News / Local

Zanu-PF gold baron refutes owing US$3m in gold deliveries, threatens

17 Oct 2024 at 16:12hrs |

0 Views

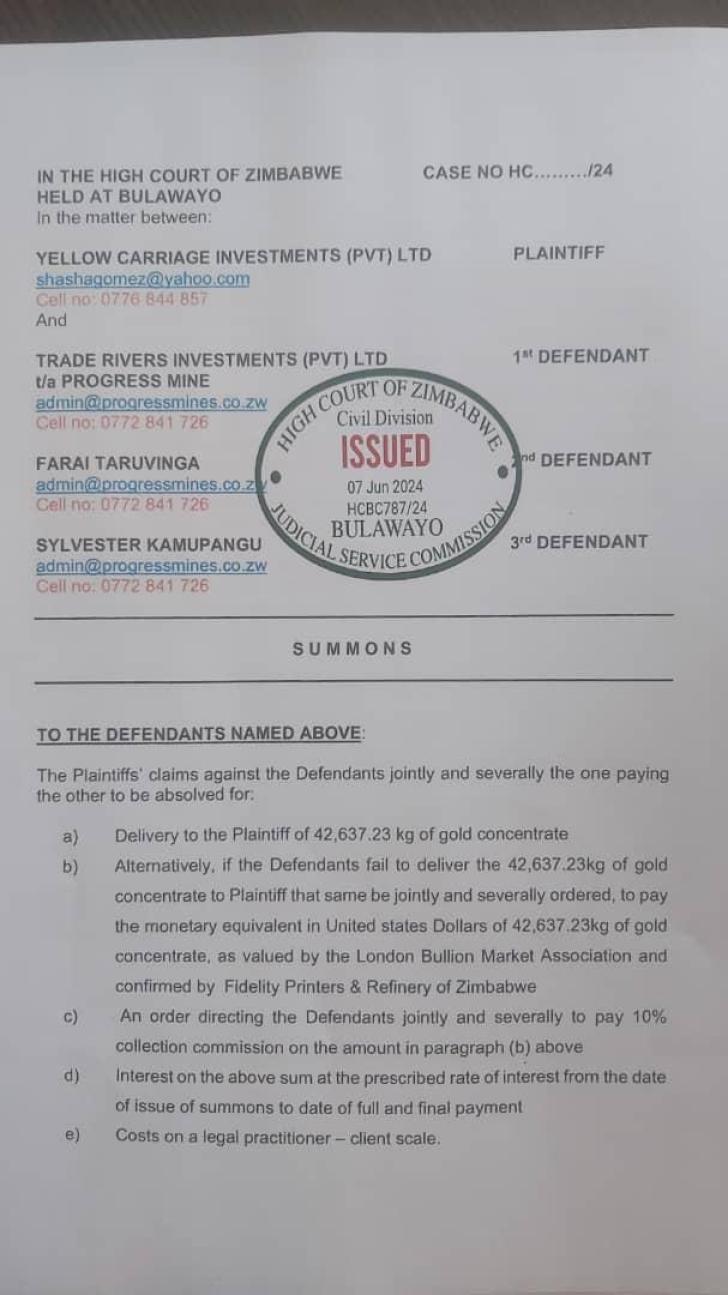

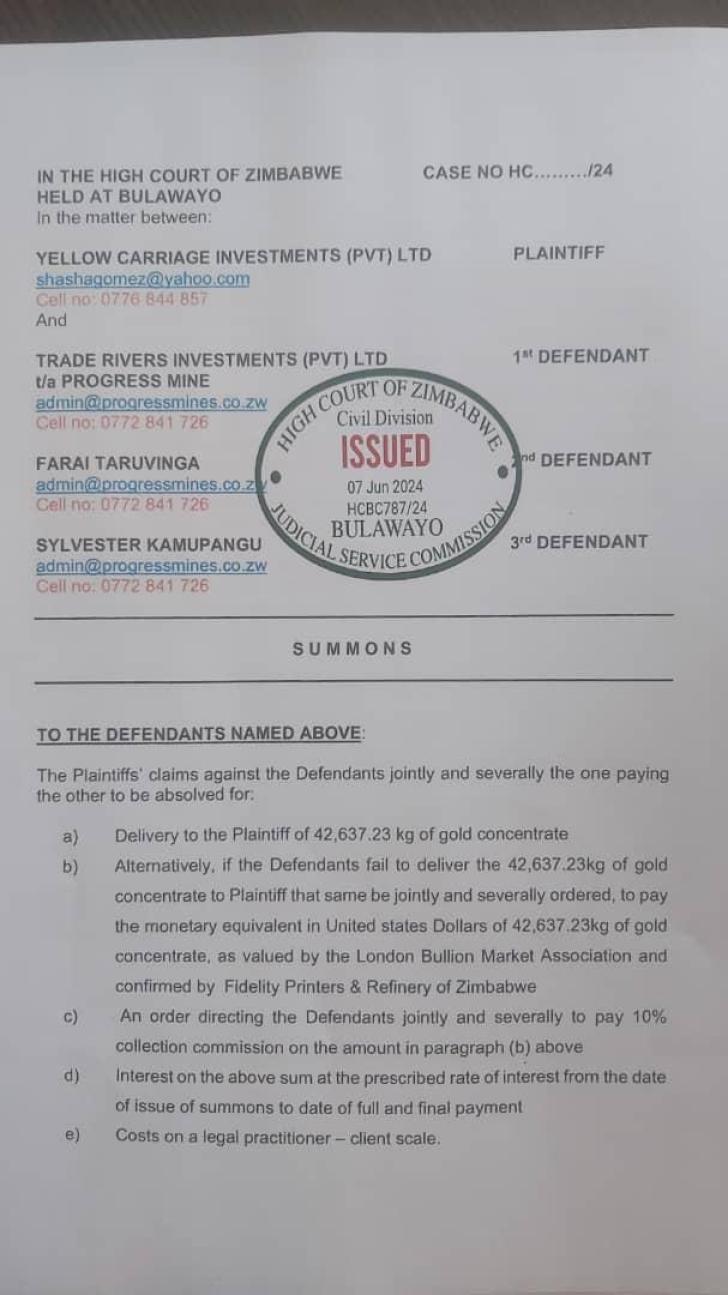

Zanu-PF's Insiza North Member of Parliament, Farai Taruvinga, a well-known gold magnate in Matabeleland South, is embroiled in a legal battle with gold buyer Shasha Richard Gomez over an unpaid gold delivery worth US$3.6 million. The case, now before the High Court, stems from a 2021 agreement in which Taruvinga's company, Trade Rivers Investments (operating as Progress Mine), borrowed US$1.7 million from Gomez's company, Yellow Carriage Investments, to finance mining operations. Despite this, the defendants have vehemently denied the claims.

At the heart of the dispute is a promise to repay the loan in gold. Court documents filed on June 7, 2024, reveal that Taruvinga and his co-director, Sylvester Kamupangu, committed to repaying the debt with 50,185.62kg of gold concentrate. However, by the end of 2021, they had only delivered 7,548kg of gold, valued at US$401,940, leaving a significant shortfall of 42,637.23kg. Due to the surge in gold prices on the international market, the value of this outstanding gold has now ballooned to US$3.6 million.

Yellow Carriage Investments, a licensed gold-buying entity, is seeking legal recourse to recover either the remaining gold or its equivalent value in US dollars. According to the court summons (case number HCBC787/24), Trade Rivers Investments, Taruvinga, and Kamupangu are named as the defendants. The plaintiff has requested that the outstanding gold be delivered or paid for based on the London Bullion Market Association's valuation.

"The plaintiff is entitled to receive the remaining 42,637.23kg of gold or its equivalent in US dollars, as confirmed by Fidelity Printers and Refinery Zimbabwe," the court documents state.

