Opinion / Columnist

The Sentry report on Mutapa Fund is shallow and weak

04 Jul 2024 at 15:37hrs |

0 Views

I had the MISFORTUNE of going through a report prepared and distributed by The Sentry, possibly written by an excitable Nick Donovan.

Long story short, the report is shallow and weak. Here is my take:.

Let's dig into this at 3 levels: technical, geo-political and personal.

TECHNICAL:

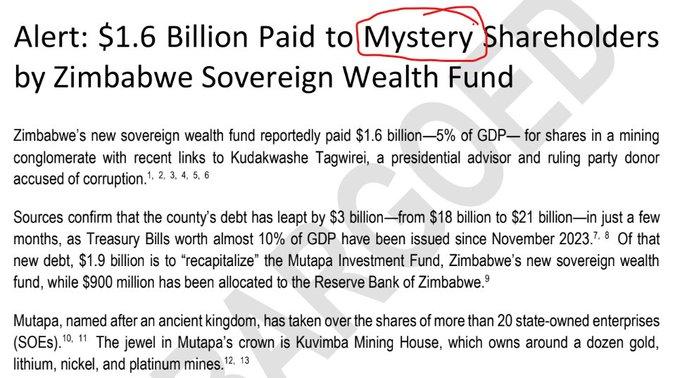

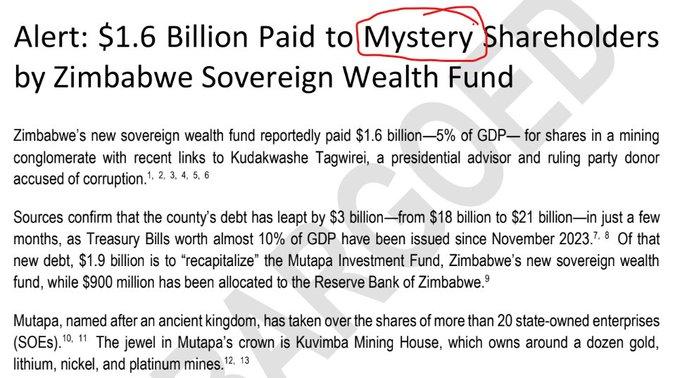

The import of The Sentry report is that the Mutapa Fund overpaid a large amount to shareholders that are unknown. The report itself uses the term "mystery".

It is not clear why a bunch of foreigners want to know shareholders in a local transaction in a sovereign country far away from their shores, BUT, that's not the point.

It is strange that the shareholders are deemed mysterious by The Sentry yet they go on to name them. The shareholders of the 35% in question are legal entities. They are legal persons, can sue and be sued in their own right. A company is separate from it's shareholders.

This separation's key to modern corporations. without it the world would go back to the Stone Age. This is why when JP Morgan ship was caught with drugs, likes of Nick Donovan didn't go around looking for JPM shareholders. The point's, Kuvimba shareholders are legal entities.

The Sentry anchors itself on reports from other shallow reporters. EG, their report on the value of the transaction is based on a report from News Hawks Live. The chaps at Sentry haven't actually seen evidence of the sale. But let's for a second assume it happened.

Even though they don't know if the sale happened, these chaps from a foreign land are bothered that Mutapa could have overpaid? Not only that, they query the valuation. They don't explain why their own sense of the valuation should have been acceptable to the seller.

