News / National

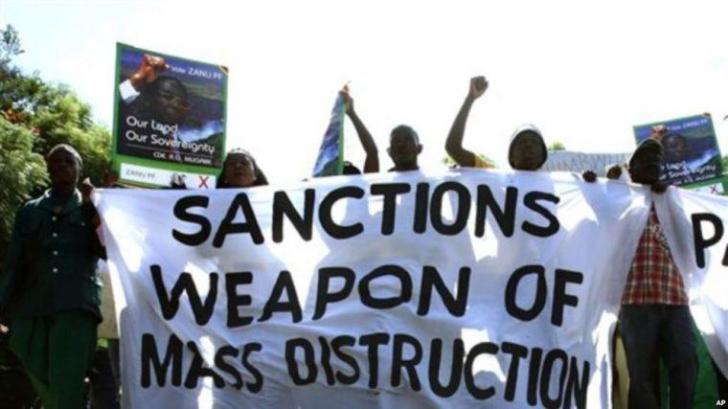

US sanctions on Zimbabwe are real, US Bank to close accounts

24 Jul 2024 at 08:57hrs |

0 Views

Mercury Bank, a fintech based in the United States offering banking services to more than 100,000 early-stage startups, has included Nigeria in a list of countries restricted from opening and operating accounts on its platform.

With this development, businesses and individuals living in Nigeria can no longer open new accounts or conduct transactions using the fintech with affected accounts to be closed by August 22, 2024.

The affected African countries include Burundi, Cameroon, Central African Republic, Republic of Congo, The Congo, Liberia, Libya, Mali, Mozambique, Somalia, South Sudan, Sudan, and Zimbabwe.

Furthermore, the bank will no longer serve companies whose founders have passports from the following non African countries - Cuba, Iran, North Korea, Syria, Ukraine, and Venezuela.

Affected users remain uncertain about the reasons behind this development. However, the fintech confirmed via email that it no longer supports accounts for businesses located in certain countries due to recent adjustments in its eligibility criteria.

This development has prompted reactions from users. “Mercury closed my accounts too even with founders living in the US. No proper process or appeal, just carry your money and go if you have ties to Nigeria," Akintunde Sultan, Co-founder of Altschool Africa reacted on X highlighting that the exact policy that led to the development was not properly explained.

The US-based fintech has previously taken action to restrict its usage by African tech startups. In March 2022, it blocked the accounts of several African startups without warning notices or clear reasons. Meanwhile, the CEO, Immad Akhund, confirmed that the bank was acting in compliance with internal procedures.

Sola Akindolu, the former CEO of Brass, a Nigerian startup previously noted that African startups often rely on US companies because it's the top way to raise money or access most things as many investors are hesitant to invest in a non-US company.

He confirmed that being incorporated in the US makes it easier for African startups to raise money and Mercury enables them to open a US bank account without actually being in the US.

With this development, businesses and individuals living in Nigeria can no longer open new accounts or conduct transactions using the fintech with affected accounts to be closed by August 22, 2024.

The affected African countries include Burundi, Cameroon, Central African Republic, Republic of Congo, The Congo, Liberia, Libya, Mali, Mozambique, Somalia, South Sudan, Sudan, and Zimbabwe.

Furthermore, the bank will no longer serve companies whose founders have passports from the following non African countries - Cuba, Iran, North Korea, Syria, Ukraine, and Venezuela.

Affected users remain uncertain about the reasons behind this development. However, the fintech confirmed via email that it no longer supports accounts for businesses located in certain countries due to recent adjustments in its eligibility criteria.

This development has prompted reactions from users. “Mercury closed my accounts too even with founders living in the US. No proper process or appeal, just carry your money and go if you have ties to Nigeria," Akintunde Sultan, Co-founder of Altschool Africa reacted on X highlighting that the exact policy that led to the development was not properly explained.

The US-based fintech has previously taken action to restrict its usage by African tech startups. In March 2022, it blocked the accounts of several African startups without warning notices or clear reasons. Meanwhile, the CEO, Immad Akhund, confirmed that the bank was acting in compliance with internal procedures.

Sola Akindolu, the former CEO of Brass, a Nigerian startup previously noted that African startups often rely on US companies because it's the top way to raise money or access most things as many investors are hesitant to invest in a non-US company.

He confirmed that being incorporated in the US makes it easier for African startups to raise money and Mercury enables them to open a US bank account without actually being in the US.

Source - TechPointAfrica

Join the discussion

Loading comments…