Opinion / Columnist

Zimbabwe finds a way to turn paper into gold long live Gushungo!!!

09 Apr 2024 at 15:58hrs |

0 Views

Money, the market, free enterprise, free trade, law, and justice, among others - existed in other forms before the colonialists introduced paper currency. The natives had their own functional institutions that served them well for centuries.

Zimbabwe has struggled to control its currency from 2005. On 18 May 2005, it sent out paramilitary units in the streets of Harare to smash stalls of street traders, in an operation code-named Murabatsvina- Drive Out the Rubbish. Under "Murabatsvina," the police "destroyed 34 flea markets, netted some Z$900 million ($100,000) in fines, and seized some Z$2.2 billion of goods."38 At least 22,000 street traders were arrested, and 700,000 people were left homeless.

The second republic came and promised heaven on earth but people are disgusted. The state fails to deliver even the most basic services such as education and health care. Every Jack and Jill is running private schools from their bedrooms. Getting a vacancy at any government training institute requires you to pay a bribe of $1,500 and above. The highest bidder gets the place. Carry US dollar to any supermarket and you will have 100 offers of better exchange rates than the shop.

The second republic tried all tricks in the book but people withdrew from the state sector and took their taxes with them or evade them altogether by bribing tax officials. For the umpteenth time, the government has discovered that, despite steep hikes in excise taxes and import duties, as well as the introduction of vampire taxes (value-added taxes or VAT), its revenues still cannot cover expenditures. The government has now ordered the central bank to change the currency altogether, thereby robbing people of their life savings. People are now stuck with useless paper currency in their hands.

For the removal of any doubt, the policy of backing currency with gold sounds great but there is no policy called 'good-but'. Either a policy is good or it is not. First and foremost, what makes good policy is the independence of the institution coming up with the policy. The Reserve Bank of Zimbabwe is not an Independent Institution but an arm of the ruling ZANU PF party, and this will never bode well with Zimbabwe's investors and citizens. While it is commendable that President Mnangagwa managed to build some reserves that were at zero when he took over; it is a mockery to our intelligence to go on TV and announce 1.1 tons of gold reserves. It is government policy that gold traders sell 10 percent of their proceeds to Fidelity, a government institution for building reserves.

On 8 January 2023, the daily news (https://dailynews.co.zw/) reported the delivery of gold to Fidelity as 35 tons. If the government took 10 percent to build the country reserves then for just that single year, we would expect at least 3 tons of reserves. Do the math. Honestly how can President Mnangagwa go on TV to announce that the whole country has 1.1 tons of gold in its reserves? Will it surprise anyone in Zimbabwe that some people amongst us have more than 1.1 tons of gold stashed at their farm houses?

This was a good policy proposal whose implementation was butchered and will not see the end of the day. If you think I am negative and doubt me, take the ZiG equivalence of USD2, 000.00 and try to buy a gold coin from Reserve bank of Zimbabwe. If you are successful, I will personally refund your purchase money and you keep the gold coin.

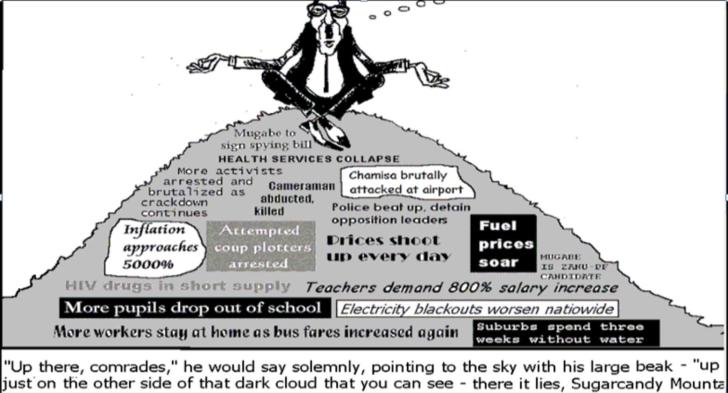

It is as clear as the sky that the economy will contract. The contraction will be accelerated through sabotage by people who have been robbed of their life savings through this fraudulent currency changes. This tactic has been used by despotic regime in dire need of funds. It is devilishly designed to steal the people's money. We have had a fair share of these currency manipulations in Zimbabwe where we saw inflation raging at the rate of 1,200 percent per year in 2006. A piece of chicken cost over 3 million Zimbabwean dollars. Eventually, Zimbabwe's currency collapsed in February 2009 when the inflation rate hit 6.5 quindecillion novemdecillion percent - 65 followed by 107 zeros. The currency was replaced by the US dollar and the South African rand.

