News / National

Zimbabwe's central bank confident of gold-backed ZiG currency

10 Mar 2025 at 08:36hrs |

2 Views

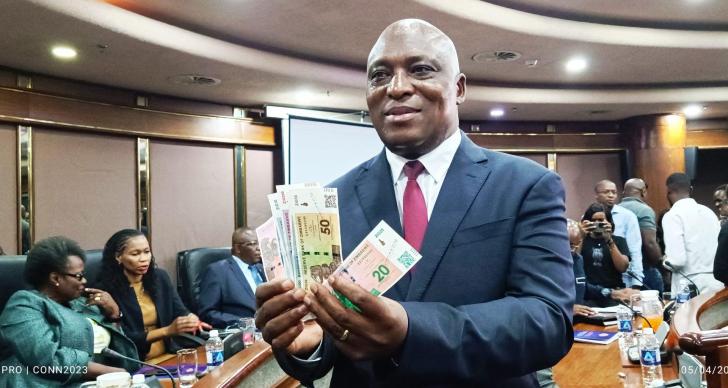

The Reserve Bank of Zimbabwe (RBZ) remains optimistic about the strength of the gold-backed Zimbabwe Gold (ZiG) currency, positioning it as a viable alternative to the United States dollar in the local economy.

Speaking at a recent Tourism Business Council of Zimbabwe (TBCZ) indaba, RBZ Governor John Mushayavanhu defended the ZiG, stating that the monetary policy measures implemented by the central bank were ensuring its stability.

"The ZiG to USD rate is firming up," Mushayavanhu said, emphasizing that strengthening confidence in the local currency remains the bank's top priority.

The ZiG was introduced in April 2023 to address Zimbabwe's persistent exchange rate volatility and inflation. The RBZ has since enforced a strict monetary policy, including high-interest rates, to curb speculative borrowing and stabilize the currency.

Mushayavanhu reiterated that the long-term goal is to fully de-dollarize the economy and restore a mono-currency system by 2030. He noted that while the US dollar remains dominant, it is not sustainable due to its impact on local industry competitiveness and the RBZ's limited capacity to regulate monetary policy effectively.

To enhance ZiG's market acceptance, the RBZ has allowed businesses to set their own exchange rates instead of adhering strictly to the official rate.

"The market is free to price their goods and services at whatever USD to ZiG rate they prefer without being limited to using the official RBZ exchange rate," Mushayavanhu explained.

The Financial Intelligence Unit (FIU) will also refrain from penalizing businesses that use independent exchange rates, provided they maintain reasonable pricing margins.

Mushayavanhu revealed that some fuel traders had approached the RBZ, offering to sell fuel in ZiG to finance their local operations. He expressed confidence that over time, more traders would voluntarily accept ZiG for fuel purchases.

"We do not want to go back to long queues and fuel shortages," he said, assuring that economic stability remains central to the bank's policy decisions.

Meanwhile, RBZ Deputy Governor Innocent Matshe projected that a realistic exchange rate based on economic fundamentals should be around US$1/ZiG22, a level authorities believe the market will gradually accept.

As Zimbabwe navigates its currency transition, the central bank remains committed to ensuring the ZiG's durability while working toward a future less dependent on the US dollar.

Speaking at a recent Tourism Business Council of Zimbabwe (TBCZ) indaba, RBZ Governor John Mushayavanhu defended the ZiG, stating that the monetary policy measures implemented by the central bank were ensuring its stability.

"The ZiG to USD rate is firming up," Mushayavanhu said, emphasizing that strengthening confidence in the local currency remains the bank's top priority.

The ZiG was introduced in April 2023 to address Zimbabwe's persistent exchange rate volatility and inflation. The RBZ has since enforced a strict monetary policy, including high-interest rates, to curb speculative borrowing and stabilize the currency.

Mushayavanhu reiterated that the long-term goal is to fully de-dollarize the economy and restore a mono-currency system by 2030. He noted that while the US dollar remains dominant, it is not sustainable due to its impact on local industry competitiveness and the RBZ's limited capacity to regulate monetary policy effectively.

To enhance ZiG's market acceptance, the RBZ has allowed businesses to set their own exchange rates instead of adhering strictly to the official rate.

The Financial Intelligence Unit (FIU) will also refrain from penalizing businesses that use independent exchange rates, provided they maintain reasonable pricing margins.

Mushayavanhu revealed that some fuel traders had approached the RBZ, offering to sell fuel in ZiG to finance their local operations. He expressed confidence that over time, more traders would voluntarily accept ZiG for fuel purchases.

"We do not want to go back to long queues and fuel shortages," he said, assuring that economic stability remains central to the bank's policy decisions.

Meanwhile, RBZ Deputy Governor Innocent Matshe projected that a realistic exchange rate based on economic fundamentals should be around US$1/ZiG22, a level authorities believe the market will gradually accept.

As Zimbabwe navigates its currency transition, the central bank remains committed to ensuring the ZiG's durability while working toward a future less dependent on the US dollar.

Source - NewZimbabwe

Join the discussion

Loading comments…