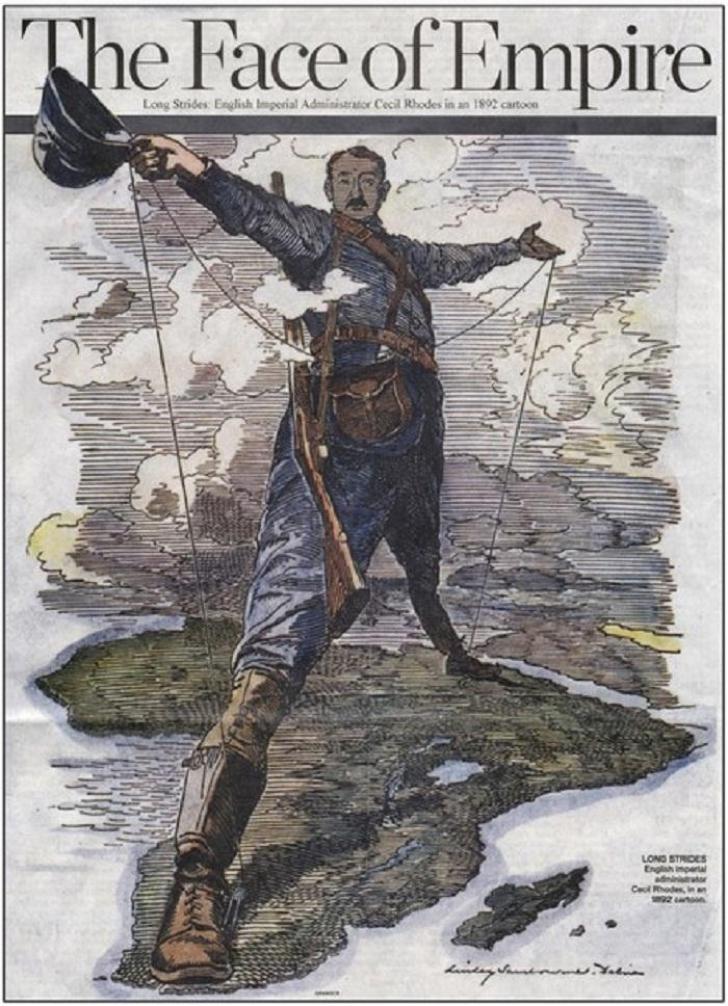

Kuvimba holds some very strategic mineral assets - both base and precious metals. Some of its assets were previously owned and mined by the British, specifically Anglo-American. NOTE that I said Anglo-American, and not OPPENHEIMERS (shareholders).

Mines that were part of BNC changed hands from the OPPENHEIMERS to OPPENHEIMER proteges like Kalaa Mpinga who then lost control to the Chinese. Between 2013 and 2019, the company was heavily mismanaged and indebted to the point of seeking bankruptcy protection.

These issues from 2013 - 2019 didn't bother the likes of Nick Donovan. Remember these are strategic national minerals like gold, nickel, copper and PGMs. It's when the bankrupt BNC was acquired and remodeled into Kuvimba and a stake sold to Mutapa that the Sentry chaps woke up.

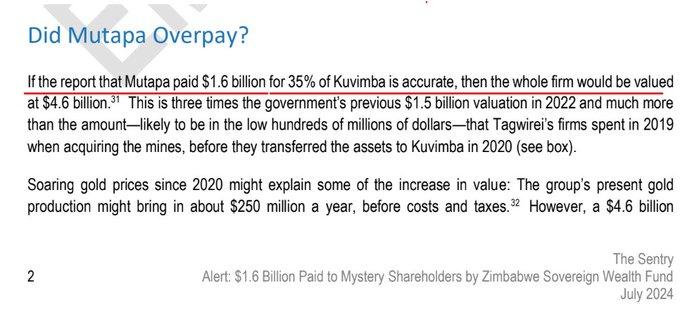

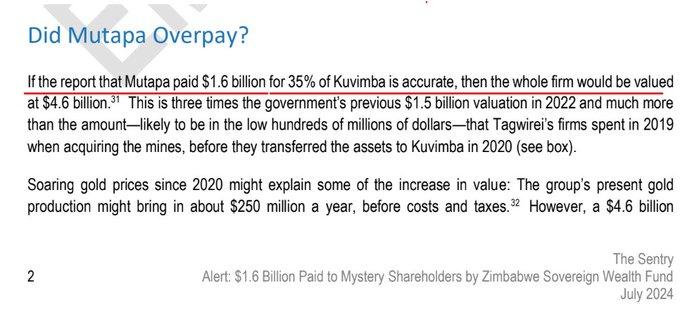

Let's look at the numbers. These chaps insinuate that $1,6 billion is too much money for the 35%, but don't say what credible valuation model they base it on and why their model should be accepted by two legitimate parties to the transaction in question.

Mines are valued using multiple factors like resource available, life of mine, projected cash flows, net asset value, technology and so forth. The Sentry chaps do not actually have facts on any of these. All they have are scant numbers and don't say why that should be used

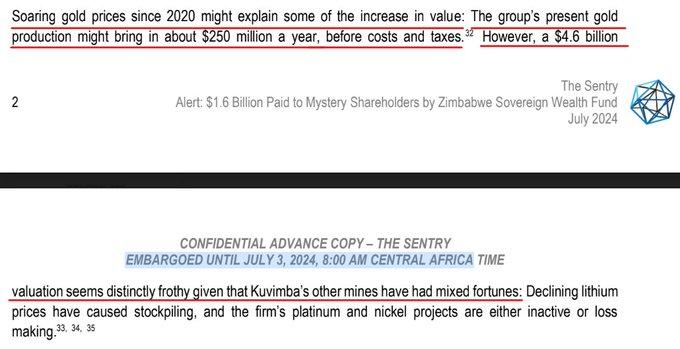

Let's use their numbers for a second. They say Kuvimba's gold assets haul in a quarter of a billion dollars a year ($250 mln) a year. That's a billion dollars in revenues every 4 years, assuming gold prices remain constant.