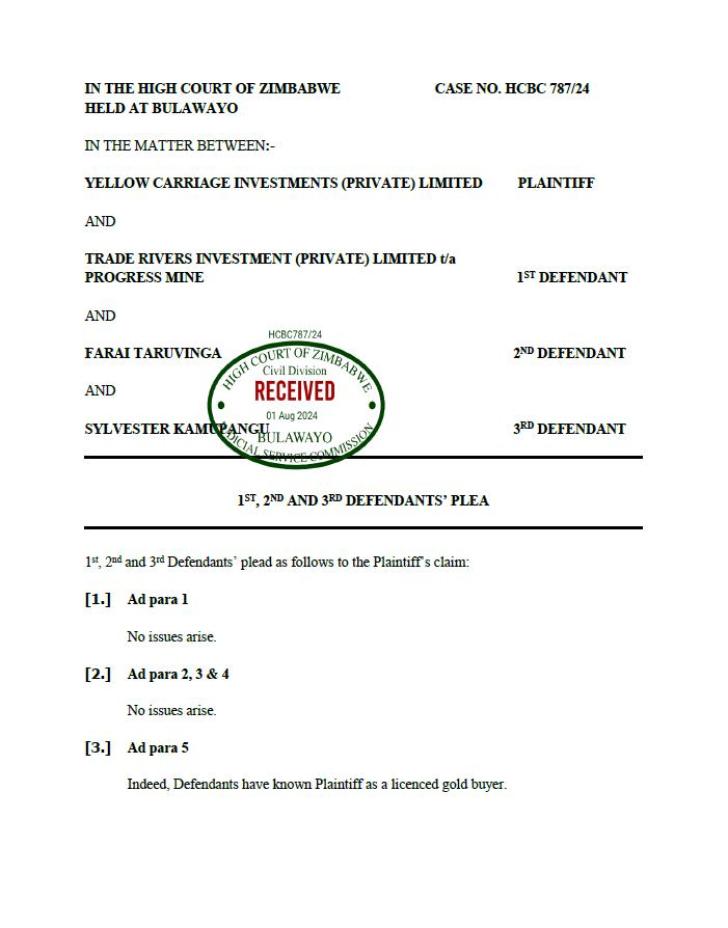

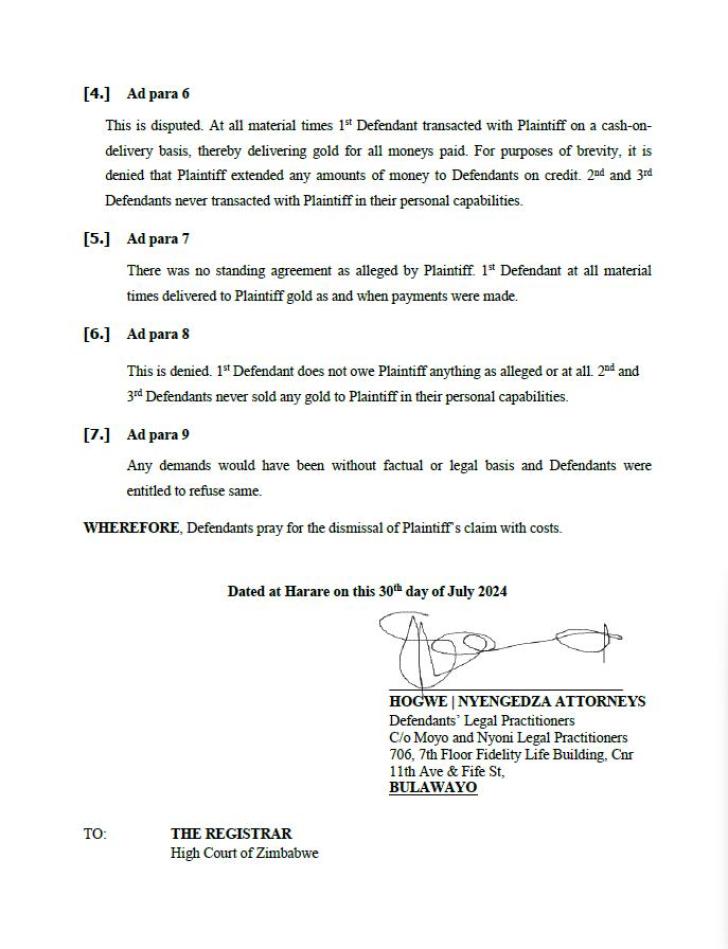

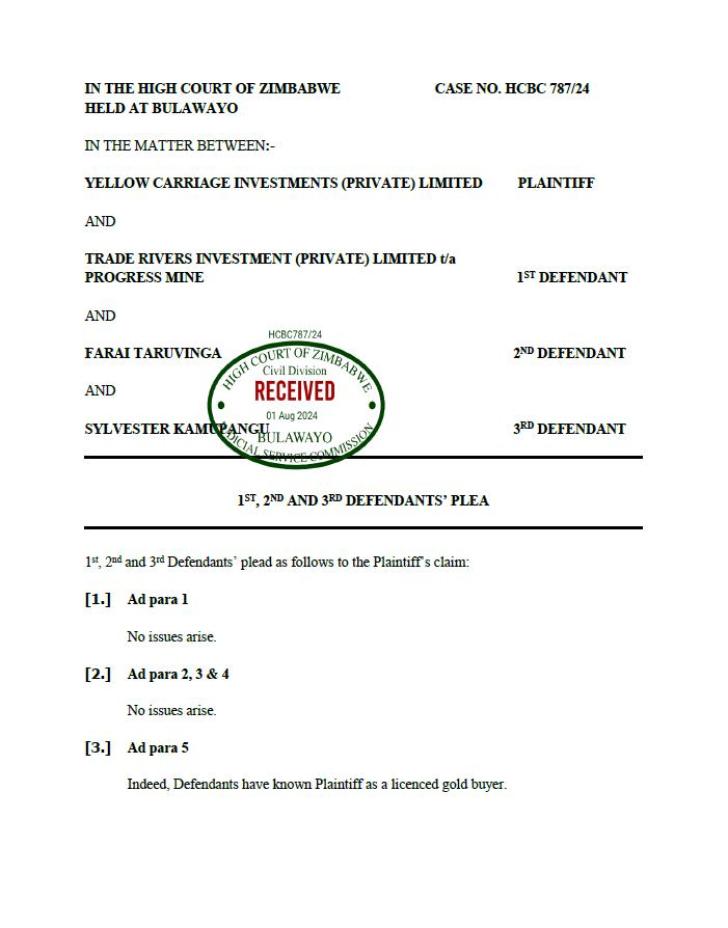

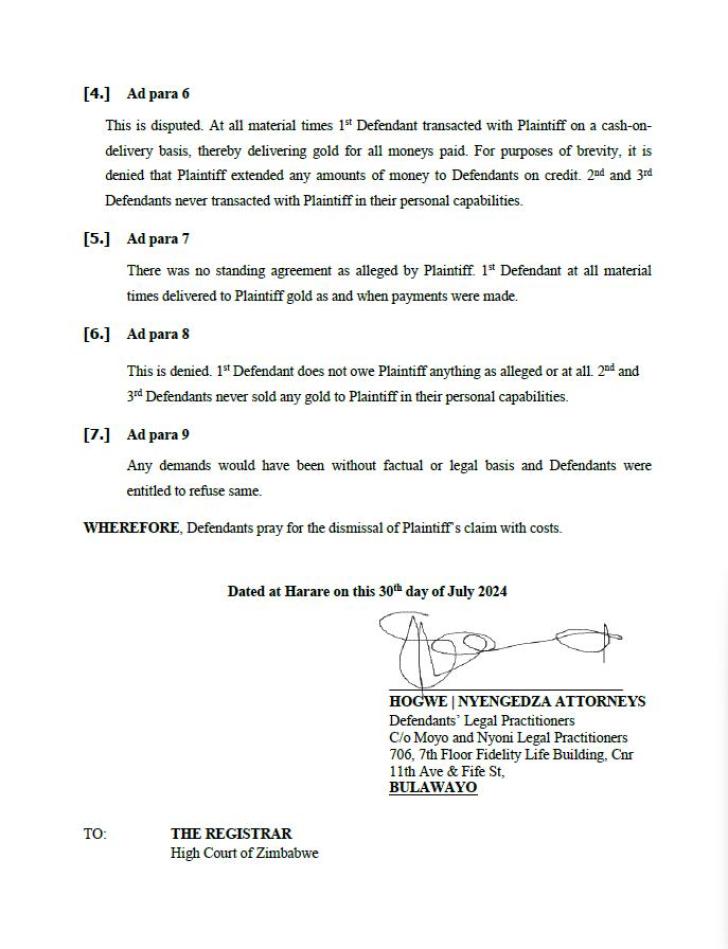

Despite this, the defendants have vehemently denied the claims. Taruvinga, through his lawyer Hongwe Nyengedza, has accused the media of being incentivized to report on the case and has refuted the allegations made by Yellow Carriage. In a response filed with the court, Taruvinga and Kamupangu argue that the agreement was conducted on a cash-on-delivery basis and that all payments made by Yellow Carriage were met with corresponding gold deliveries.

"There was no standing agreement as alleged by Plaintiff," their court submission reads. "The 1st Defendant [Trade Rivers Investments] does not owe Plaintiff anything as alleged or at all."

The defense has called for the case to be dismissed, stating that the plaintiff's demands have no factual or legal basis.

This high-profile legal clash has attracted significant public interest, not only because of Taruvinga's influential position in the ruling Zanu-PF party but also due to the vast sums involved and the ever-changing value of gold on the global market. The lawsuit underscores the complexities and high stakes of Zimbabwe's gold trade, particularly when linked to political figures.

