News / National

Zimbabwe central bank urges banks to increase ZiG lending

01 Mar 2025 at 08:56hrs |

0 Views

With the Zimbabwe Gold (ZiG) currency now largely stable, the Reserve Bank of Zimbabwe (RBZ) has urged banks to increase lending in ZiG, assuring financial institutions that the risk of depreciation has significantly diminished.

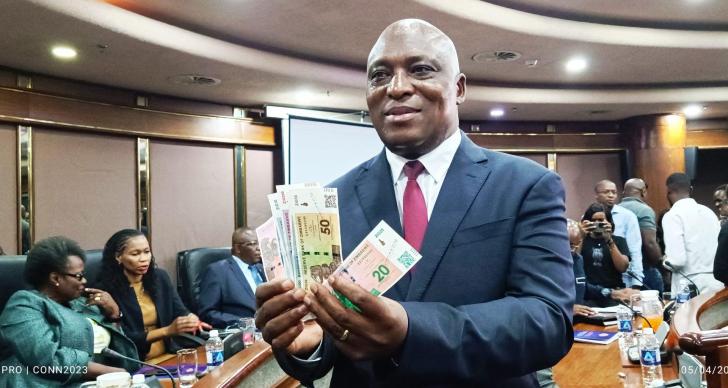

This follows reports that some banks have scaled down ZiG lending due to liquidity constraints. However, RBZ Governor Dr. John Mushayavanhu, in a podcast interview with ZTN Prime yesterday, attributed this reluctance to lingering fears over currency depreciation, which he argued should no longer be a major concern given the currency's stability.

Dr. Mushayavanhu highlighted that ZiG has maintained relative stability and demonstrated firm appreciation against the US dollar, including on the parallel market, making a strong case for increased lending.

"Banks are losing potential income by not lending, fearing depreciation will erode loan returns. But the RBZ has ‘walked the talk' in stabilising the currency, with nearly a full year of relative stability," he said.

The RBZ Governor urged financial institutions to reconsider their strategies in light of the stable currency.

"We are almost going a full year with stability. That should force banks to rethink their strategies and realise that this currency is stable," he added.

Dr. Mushayavanhu also expressed concern over the lack of interbank lending, which has led to capital stagnation within the financial system.

Since its introduction in April last year, ZiG initially held steady against the US dollar at around 13 before depreciating sharply to 24.4 by September 27. It has since stabilised, closing at 26.5/US$1 on Friday. Even on the unofficial market, rates peaked at 42 but have since declined to around 32.

Responding to concerns that payments to government contractors could destabilise the currency, Dr. Mushayavanhu reassured the public that the RBZ would neither create new money nor extend loans to the Government for these obligations.

"(The) Treasury collects money through taxes, which is already in the system—it's not printing. Inflation occurs when the Treasury borrows from the central bank to pay contractors, and that has not happened since I assumed office at RBZ," he said.

Dr. Mushayavanhu dismissed speculation that the Government was monetising the fiscal deficit through borrowing from the central bank, stating that the Treasury has no appetite for such borrowing.

He noted that contractors who previously sought US dollars on the black market were now holding onto their ZiG, as the currency's stability made it less necessary to convert to foreign currency.

"Contractors are realising that selling their ZiG at 35 or 40 just to acquire US dollars makes no sense when the currency is stable. That realisation has contributed to strengthening the parallel market," he said.

With the upcoming Quarterly Payment Dates (QPD), Dr. Mushayavanhu expects increased demand for ZiG, citing December's trend where banks sought local currency from account holders to meet tax obligations.

"The time has now come for holders of ZiG balances to dictate the price instead of what was happening in the past," he said.

Addressing concerns of exchange rate manipulation due to disparities between official and black market rates, Dr. Mushayavanhu insisted that the Willing Buyer Willing Seller (WBWS) system accurately reflects market dynamics.

He revealed that Zimbabwe's foreign currency reserves, including gold and other assets, are approaching US$600 million.

