Opinion / Columnist

Mthuli Ncube's 2026 budget does not pass the constitutional test

05 Dec 2025 at 09:50hrs |

0 Views

SECTION 7 of the Public Finance Management Act obliges the minister of finance to develop and implement a sound macroeconomic and fiscal policy for Zimbabwe.

It also obliges him to ensure that full and transparent accounts are presented from time to time to parliament indicating the current and projected state of the economy, the public resources of Zimbabwe and the fiscal policy of Zimbabwe.

The minister's management of public finances is anchored in section 298 of the constitution which defines principles of public financial management.

Section 298 demands that there must be transparency and accountability in financial matters. It demands that public finances must be directed towards national development. It demands that public funds must be expended transparently, prudently economically and effectively. Most importantly, it demands that the burden of taxation must be shared fairly.

Section 298 therefore creates the basis of a Democratic Developmental State in its thrust and emphasis. It creates an ideological compass that defines the parameters of public finance.

Any budget therefore must meet the constitutional principles defined in the constitution. It must have as its fulcrum the binding principles of democratic and equitable management of the public coffers.

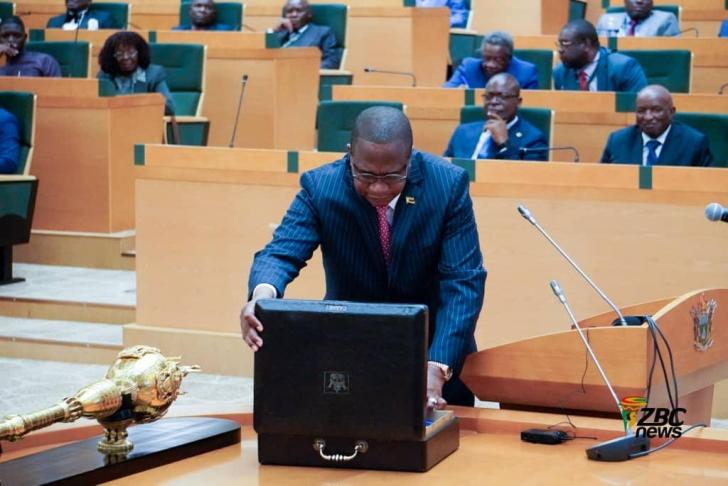

On November 27, 2025, the minister of finance Mthuli Ncube presented the 2026 national budget to the National Assembly. He also presented a Public Debt Report and the Medium Debt Management Strategy 2026-2030.

There is no question that the budget presented and its accompanying documents do not pass the constitutional test. It's a potpourri of self-serving deception, mendacity and opaqueness. It is budget alien to the developmental and transparency thrust demanded by the constitution.

Its revenue proposals are narcissistic and anti-people. It is an ideologically vacuous ritual that confirms and entrenches the deep capture of this regime by the cartels and mafia that have also taken over Zanu PF. It frighteningly confirms the existence of a parallel state and its parallel government.

Let us begin with its macroeconomic framework.

The budget projects a 6.6 percent GDP growth rate in 2025 that will push the country's nominal GDP to US$52.4 billion from US$44.5 billion and US$45.7 billion in 2023 and 2024 respectively.

The per capita Gross National Income is now US$3,200.

The World Bank defines the per capita GNI of an upper middle income country from US$4,496 to US$13,900. Thus lo and behold Zimbabwe will achieve Emmerson Mnangagwa's vision of an upper middle income country by 2026, long before 2030.

The average ordinary Zimbabwean in Dotito or Chiendambuya knows that this is not a $52 billion dollar economy.

Mai Ezra in Chidyamakuni Village knows that her GNI is nowhere near US$3,200.

The truth is 79 percent of Zimbabweans are living in poverty.

The World Bank's Zimbabwe Economic Outlook 2025 published a few days ago on December 1, 2025 , states that the national extreme poverty rate rose to 49 percent in 2020 and fell to 42 percent in 2023.

Shockingly according to the World Bank, Zimbabwe's international poverty rate doubled between 2011 and 2019.

The national extreme poverty rate is defined as the share of population that cannot afford a food basket to meet the minimum daily caloric requirements. The international poverty rate is the percentage of the population that cannot afford the international poverty line set at US$2.15 per day.

In urban communities our people are surviving on "tsaona." A few leaves of vegetable, a cork of cooking fat and a small plate of mealie meal.