But we know that gold prices per ounce have moved from $1,773 (2020) to $1,798 (2022) to $1,801 (2022) to 2,358 (now). Gold prices have risen ~33% over the last 4 years. If the same trend continues over the next 4, gold prices will be $3136 per ounce. We'll come back to that.

Let's assume that Kuvimba was only selling its gold assets currently generating a quarter of a billion dollars as claimed by chaps at The Sentry, if you valued them at a conservative 10X gross revenues, the gold mining assets valuation alone would be $2.5 billion.

But we know that a 10X gross revenues valuation is way too conservative - WHY? Because (i) when you dig gold out, you are digging out pure cash, and (ii), gold prices are rising (33% over the last 4 years).

If I was selling MY gold mines, I'd value them at minimum 15X gross revenues. That would be a minimum $3.75 billion for Kuvimba's gold assets.

In fact, I'd seek a 20X gross revenues valuation and negotiate - meaning my valuation would be between $3.75 bln & $5bln

Mind you, we are only talking about Kuvimba's gold assets. We are not including Kuvimba's lithium, copper, nickel, platinum, palladium, rhodium, iridium, osmium, and other precious and base metals.

So at a valuation of $4,6 billion being questioned by chaps at The Sentry, Mutapa actually got the 35% on the cheap. Huge bargain.

Sentry chaps say that the 35% shareholding was paid for using a Treasury Bill. Apparently, this Bill matures in 10 years.

If the 35% shareholders wanted cash now, and not wait for 10 years, they would have to sell the TBs at a discount, say at $700 000. Which makes sense, right? Why would you otherwise sell mines generating at least a quarter of a billion annually if you don't need the cash now?

MY POINT IS, using the same speculative information they used, the chaps at The Sentry came to a daft conclusion. Mutapa Fund got the assets at a bargain. In any case, it makes sense if the assets are being bought using 10 year TBs that have to be discounted to liquidate.

BUT, are chaps at The Sentry being daft? The answer is NO. Folks, its well-funded propaganda. It's geo-political propaganda: Zimbabwe's gold-backed currency, onslaught on Zimbabwe and Western imperialism.

Folks, imperialists can change their methods, but their goal is the same. That's why the reporting is well coordinated by News Hawks Live, NewsDay Zimbabwe ZimLive etc.

US senator recently disclosed why Ukrainians are dying on the war-front for America - minerals.

Lindsay Graham stated categorically that Ukraine has $12 trillion in minerals the imperialists "can't afford to lose". He called Ukraine a "GOLD MINE".

That's why Ukrainians are dying. Imperialists go to war over minerals.

Imperialists go to war over minerals. Full article here

So why's Nick Donovan and The Sentry so obsessed with Tagwirei and lithium, PGM and gold mines in Zim?

If Tagwirei structured the purchase of mines formerly owned by Anglo-American, and later by Oppenheimer proteges, and then sold them to Mutapa, therein lies the issue.

Mines are sold and bought every year all over the world. Of all sorts of acquisitions all over the world, Nick Donovan is mostly concerned about Zimbabwe. In fact in the last few months, Prospect (Australian) bought a mine in Zambia. No "investigations" from Sentry chaps.

There are dubious transactions by Western companies such as Glencore.

Glencore admitted to corruption and bribery in many African countries in a US court, paying nearly a billion dollar fine.

Full article here

Did The Sentry investigate these? NO.

So why are chaps at The Sentry so obsessed with Tagwirei? It's because he is a genius who organised the purchase of mining assets formerly held by the British (Oppenheimers), controlled by foreigners and put them in the hands of Zimbabweans through the Mutapa Fund.

I am not the only one observing that Tagwirei is smart - even Eddie Cross, a British descendant begrudgingly made the same observation.

So the chaps The Sentry are a propaganda LYNCH MOB mobilising against an individual outside the justice system. It's an onslaught.

Remember Tagwirei was sanctioned. Sanctions are punitive punishment and a violation of rights without legal processes or a hearing in a court of law.

Tagwirei was sanctioned, but Trafigura wasn't.

A corrupt Glencore wasn't sanctioned, but got a right of reply in US courts

But let's go to the bigger picture: Zimbabwe.

Zimbabwe, burdened by sanctions for decades has gone through serious currency problems. It recently introduced a gold-indexed currency, the Zimbabwe GOLD. It's probably the only GOLD-indexed currency in the world.

