News / National

Mushayavanhu under fire for outdated monetary assumptions

20 Jun 2025 at 15:32hrs |

238 Views

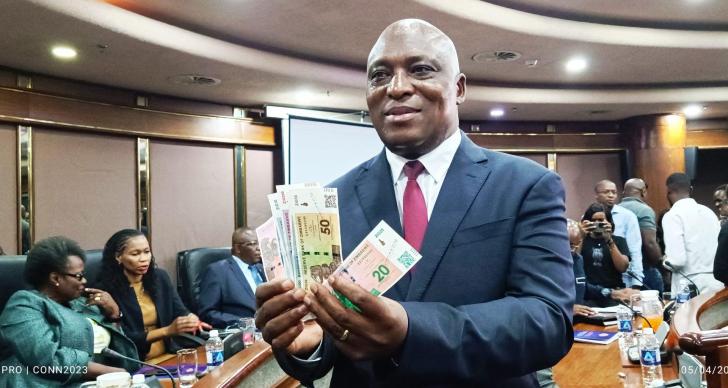

Reserve Bank of Zimbabwe (RBZ) governor John Mushayavanhu is facing mounting criticism over his persistent claim that the ZiG, Zimbabwe's embattled local currency, can only be strong if it is backed by gold pound-for-pound - an outdated notion that economic experts say ignores the complexities of modern monetary policy.

Since its launch in April 2024 as a replacement for the discredited Bond note, the ZiG - or Zimbabwe Gold - has suffered dramatic depreciation, triggering inflation and public distrust. Initially pegged at 13.56 ZiG per US dollar, the currency quickly spiralled on the parallel market, losing nearly 80% of its value by September 2024. By February 2025, the official rate had slid to 26.4 ZiG to the US dollar, marking a 94% decline since inception.

In an effort to address the crisis, the RBZ devalued the ZiG by 42.6% on September 27, 2024. However, year-on-year inflation has continued to rise, climbing from 85.7% in April to 92.1% in May 2025, largely due to the devaluation shock and ongoing instability in monetary policy implementation.

Despite these grim statistics, Mushayavanhu maintains that Zimbabwe's US$700 million gold reserves, equivalent to ZiG19 billion, are sufficient to back the ZiG17 billion in circulation, suggesting a one-to-one coverage that, in his view, should ensure the currency's strength and stability.

Economists, however, have dismissed Mushayavanhu's claims as misleading and anchored in archaic economic thinking.

"Currencies do not derive strength simply from being backed by gold. That idea belongs to a bygone era of the gold standard," one senior economist told this publication.

"Modern currencies are fiat currencies - their value is determined by market confidence, economic fundamentals, and credible monetary policy, not gold reserves alone."

Globally, currencies today float on the basis of supply and demand, influenced by macroeconomic indicators such as inflation, interest rates, GDP growth, and trade balances. Central banks manage these dynamics through policy tools like interest rate adjustments, money supply control, and open market operations - areas in which the RBZ is seen as struggling.

Beyond reserves, economists argue, public and investor confidence is central to a currency's strength. Zimbabwe's history of hyperinflation in 2008, the abandonment of its own currency in 2009, and recurring bouts of currency devaluation have eroded public trust. Even now, the US dollar remains dominant, accounting for over 80% of all transactions, despite official promotion of the ZiG.

"Mushayavanhu's continued reference to gold backing as a measure of strength is not only unconvincing but also shows a fundamental misunderstanding of modern monetary dynamics," said a Harare-based financial analyst.

"You need transparent policy, credible leadership, and institutional reform - not just shiny gold bars in a vault."

The central bank governor's performance has also reignited debate about the qualifications needed for such a critical role. While a degree in economics is not a statutory requirement, many argue that deep knowledge of monetary theory, financial systems, and economic modelling is essential to making sound policy decisions.

"The role of a central bank governor is not ceremonial," said another economist.

"You must interpret data, communicate policy, foresee economic risks, and maintain stability. Mushayavanhu is failing in that regard."

As the ZiG continues to lose ground and inflation rises, the RBZ is under pressure to abandon outdated monetary dogma and adopt realistic, modern frameworks for stabilising the economy.

Observers say that without policy credibility, institutional transparency, and macro-economic discipline, the central bank's gold stockpile - however glittering - will do little to rescue the ZiG or restore Zimbabwe's long-lost monetary sovereignty.

Since its launch in April 2024 as a replacement for the discredited Bond note, the ZiG - or Zimbabwe Gold - has suffered dramatic depreciation, triggering inflation and public distrust. Initially pegged at 13.56 ZiG per US dollar, the currency quickly spiralled on the parallel market, losing nearly 80% of its value by September 2024. By February 2025, the official rate had slid to 26.4 ZiG to the US dollar, marking a 94% decline since inception.

In an effort to address the crisis, the RBZ devalued the ZiG by 42.6% on September 27, 2024. However, year-on-year inflation has continued to rise, climbing from 85.7% in April to 92.1% in May 2025, largely due to the devaluation shock and ongoing instability in monetary policy implementation.

Despite these grim statistics, Mushayavanhu maintains that Zimbabwe's US$700 million gold reserves, equivalent to ZiG19 billion, are sufficient to back the ZiG17 billion in circulation, suggesting a one-to-one coverage that, in his view, should ensure the currency's strength and stability.

Economists, however, have dismissed Mushayavanhu's claims as misleading and anchored in archaic economic thinking.

"Currencies do not derive strength simply from being backed by gold. That idea belongs to a bygone era of the gold standard," one senior economist told this publication.

"Modern currencies are fiat currencies - their value is determined by market confidence, economic fundamentals, and credible monetary policy, not gold reserves alone."

Globally, currencies today float on the basis of supply and demand, influenced by macroeconomic indicators such as inflation, interest rates, GDP growth, and trade balances. Central banks manage these dynamics through policy tools like interest rate adjustments, money supply control, and open market operations - areas in which the RBZ is seen as struggling.

Beyond reserves, economists argue, public and investor confidence is central to a currency's strength. Zimbabwe's history of hyperinflation in 2008, the abandonment of its own currency in 2009, and recurring bouts of currency devaluation have eroded public trust. Even now, the US dollar remains dominant, accounting for over 80% of all transactions, despite official promotion of the ZiG.

"Mushayavanhu's continued reference to gold backing as a measure of strength is not only unconvincing but also shows a fundamental misunderstanding of modern monetary dynamics," said a Harare-based financial analyst.

"You need transparent policy, credible leadership, and institutional reform - not just shiny gold bars in a vault."

The central bank governor's performance has also reignited debate about the qualifications needed for such a critical role. While a degree in economics is not a statutory requirement, many argue that deep knowledge of monetary theory, financial systems, and economic modelling is essential to making sound policy decisions.

"The role of a central bank governor is not ceremonial," said another economist.

"You must interpret data, communicate policy, foresee economic risks, and maintain stability. Mushayavanhu is failing in that regard."

As the ZiG continues to lose ground and inflation rises, the RBZ is under pressure to abandon outdated monetary dogma and adopt realistic, modern frameworks for stabilising the economy.

Observers say that without policy credibility, institutional transparency, and macro-economic discipline, the central bank's gold stockpile - however glittering - will do little to rescue the ZiG or restore Zimbabwe's long-lost monetary sovereignty.

Source - online

Join the discussion

Loading comments…