The rebasing of Zimbabwe's national accounts in July 2025 from a nominal GDP in 2024 of US$35 billion to US$45.7 billion was an opaque exercise in political self-indulgence.

This economy was a US$20 billion economy in 2019. No-one can be pursuaded that it has since doubled in a mere six years.

The projected growth rate for 2026 is 5 percent anchored on normal rains, currency stability, fiscal discipline and strong international commodity prices. In short, the regime has anchored its fate on tobacco and gold.

This is to be expected given that Zimbabwe's agriculture grew by 21 percent in 2025 anchored by 306 million kg of tobacco that fetched a gross figure of US$1.6 billion.

Gold deliveries are expected to exceed 47 tons with 65 percent being produced by artisanal miners.

The expectation in the budget is that international gold prices will remain high as gold is now contributing 70 percent of foreign currency receipts and over 50 percent of total exports.

We are not prophets of doom, so we grant them the benefit of doubt. This is notwithstanding that weather patterns have become erratic and international commodity prices will always be volatile.

But the regime mendaciously excludes continued diaspora remittances in its framework . Diaspora remittances of almost US$2 billion annually have become so key. They exceed both official development assistance and foreign direct investment combined.

The regime can't blow its horn about this. A huge diaspora population is proof of conflict, political abuse, corruption and economic mismanagement.

But remittances require the reciprocal obligation of a diaspora vote. This, the regime cannot countenance.

The other assumptions are not sustainable in the medium to long term. The hyped ZiG stability is a fad. The ZIG is an alien currency which the majority of Zimbabweans have never seen.

Eighty-two percent of all transactions in Zimbabwe remain in United States dollars. According to the World Bank, foreign currency accounts as a share of deposits stood at 82.5 percent as of July 2025.

There is absolutely no confidence in the local currency given years of abuse. The Reserve Bank of Zimbabwe and its stooges in the Monetary Policy Committee are innocent bystanders. Monetary policy is a fiction in a heavily dollarised economy.

This explains the bank's desire towards a mono currency by 2030. Such a move is ahistorical and economic hari kiri. Besides, Zimbabwe lacks the necessary US$ reserves to back up its own currency.

Countries like Kenya (US$12 billion) and Zambia (US$5.5 billion) have built reserves whilst Zimbabwe has one month of import cover. This economy requires durable macroeconomic stability and de-dollarisation is the antithesis of this.

You would have thought the regime learnt something from the collapse of the 2019 de-dollarisation exercise ushered in by the notorious Statutory Instrument 33 of 2019.

Perhaps the biggest lie in the budget is the hope of fiscal prudence and a tight fiscal policy. This regime faces massive fiscal pressures and persistent fiscal financing gaps.

A disingenuous way of hiding the deficit has simply been underfunding the budget. The 2024 budget was 54 percent funded. By June of this year the 2025 budget had a 35 percent drawdown .By September 2025 only 55 percent had been utilised.

An underfunded budget inevitably creates serious arrears to domestic suppliers. The 2025 Public Debt Report puts validated domestic arrears to servise providers in the sum US$1.2 billion. But we now know that during the same period the regime accrued invalidated domestic arrears to the tune of US$1.7 billion.

These invalidated claims are nothing but the expression of corruption. They prove the existence of a parallel government.

To sanitise these unlawful expenditures, the regime tabled an unorthodox document headed "Expenditure Arrears Clearance Startegy 2026-2030." A fancy sounding mascara to pure gross theft.

The proper constituional procedure for unauthorised expenditure is the presentation of a Bill of condonation provided for in section 307 of the constitution.

Domestic debt accumulation is another form of fiscal evasion. Total domestic debt increased from US$8.7 billion to US$9.8 billion in 2025. This debt is contracted through various instruments, government securities alone being US$5.3 billion.

Treasury Bills, Treasury Bonds and NNCDs are the new form of looting. Huge resources are now being channeled from the state though debt instruments. Massive debt contraction is taking place in the covers of darkness.

It is time to amend the Public Debt Management Act to provide high threshold caps on domestic borrowing as well removing the blank cheque that the minister has of borrowing domestically without parliamentary approval.

Of course the biggest fiscal threat comes from corruption. Corruption remains the biggest source of pressure on fiscal discipline and prudence.

Public sector investment programmes such as roads, dams, traffic interchanges and State House renovations have become a major source of leakage in Zimbabwe.

