News / National

China intensifies lithium interest in Zimbabwe

09 Jul 2023 at 13:25hrs |

461 Views

CHINA has accounted for more than half of investment licences issued by Zimbabwean authorities during the first quarter of the year amid a boom in global demand for lithium as commercial and domestic consumers of energy migrate to alternative sources of energy, official figures obtained by The NewsHawks have shown.

Lithium is becoming a highly sought-after commodity in the drive to achieve a net-zero global economy.

The International Monetary Fund (IMF) has warned that by 2030 the global economy would have to have reduced its greenhouse gas emissions by at least 25% in order to meet the goal set in the 2015 Paris Climate Accords to limit the global temperature increase to 1.5°C.

One way of achieving this goal is by taking steps to reduce global carbon dioxide (CO2) emissions to net zero by 2050.

Statistics from the Zimbabwe Investment and Development Agency (Zida) have shown that more than a third of total investments registered between January and March 2023 have come from China, as Zimbabwe seeks to become a significant player in the lithium industry.

The figures show that China accounted for 72 out of 116 investment licences issued by source country during the first quarter of the year. The world's second-largest economy is followed by Zimbabwe which has just 12 applications while India and United Kingdom are a distant third and fourth respectively.

Official figures obtained from Zida also show that the value of total actual investment recorded during the first quarter of this year stood at US$154.5 million which comprised capital equipment from abroad US$64.45 million; equity US$26.86 million; loans US$2.41 and local assets of US$60,77 million respectively, which includes local funds and raw materials.

"The global boom in renewable energy has seen an increase in the number of investor inquiries into the sector, with the processing of applications underway," reads the first-quarter (Q1) report.

"In Q1 2023, 36% of all licences were issued to lithium investors (prospecting, mining and processing). The strong trend began in 2022 and is expected to continue for the rest of 2023 and beyond."

Zida says while there has been increased interest in the mining sector, particularly mining, the authority also expects the manufacturing sector to draw "significant" investment in the coming year.

"We have noticed that over the years, a certain number of investors move on to different sectors and start investing in different investors," said Silibaziso Chizwina, Zida's chief investment promotion officer, during a media engagement workshop.

"Based on what has been happening over the years, we think that we can achieve US$2 billion retention investment into the country in 2023. In order to do this, we have to bring the right kind of investment in the right investor."

Experts say as the global economy transitions towards a net-zero scenario, the demand for raw minerals which are critical to many clean energy technologies will increase.

Such minerals include lithium, copper and nickel. The International Energy Agency estimates that by 2040 the global demand for these vital minerals may exceed the current demand for coal.

Open sources show that the production and processing operations for lithium are concentrated mainly in Australia, Chile and Brazil.

According to the World Economic Forum, 540 000 metric tonnes of lithium were mined globally in 2021. This is expected to increase to 1.5 million metric tonnes and 3 million metric tonnes by 2025 and 2030 respectively.

Such figures pale in comparison to the approximately 10 million metric tonnes of untapped lithium resources that are believed to be present at the Bikita lithium project. Experts estimate that 20% of the world's lithium demand can be met by Zimbabwe if it fully exploits its reserves.

State of the lithium sector

Efforts to increase lithium production are now seen as the silver lining on Zimbabwe's wobbling economy. Authorities have projected to build a US$12 billion mining industry by year end, with gold, lithium, platinum group metals and chrome at the centre of this ambitious project.

The country, which is battling high levels of inflation and a weakening currency, among other socio-economic problems, has the largest lithium reserve in Africa and the sixth largest in the world. Zimbabwe is also estimated to have the highest number of lithium projects under exploration on the African continent.

While there have been concerns over the exploration of the mineral by some local communities, the southern African country has reported enormous investment in the lithium industry.

Pressure groups say a surge in applications filed through the country's investment promotion agency should prompt the authorities to review regulations for the mineral.

Public outcry over lithium mining in areas such as Bikita and Mutoko as well as the smuggling and under-declaration of the mineral have been blamed for fueling illicit financial flows in the country.

Who is mining lithium in Zimbabwe?

Zimbabwe has reported some major lithium projects since 2021 and these include: the US$422

million deal where Zhejiang Huayou (world's biggest producer of cobalt) acquired controlling rights to Zimbabwe's Arcadia mine [Prospect Lithium (Pvt) Ltd]; the Premier African Minerals Limited joint venture agreement with Li3 Resources Inc to acquire a 50% interest in Premier's lithium assets located in Mutare; the acquisition of a 100% stake in African Metals Management Services and Southern African Metals and Minerals by Hong Kong's Sinomine for US$180 million (Bikita Lithium Mine); and, more recently, the potential acquisition of a Zimbabwean lithium mine between China Natural Resources Inc, Feishang Group Limited and Top Pacific (China) Limited valued at approximately US$1.75 billion.

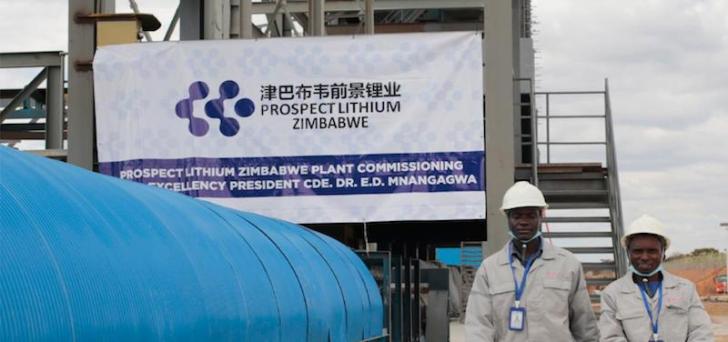

Just this week, Prospect Lithium's US$300 million spodumene, petalite and tantalite processing plant, widely regarded as the largest in Africa, was showcased as Chinese giant Hayou Cobalt expands its footprint in Zimbabwe.