"If you divide the ZiG deposits in the market, about $14 billion, by the value of forex reserves, you get an implied exchange rate of approximately 22 ZiG to the US dollar. If we were controlling the exchange rate, it would not be above 22 because that's the logical clearing rate," he explained.

Dr. Mushayavanhu said the adoption of ZiG had been encouraging, with local currency transactions rising from 20 percent to 30 percent since its introduction. He suggested that adoption would have been even higher if not for the impact of drought on rural communities reliant on agriculture.

With ongoing efforts to stabilise the economy, the RBZ remains committed to ensuring a functional financial system that supports lending, investment, and sustainable growth.

This follows reports that some banks have scaled down ZiG lending due to liquidity constraints. However, RBZ Governor Dr. John Mushayavanhu, in a podcast interview with ZTN Prime yesterday, attributed this reluctance to lingering fears over currency depreciation, which he argued should no longer be a major concern given the currency's stability.

Dr. Mushayavanhu highlighted that ZiG has maintained relative stability and demonstrated firm appreciation against the US dollar, including on the parallel market, making a strong case for increased lending.

"Banks are losing potential income by not lending, fearing depreciation will erode loan returns. But the RBZ has ‘walked the talk' in stabilising the currency, with nearly a full year of relative stability," he said.

The RBZ Governor urged financial institutions to reconsider their strategies in light of the stable currency.

"We are almost going a full year with stability. That should force banks to rethink their strategies and realise that this currency is stable," he added.

Dr. Mushayavanhu also expressed concern over the lack of interbank lending, which has led to capital stagnation within the financial system.

Since its introduction in April last year, ZiG initially held steady against the US dollar at around 13 before depreciating sharply to 24.4 by September 27. It has since stabilised, closing at 26.5/US$1 on Friday. Even on the unofficial market, rates peaked at 42 but have since declined to around 32.

Responding to concerns that payments to government contractors could destabilise the currency, Dr. Mushayavanhu reassured the public that the RBZ would neither create new money nor extend loans to the Government for these obligations.

"(The) Treasury collects money through taxes, which is already in the system—it's not printing. Inflation occurs when the Treasury borrows from the central bank to pay contractors, and that has not happened since I assumed office at RBZ," he said.

Dr. Mushayavanhu dismissed speculation that the Government was monetising the fiscal deficit through borrowing from the central bank, stating that the Treasury has no appetite for such borrowing.

He noted that contractors who previously sought US dollars on the black market were now holding onto their ZiG, as the currency's stability made it less necessary to convert to foreign currency.

"Contractors are realising that selling their ZiG at 35 or 40 just to acquire US dollars makes no sense when the currency is stable. That realisation has contributed to strengthening the parallel market," he said.

With the upcoming Quarterly Payment Dates (QPD), Dr. Mushayavanhu expects increased demand for ZiG, citing December's trend where banks sought local currency from account holders to meet tax obligations.

"The time has now come for holders of ZiG balances to dictate the price instead of what was happening in the past," he said.

Addressing concerns of exchange rate manipulation due to disparities between official and black market rates, Dr. Mushayavanhu insisted that the Willing Buyer Willing Seller (WBWS) system accurately reflects market dynamics.

He revealed that Zimbabwe's foreign currency reserves, including gold and other assets, are approaching US$600 million.

"If you divide the ZiG deposits in the market, about $14 billion, by the value of forex reserves, you get an implied exchange rate of approximately 22 ZiG to the US dollar. If we were controlling the exchange rate, it would not be above 22 because that's the logical clearing rate," he explained.

Dr. Mushayavanhu said the adoption of ZiG had been encouraging, with local currency transactions rising from 20 percent to 30 percent since its introduction. He suggested that adoption would have been even higher if not for the impact of drought on rural communities reliant on agriculture.

With ongoing efforts to stabilise the economy, the RBZ remains committed to ensuring a functional financial system that supports lending, investment, and sustainable growth.

Source - the herald

Join the discussion

Loading comments…