There is a creature called the Mutapa Fund. In the few years of its existence, billions have been syphoned out of it. In 2023, US$1,9 billion was syphoned from it to pay Kudakwashe Tagwirei and partners in a transaction involving Kuvimba.

The IMF in its cynical 2025 Article IV report published in October 2025 red flagged the Mutapa Fund and naively called for "amending legal provisions applicable to Mutapa… to clarify its mandate, intergrating it into the budget process, including proceeds obtained from dividends… and ensuring highest standards of corporate accountability and transparency through appropriate oversight and disclosure and publication of audited financial statements."

Truth is this will never happen . Legal proposals made in the 2026 Finance Bill currently before parliament totally excludes the Mutapa Fund from any form of accountability or responsibility to Zimbabwe.

The Mutapa Fund, contrary to the provisions of Chapter 9 and section 298 of the constitution, has become a state within a state.

We now address the budget's revenue measures.

The 2025 budget tax proposals present a predatory extractive regime that has no empathy for its people.

The tax measures are regressive, punitive, narssistic and push the burden of taxation to the poor.

IMMT should have been scrapped in its entirety. Instead, the regime reduces IMMT on ZiG transactions to 1,5 percent but immediately increases VAT to 15,5 percent.

But VAT is the most regressive of all taxes.

Another punitive measure is the proposal to register owners, lessees and sub lessees as registrable proprietors for the purpose of presumptive taxes on rental income.

A non residents tax on interest of 15 percent has been reinstated

The introduction of a 2 percent US$ cash withdrawal levy is ill thought and counter productive.

Truth is the banking sector requires reforms. The absence of savings is putting a premium on the country. Bank charges are extortionate and it is unacceptable that they constitute 45 percent of bank income.

This budget ought to have pushed for policy measures to address savings and the presence of cheap credit in the economy.

The introduction of a three-tier royalties regime on gold incomes may as yet prove counter productive. It may lead artisanal miners to sell their gold underground. It may be a disincentive for investments.

The introduction of a withholding tax on imported digital services and platforms will punish the ordinary citizen who lives off Starlink, Tik Tok or Instagram.

In short, the bulk of the tax measures remain egregious and regressive.

Truth is the 2026 budget is egregious unconstitutional and extractive. It fails to address the structural challenges addressing this economy. It fails to offer bold leadership on underlying structural issues that must be solved.

In our view Zimbabwe, must urgently address the following issues: The currency and exchange rate conondrium; durable macroeconomic stability; the debt burden; governance issues and corruption; banking sector reform; pension and insurance reform; industrialisation and beneficiation; mining sector reform; rural development; gross capital formation; social sector reform; digitisation and climate change adapatation.

But defending and deepening the constitution remains the starting point!

Tendai Biti was Zimbabwe's finance minister from 2009 to 2013

It also obliges him to ensure that full and transparent accounts are presented from time to time to parliament indicating the current and projected state of the economy, the public resources of Zimbabwe and the fiscal policy of Zimbabwe.

The minister's management of public finances is anchored in section 298 of the constitution which defines principles of public financial management.

Section 298 demands that there must be transparency and accountability in financial matters. It demands that public finances must be directed towards national development. It demands that public funds must be expended transparently, prudently economically and effectively. Most importantly, it demands that the burden of taxation must be shared fairly.

Section 298 therefore creates the basis of a Democratic Developmental State in its thrust and emphasis. It creates an ideological compass that defines the parameters of public finance.

Any budget therefore must meet the constitutional principles defined in the constitution. It must have as its fulcrum the binding principles of democratic and equitable management of the public coffers.

On November 27, 2025, the minister of finance Mthuli Ncube presented the 2026 national budget to the National Assembly. He also presented a Public Debt Report and the Medium Debt Management Strategy 2026-2030.

There is no question that the budget presented and its accompanying documents do not pass the constitutional test. It's a potpourri of self-serving deception, mendacity and opaqueness. It is budget alien to the developmental and transparency thrust demanded by the constitution.

Its revenue proposals are narcissistic and anti-people. It is an ideologically vacuous ritual that confirms and entrenches the deep capture of this regime by the cartels and mafia that have also taken over Zanu PF. It frighteningly confirms the existence of a parallel state and its parallel government.

Let us begin with its macroeconomic framework.

The budget projects a 6.6 percent GDP growth rate in 2025 that will push the country's nominal GDP to US$52.4 billion from US$44.5 billion and US$45.7 billion in 2023 and 2024 respectively.