People who were already trading clandestinely in the parallel or informal economy to keep their incomes and assets out of the reach of the state will go back to native institutions. They will adopt defensive survival mechanisms. The native approach will turn most houses into hoarding, smuggling, illegal currency deals, bribery, and corruption centers. With time, larger and larger segments of the economy will slip out of the control of the government, which soon finds that its control does not extend beyond a few miles of the capital. To be admitted into a Nursing School today, one needs to corruptly pay the recruiter USD$1,500. If you think this is ridiculous, then wait for six more months and come back and let me know how ridiculous I sounded.

Zimbabwe has struggled to control its currency from 2005. On 18 May 2005, it sent out paramilitary units in the streets of Harare to smash stalls of street traders, in an operation code-named Murabatsvina- Drive Out the Rubbish. Under "Murabatsvina," the police "destroyed 34 flea markets, netted some Z$900 million ($100,000) in fines, and seized some Z$2.2 billion of goods."38 At least 22,000 street traders were arrested, and 700,000 people were left homeless.

The second republic came and promised heaven on earth but people are disgusted. The state fails to deliver even the most basic services such as education and health care. Every Jack and Jill is running private schools from their bedrooms. Getting a vacancy at any government training institute requires you to pay a bribe of $1,500 and above. The highest bidder gets the place. Carry US dollar to any supermarket and you will have 100 offers of better exchange rates than the shop.

The second republic tried all tricks in the book but people withdrew from the state sector and took their taxes with them or evade them altogether by bribing tax officials. For the umpteenth time, the government has discovered that, despite steep hikes in excise taxes and import duties, as well as the introduction of vampire taxes (value-added taxes or VAT), its revenues still cannot cover expenditures. The government has now ordered the central bank to change the currency altogether, thereby robbing people of their life savings. People are now stuck with useless paper currency in their hands.

On 8 January 2023, the daily news (https://dailynews.co.zw/) reported the delivery of gold to Fidelity as 35 tons. If the government took 10 percent to build the country reserves then for just that single year, we would expect at least 3 tons of reserves. Do the math. Honestly how can President Mnangagwa go on TV to announce that the whole country has 1.1 tons of gold in its reserves? Will it surprise anyone in Zimbabwe that some people amongst us have more than 1.1 tons of gold stashed at their farm houses?

This was a good policy proposal whose implementation was butchered and will not see the end of the day. If you think I am negative and doubt me, take the ZiG equivalence of USD2, 000.00 and try to buy a gold coin from Reserve bank of Zimbabwe. If you are successful, I will personally refund your purchase money and you keep the gold coin.

It is as clear as the sky that the economy will contract. The contraction will be accelerated through sabotage by people who have been robbed of their life savings through this fraudulent currency changes. This tactic has been used by despotic regime in dire need of funds. It is devilishly designed to steal the people's money. We have had a fair share of these currency manipulations in Zimbabwe where we saw inflation raging at the rate of 1,200 percent per year in 2006. A piece of chicken cost over 3 million Zimbabwean dollars. Eventually, Zimbabwe's currency collapsed in February 2009 when the inflation rate hit 6.5 quindecillion novemdecillion percent - 65 followed by 107 zeros. The currency was replaced by the US dollar and the South African rand.

People who were already trading clandestinely in the parallel or informal economy to keep their incomes and assets out of the reach of the state will go back to native institutions. They will adopt defensive survival mechanisms. The native approach will turn most houses into hoarding, smuggling, illegal currency deals, bribery, and corruption centers. With time, larger and larger segments of the economy will slip out of the control of the government, which soon finds that its control does not extend beyond a few miles of the capital. To be admitted into a Nursing School today, one needs to corruptly pay the recruiter USD$1,500. If you think this is ridiculous, then wait for six more months and come back and let me know how ridiculous I sounded.

Source - Sam Wezhira

All articles and letters published on Bulawayo24 have been independently written by members of Bulawayo24's community. The views of users published on Bulawayo24 are therefore their own and do not necessarily represent the views of Bulawayo24. Bulawayo24 editors also reserve the right to edit or delete any and all comments received.

Join the discussion

Loading comments…