in a multi-currency environment," Dr. Mushayavanhu said.

The RBZ anticipates annual inflation to rise temporarily from April to September 2025 due to base effects linked to a spike in inflation in October 2024. However, inflation is expected to moderate significantly by year-end.

Zimbabwe operates a dual currency system, predominantly using the US dollar and Zimbabwe Gold (ZiG). Recent inflation trends indicate some volatility, with January 2025 monthly inflation in ZiG terms surging to 10.5%, up from 3.7% in December 2024. Similarly, US dollar inflation rose by 11.5% in January, following a modest 0.6% increase in December.

Since adopting a tight monetary policy stance in April 2024, the RBZ has managed to stabilize inflation and the exchange rate. Monthly ZiG inflation rates dropped from 37.2% in October 2024 to 3.7% by December 2024.

The Monetary Policy Committee (MPC) has reinforced these efforts by increasing the Bank Policy Rate from 20% to 35%, while corporate lending rates were adjusted upwards. Minimum corporate lending rates rose from 24.2% to 40%, and maximum rates increased from 32.4% to 45.6%.

These measures have curbed credit growth and alleviated inflationary pressures. RBZ's strategic approach to monetary policy has also helped to maintain exchange rate stability, an essential factor for Zimbabwe's economic stability.

Managing inflation remains the central bank's top priority as it seeks to sustain the current slowdown in ZiG inflation while ensuring US dollar inflation remains under control. The RBZ's tight policy framework is aimed at fostering a stable monetary environment that supports economic growth and price stability.

This proactive stance underlines RBZ's commitment to mitigating inflation risks and ensuring Zimbabwe's economic resilience in the face of global and domestic challenges.

In its 2025 Monetary Policy Statement, RBZ Governor Dr. John Mushayavanhu attributed the projected decline in inflation to tight monetary policies, including prudent reserve money targeting, which limits excessive money supply. He emphasized that stabilizing the exchange rate is critical for controlling price movements within Zimbabwe's multi-currency framework.

"The commitment by the reserve bank to pursue optimal monetary policies through prudent reserve money targeting and strategic interventions in the foreign exchange market will stabilize the exchange rate, which is a key driver of price dynamics in a multi-currency environment," Dr. Mushayavanhu said.

The RBZ anticipates annual inflation to rise temporarily from April to September 2025 due to base effects linked to a spike in inflation in October 2024. However, inflation is expected to moderate significantly by year-end.

Zimbabwe operates a dual currency system, predominantly using the US dollar and Zimbabwe Gold (ZiG). Recent inflation trends indicate some volatility, with January 2025 monthly inflation in ZiG terms surging to 10.5%, up from 3.7% in December 2024. Similarly, US dollar inflation rose by 11.5% in January, following a modest 0.6% increase in December.

Since adopting a tight monetary policy stance in April 2024, the RBZ has managed to stabilize inflation and the exchange rate. Monthly ZiG inflation rates dropped from 37.2% in October 2024 to 3.7% by December 2024.

The Monetary Policy Committee (MPC) has reinforced these efforts by increasing the Bank Policy Rate from 20% to 35%, while corporate lending rates were adjusted upwards. Minimum corporate lending rates rose from 24.2% to 40%, and maximum rates increased from 32.4% to 45.6%.

These measures have curbed credit growth and alleviated inflationary pressures. RBZ's strategic approach to monetary policy has also helped to maintain exchange rate stability, an essential factor for Zimbabwe's economic stability.

Managing inflation remains the central bank's top priority as it seeks to sustain the current slowdown in ZiG inflation while ensuring US dollar inflation remains under control. The RBZ's tight policy framework is aimed at fostering a stable monetary environment that supports economic growth and price stability.

This proactive stance underlines RBZ's commitment to mitigating inflation risks and ensuring Zimbabwe's economic resilience in the face of global and domestic challenges.

Source - The Herald

Join the discussion

Loading comments…