The per capita Gross National Income is now US$3,200.

The World Bank defines the per capita GNI of an upper middle income country from US$4,496 to US$13,900. Thus lo and behold Zimbabwe will achieve Emmerson Mnangagwa's vision of an upper middle income country by 2026, long before 2030.

The average ordinary Zimbabwean in Dotito or Chiendambuya knows that this is not a $52 billion dollar economy.

Mai Ezra in Chidyamakuni Village knows that her GNI is nowhere near US$3,200.

The truth is 79 percent of Zimbabweans are living in poverty.

The World Bank's Zimbabwe Economic Outlook 2025 published a few days ago on December 1, 2025 , states that the national extreme poverty rate rose to 49 percent in 2020 and fell to 42 percent in 2023.

Shockingly according to the World Bank, Zimbabwe's international poverty rate doubled between 2011 and 2019.

The national extreme poverty rate is defined as the share of population that cannot afford a food basket to meet the minimum daily caloric requirements. The international poverty rate is the percentage of the population that cannot afford the international poverty line set at US$2.15 per day.

In urban communities our people are surviving on "tsaona." A few leaves of vegetable, a cork of cooking fat and a small plate of mealie meal.

The rebasing of Zimbabwe's national accounts in July 2025 from a nominal GDP in 2024 of US$35 billion to US$45.7 billion was an opaque exercise in political self-indulgence.

This economy was a US$20 billion economy in 2019. No-one can be pursuaded that it has since doubled in a mere six years.

The projected growth rate for 2026 is 5 percent anchored on normal rains, currency stability, fiscal discipline and strong international commodity prices. In short, the regime has anchored its fate on tobacco and gold.

This is to be expected given that Zimbabwe's agriculture grew by 21 percent in 2025 anchored by 306 million kg of tobacco that fetched a gross figure of US$1.6 billion.

Gold deliveries are expected to exceed 47 tons with 65 percent being produced by artisanal miners.

The expectation in the budget is that international gold prices will remain high as gold is now contributing 70 percent of foreign currency receipts and over 50 percent of total exports.

We are not prophets of doom, so we grant them the benefit of doubt. This is notwithstanding that weather patterns have become erratic and international commodity prices will always be volatile.

But the regime mendaciously excludes continued diaspora remittances in its framework . Diaspora remittances of almost US$2 billion annually have become so key. They exceed both official development assistance and foreign direct investment combined.

The regime can't blow its horn about this. A huge diaspora population is proof of conflict, political abuse, corruption and economic mismanagement.

But remittances require the reciprocal obligation of a diaspora vote. This, the regime cannot countenance.

The other assumptions are not sustainable in the medium to long term. The hyped ZiG stability is a fad. The ZIG is an alien currency which the majority of Zimbabweans have never seen.

Eighty-two percent of all transactions in Zimbabwe remain in United States dollars. According to the World Bank, foreign currency accounts as a share of deposits stood at 82.5 percent as of July 2025.

There is absolutely no confidence in the local currency given years of abuse. The Reserve Bank of Zimbabwe and its stooges in the Monetary Policy Committee are innocent bystanders. Monetary policy is a fiction in a heavily dollarised economy.

This explains the bank's desire towards a mono currency by 2030. Such a move is ahistorical and economic hari kiri. Besides, Zimbabwe lacks the necessary US$ reserves to back up its own currency.

Countries like Kenya (US$12 billion) and Zambia (US$5.5 billion) have built reserves whilst Zimbabwe has one month of import cover. This economy requires durable macroeconomic stability and de-dollarisation is the antithesis of this.

You would have thought the regime learnt something from the collapse of the 2019 de-dollarisation exercise ushered in by the notorious Statutory Instrument 33 of 2019.

Perhaps the biggest lie in the budget is the hope of fiscal prudence and a tight fiscal policy. This regime faces massive fiscal pressures and persistent fiscal financing gaps.

A disingenuous way of hiding the deficit has simply been underfunding the budget. The 2024 budget was 54 percent funded. By June of this year the 2025 budget had a 35 percent drawdown .By September 2025 only 55 percent had been utilised.

An underfunded budget inevitably creates serious arrears to domestic suppliers. The 2025 Public Debt Report puts validated domestic arrears to servise providers in the sum US$1.2 billion. But we now know that during the same period the regime accrued invalidated domestic arrears to the tune of US$1.7 billion.