To buttress that, in its great wisdom, the GVT of Zimbabwe decides to use America's paper money backed by nothing to wholly acquire an asset generating $250 million worth of GOLD annually or a billion dollars worth of GOLD every 4 years to anchor the ZiG.

Are you with me?

Via this acquisition, the GVT transferred the gold mines to the people of Zimbabwe via the sovereign wealth fund.

Remember, at today's gold price, $250 million worth of gold a year is 3 250 KGs of gold, or over 3 tons - now owned by Mutapa Fund, to anchor ZiG.

You get it?

It is very clear that The Sentry chaps want to scuttle Zimbabwe's debt restructuring program via their report. Zimbabwe is working on restructuring the debt, some of which is owed to the same imperialist countries and institutions. These people thrive on debt yokes.

Our people need to wake up and smell the coffee. The Sentry chaps don't really care about the people of Zimbabwe. They are propaganda LYNCH MOBS and CHARLATANS pushing an imperialist agenda. And they have willing local media running dogs amplifying their message.

Long story short, the report is shallow and weak. Here is my take:.

Let's dig into this at 3 levels: technical, geo-political and personal.

TECHNICAL:

The import of The Sentry report is that the Mutapa Fund overpaid a large amount to shareholders that are unknown. The report itself uses the term "mystery".

It is not clear why a bunch of foreigners want to know shareholders in a local transaction in a sovereign country far away from their shores, BUT, that's not the point.

It is strange that the shareholders are deemed mysterious by The Sentry yet they go on to name them. The shareholders of the 35% in question are legal entities. They are legal persons, can sue and be sued in their own right. A company is separate from it's shareholders.

This separation's key to modern corporations. without it the world would go back to the Stone Age. This is why when JP Morgan ship was caught with drugs, likes of Nick Donovan didn't go around looking for JPM shareholders. The point's, Kuvimba shareholders are legal entities.

The Sentry anchors itself on reports from other shallow reporters. EG, their report on the value of the transaction is based on a report from News Hawks Live. The chaps at Sentry haven't actually seen evidence of the sale. But let's for a second assume it happened.

Even though they don't know if the sale happened, these chaps from a foreign land are bothered that Mutapa could have overpaid? Not only that, they query the valuation. They don't explain why their own sense of the valuation should have been acceptable to the seller.

Kuvimba holds some very strategic mineral assets - both base and precious metals. Some of its assets were previously owned and mined by the British, specifically Anglo-American. NOTE that I said Anglo-American, and not OPPENHEIMERS (shareholders).

Mines that were part of BNC changed hands from the OPPENHEIMERS to OPPENHEIMER proteges like Kalaa Mpinga who then lost control to the Chinese. Between 2013 and 2019, the company was heavily mismanaged and indebted to the point of seeking bankruptcy protection.

These issues from 2013 - 2019 didn't bother the likes of Nick Donovan. Remember these are strategic national minerals like gold, nickel, copper and PGMs. It's when the bankrupt BNC was acquired and remodeled into Kuvimba and a stake sold to Mutapa that the Sentry chaps woke up.

Let's look at the numbers. These chaps insinuate that $1,6 billion is too much money for the 35%, but don't say what credible valuation model they base it on and why their model should be accepted by two legitimate parties to the transaction in question.

Mines are valued using multiple factors like resource available, life of mine, projected cash flows, net asset value, technology and so forth. The Sentry chaps do not actually have facts on any of these. All they have are scant numbers and don't say why that should be used

Let's use their numbers for a second. They say Kuvimba's gold assets haul in a quarter of a billion dollars a year ($250 mln) a year. That's a billion dollars in revenues every 4 years, assuming gold prices remain constant.

But we know that gold prices per ounce have moved from $1,773 (2020) to $1,798 (2022) to $1,801 (2022) to 2,358 (now). Gold prices have risen ~33% over the last 4 years. If the same trend continues over the next 4, gold prices will be $3136 per ounce. We'll come back to that.

Let's assume that Kuvimba was only selling its gold assets currently generating a quarter of a billion dollars as claimed by chaps at The Sentry, if you valued them at a conservative 10X gross revenues, the gold mining assets valuation alone would be $2.5 billion.

But we know that a 10X gross revenues valuation is way too conservative - WHY? Because (i) when you dig gold out, you are digging out pure cash, and (ii), gold prices are rising (33% over the last 4 years).

If I was selling MY gold mines, I'd value them at minimum 15X gross revenues. That would be a minimum $3.75 billion for Kuvimba's gold assets.