As the legal proceedings continue, all eyes are on the courts to see how the dispute over this multimillion-dollar gold deal will unfold.

At the heart of the dispute is a promise to repay the loan in gold. Court documents filed on June 7, 2024, reveal that Taruvinga and his co-director, Sylvester Kamupangu, committed to repaying the debt with 50,185.62kg of gold concentrate. However, by the end of 2021, they had only delivered 7,548kg of gold, valued at US$401,940, leaving a significant shortfall of 42,637.23kg. Due to the surge in gold prices on the international market, the value of this outstanding gold has now ballooned to US$3.6 million.

Yellow Carriage Investments, a licensed gold-buying entity, is seeking legal recourse to recover either the remaining gold or its equivalent value in US dollars. According to the court summons (case number HCBC787/24), Trade Rivers Investments, Taruvinga, and Kamupangu are named as the defendants. The plaintiff has requested that the outstanding gold be delivered or paid for based on the London Bullion Market Association's valuation.

"The plaintiff is entitled to receive the remaining 42,637.23kg of gold or its equivalent in US dollars, as confirmed by Fidelity Printers and Refinery Zimbabwe," the court documents state.

Despite this, the defendants have vehemently denied the claims. Taruvinga, through his lawyer Hongwe Nyengedza, has accused the media of being incentivized to report on the case and has refuted the allegations made by Yellow Carriage. In a response filed with the court, Taruvinga and Kamupangu argue that the agreement was conducted on a cash-on-delivery basis and that all payments made by Yellow Carriage were met with corresponding gold deliveries.

The defense has called for the case to be dismissed, stating that the plaintiff's demands have no factual or legal basis.

This high-profile legal clash has attracted significant public interest, not only because of Taruvinga's influential position in the ruling Zanu-PF party but also due to the vast sums involved and the ever-changing value of gold on the global market. The lawsuit underscores the complexities and high stakes of Zimbabwe's gold trade, particularly when linked to political figures.

As the legal proceedings continue, all eyes are on the courts to see how the dispute over this multimillion-dollar gold deal will unfold.

Source - Byo24News

Join the discussion

Loading comments…