These invalidated claims are nothing but the expression of corruption. They prove the existence of a parallel government.

To sanitise these unlawful expenditures, the regime tabled an unorthodox document headed "Expenditure Arrears Clearance Startegy 2026-2030." A fancy sounding mascara to pure gross theft.

The proper constituional procedure for unauthorised expenditure is the presentation of a Bill of condonation provided for in section 307 of the constitution.

Domestic debt accumulation is another form of fiscal evasion. Total domestic debt increased from US$8.7 billion to US$9.8 billion in 2025. This debt is contracted through various instruments, government securities alone being US$5.3 billion.

Treasury Bills, Treasury Bonds and NNCDs are the new form of looting. Huge resources are now being channeled from the state though debt instruments. Massive debt contraction is taking place in the covers of darkness.

It is time to amend the Public Debt Management Act to provide high threshold caps on domestic borrowing as well removing the blank cheque that the minister has of borrowing domestically without parliamentary approval.

Of course the biggest fiscal threat comes from corruption. Corruption remains the biggest source of pressure on fiscal discipline and prudence.

Public sector investment programmes such as roads, dams, traffic interchanges and State House renovations have become a major source of leakage in Zimbabwe.

There is a creature called the Mutapa Fund. In the few years of its existence, billions have been syphoned out of it. In 2023, US$1,9 billion was syphoned from it to pay Kudakwashe Tagwirei and partners in a transaction involving Kuvimba.

The IMF in its cynical 2025 Article IV report published in October 2025 red flagged the Mutapa Fund and naively called for "amending legal provisions applicable to Mutapa… to clarify its mandate, intergrating it into the budget process, including proceeds obtained from dividends… and ensuring highest standards of corporate accountability and transparency through appropriate oversight and disclosure and publication of audited financial statements."

Truth is this will never happen . Legal proposals made in the 2026 Finance Bill currently before parliament totally excludes the Mutapa Fund from any form of accountability or responsibility to Zimbabwe.

The Mutapa Fund, contrary to the provisions of Chapter 9 and section 298 of the constitution, has become a state within a state.

We now address the budget's revenue measures.

The 2025 budget tax proposals present a predatory extractive regime that has no empathy for its people.

The tax measures are regressive, punitive, narssistic and push the burden of taxation to the poor.

IMMT should have been scrapped in its entirety. Instead, the regime reduces IMMT on ZiG transactions to 1,5 percent but immediately increases VAT to 15,5 percent.

But VAT is the most regressive of all taxes.

Another punitive measure is the proposal to register owners, lessees and sub lessees as registrable proprietors for the purpose of presumptive taxes on rental income.

A non residents tax on interest of 15 percent has been reinstated

The introduction of a 2 percent US$ cash withdrawal levy is ill thought and counter productive.

Truth is the banking sector requires reforms. The absence of savings is putting a premium on the country. Bank charges are extortionate and it is unacceptable that they constitute 45 percent of bank income.

This budget ought to have pushed for policy measures to address savings and the presence of cheap credit in the economy.

The introduction of a three-tier royalties regime on gold incomes may as yet prove counter productive. It may lead artisanal miners to sell their gold underground. It may be a disincentive for investments.

The introduction of a withholding tax on imported digital services and platforms will punish the ordinary citizen who lives off Starlink, Tik Tok or Instagram.

In short, the bulk of the tax measures remain egregious and regressive.

Truth is the 2026 budget is egregious unconstitutional and extractive. It fails to address the structural challenges addressing this economy. It fails to offer bold leadership on underlying structural issues that must be solved.

In our view Zimbabwe, must urgently address the following issues: The currency and exchange rate conondrium; durable macroeconomic stability; the debt burden; governance issues and corruption; banking sector reform; pension and insurance reform; industrialisation and beneficiation; mining sector reform; rural development; gross capital formation; social sector reform; digitisation and climate change adapatation.

But defending and deepening the constitution remains the starting point!

Tendai Biti was Zimbabwe's finance minister from 2009 to 2013

Source - zimlive

All articles and letters published on Bulawayo24 have been independently written by members of Bulawayo24's community. The views of users published on Bulawayo24 are therefore their own and do not necessarily represent the views of Bulawayo24. Bulawayo24 editors also reserve the right to edit or delete any and all comments received.

Join the discussion

Loading comments…