In fact, I'd seek a 20X gross revenues valuation and negotiate - meaning my valuation would be between $3.75 bln & $5bln

Mind you, we are only talking about Kuvimba's gold assets. We are not including Kuvimba's lithium, copper, nickel, platinum, palladium, rhodium, iridium, osmium, and other precious and base metals.

So at a valuation of $4,6 billion being questioned by chaps at The Sentry, Mutapa actually got the 35% on the cheap. Huge bargain.

Sentry chaps say that the 35% shareholding was paid for using a Treasury Bill. Apparently, this Bill matures in 10 years.

If the 35% shareholders wanted cash now, and not wait for 10 years, they would have to sell the TBs at a discount, say at $700 000. Which makes sense, right? Why would you otherwise sell mines generating at least a quarter of a billion annually if you don't need the cash now?

MY POINT IS, using the same speculative information they used, the chaps at The Sentry came to a daft conclusion. Mutapa Fund got the assets at a bargain. In any case, it makes sense if the assets are being bought using 10 year TBs that have to be discounted to liquidate.

Folks, imperialists can change their methods, but their goal is the same. That's why the reporting is well coordinated by News Hawks Live, NewsDay Zimbabwe ZimLive etc.

US senator recently disclosed why Ukrainians are dying on the war-front for America - minerals.

Lindsay Graham stated categorically that Ukraine has $12 trillion in minerals the imperialists "can't afford to lose". He called Ukraine a "GOLD MINE".

That's why Ukrainians are dying. Imperialists go to war over minerals.

Imperialists go to war over minerals. Full article here

So why's Nick Donovan and The Sentry so obsessed with Tagwirei and lithium, PGM and gold mines in Zim?

If Tagwirei structured the purchase of mines formerly owned by Anglo-American, and later by Oppenheimer proteges, and then sold them to Mutapa, therein lies the issue.

Mines are sold and bought every year all over the world. Of all sorts of acquisitions all over the world, Nick Donovan is mostly concerned about Zimbabwe. In fact in the last few months, Prospect (Australian) bought a mine in Zambia. No "investigations" from Sentry chaps.

There are dubious transactions by Western companies such as Glencore.

Glencore admitted to corruption and bribery in many African countries in a US court, paying nearly a billion dollar fine.

Full article here

Did The Sentry investigate these? NO.

So why are chaps at The Sentry so obsessed with Tagwirei? It's because he is a genius who organised the purchase of mining assets formerly held by the British (Oppenheimers), controlled by foreigners and put them in the hands of Zimbabweans through the Mutapa Fund.

I am not the only one observing that Tagwirei is smart - even Eddie Cross, a British descendant begrudgingly made the same observation.

So the chaps The Sentry are a propaganda LYNCH MOB mobilising against an individual outside the justice system. It's an onslaught.

Remember Tagwirei was sanctioned. Sanctions are punitive punishment and a violation of rights without legal processes or a hearing in a court of law.

Tagwirei was sanctioned, but Trafigura wasn't.

A corrupt Glencore wasn't sanctioned, but got a right of reply in US courts

But let's go to the bigger picture: Zimbabwe.

Zimbabwe, burdened by sanctions for decades has gone through serious currency problems. It recently introduced a gold-indexed currency, the Zimbabwe GOLD. It's probably the only GOLD-indexed currency in the world.

To buttress that, in its great wisdom, the GVT of Zimbabwe decides to use America's paper money backed by nothing to wholly acquire an asset generating $250 million worth of GOLD annually or a billion dollars worth of GOLD every 4 years to anchor the ZiG.

Are you with me?

Via this acquisition, the GVT transferred the gold mines to the people of Zimbabwe via the sovereign wealth fund.

Remember, at today's gold price, $250 million worth of gold a year is 3 250 KGs of gold, or over 3 tons - now owned by Mutapa Fund, to anchor ZiG.

You get it?

It is very clear that The Sentry chaps want to scuttle Zimbabwe's debt restructuring program via their report. Zimbabwe is working on restructuring the debt, some of which is owed to the same imperialist countries and institutions. These people thrive on debt yokes.

Our people need to wake up and smell the coffee. The Sentry chaps don't really care about the people of Zimbabwe. They are propaganda LYNCH MOBS and CHARLATANS pushing an imperialist agenda. And they have willing local media running dogs amplifying their message.

Source - X

All articles and letters published on Bulawayo24 have been independently written by members of Bulawayo24's community. The views of users published on Bulawayo24 are therefore their own and do not necessarily represent the views of Bulawayo24. Bulawayo24 editors also reserve the right to edit or delete any and all comments received.

Join the discussion

Loading comments…