The 4.5 million tonnes annual capacity plant has already shipped over 30 000 tonnes of lithium concentrates since commercial production began in April this year.

"Prospect Lithium Zimbabwe has so far earned about US$40 million from shipments of 30 000 tonnes of lithium since April and our quest is to become a market leader in the renewable and technologies market hence our commitment to ensure that Zimbabwe is on top of the sector," said Prospect Lithium Zimbabwe chairperson, George Fang.

Red Rock Resources, the UK exploration company, expects to commence test production of lithium in Zimbabwe this year, after acquiring prospects in Bikita and Arcturus last year.

What authorities are doing to boost earnings from lithium

The most significant recent development in the lithium mining space has been the ban on the export of unprocessed lithium imposed by the Zimbabwean government in December 2022. This ban came by way of Statutory Instrument 213 of 2022, otherwise known as the Base Minerals Export Control (Lithium Bearing Ores and Unbeneficiated Lithium) Order, 2022.

In terms of the regulations, no lithium-bearing ores, or unbeneficiated lithium whatsoever, shall be exported from Zimbabwe to another country except with a written permit from the minister of Mines and Mining Development

The government hopes that the ban will, in the long term, unlock more benefits from lithium extraction in the nation through value addition, as it may trigger the relocation to, and setting up of processing firms in Zimbabwe, especially in the manufacturing space.

Lithium is becoming a highly sought-after commodity in the drive to achieve a net-zero global economy.

The International Monetary Fund (IMF) has warned that by 2030 the global economy would have to have reduced its greenhouse gas emissions by at least 25% in order to meet the goal set in the 2015 Paris Climate Accords to limit the global temperature increase to 1.5°C.

One way of achieving this goal is by taking steps to reduce global carbon dioxide (CO2) emissions to net zero by 2050.

Statistics from the Zimbabwe Investment and Development Agency (Zida) have shown that more than a third of total investments registered between January and March 2023 have come from China, as Zimbabwe seeks to become a significant player in the lithium industry.

The figures show that China accounted for 72 out of 116 investment licences issued by source country during the first quarter of the year. The world's second-largest economy is followed by Zimbabwe which has just 12 applications while India and United Kingdom are a distant third and fourth respectively.

Official figures obtained from Zida also show that the value of total actual investment recorded during the first quarter of this year stood at US$154.5 million which comprised capital equipment from abroad US$64.45 million; equity US$26.86 million; loans US$2.41 and local assets of US$60,77 million respectively, which includes local funds and raw materials.

"The global boom in renewable energy has seen an increase in the number of investor inquiries into the sector, with the processing of applications underway," reads the first-quarter (Q1) report.

"In Q1 2023, 36% of all licences were issued to lithium investors (prospecting, mining and processing). The strong trend began in 2022 and is expected to continue for the rest of 2023 and beyond."

Zida says while there has been increased interest in the mining sector, particularly mining, the authority also expects the manufacturing sector to draw "significant" investment in the coming year.

"We have noticed that over the years, a certain number of investors move on to different sectors and start investing in different investors," said Silibaziso Chizwina, Zida's chief investment promotion officer, during a media engagement workshop.

"Based on what has been happening over the years, we think that we can achieve US$2 billion retention investment into the country in 2023. In order to do this, we have to bring the right kind of investment in the right investor."

Experts say as the global economy transitions towards a net-zero scenario, the demand for raw minerals which are critical to many clean energy technologies will increase.

Such minerals include lithium, copper and nickel. The International Energy Agency estimates that by 2040 the global demand for these vital minerals may exceed the current demand for coal.

Open sources show that the production and processing operations for lithium are concentrated mainly in Australia, Chile and Brazil.

According to the World Economic Forum, 540 000 metric tonnes of lithium were mined globally in 2021. This is expected to increase to 1.5 million metric tonnes and 3 million metric tonnes by 2025 and 2030 respectively.

Such figures pale in comparison to the approximately 10 million metric tonnes of untapped lithium resources that are believed to be present at the Bikita lithium project. Experts estimate that 20% of the world's lithium demand can be met by Zimbabwe if it fully exploits its reserves.

Efforts to increase lithium production are now seen as the silver lining on Zimbabwe's wobbling economy. Authorities have projected to build a US$12 billion mining industry by year end, with gold, lithium, platinum group metals and chrome at the centre of this ambitious project.

The country, which is battling high levels of inflation and a weakening currency, among other socio-economic problems, has the largest lithium reserve in Africa and the sixth largest in the world. Zimbabwe is also estimated to have the highest number of lithium projects under exploration on the African continent.

While there have been concerns over the exploration of the mineral by some local communities, the southern African country has reported enormous investment in the lithium industry.

Pressure groups say a surge in applications filed through the country's investment promotion agency should prompt the authorities to review regulations for the mineral.

Public outcry over lithium mining in areas such as Bikita and Mutoko as well as the smuggling and under-declaration of the mineral have been blamed for fueling illicit financial flows in the country.

Who is mining lithium in Zimbabwe?

Zimbabwe has reported some major lithium projects since 2021 and these include: the US$422

million deal where Zhejiang Huayou (world's biggest producer of cobalt) acquired controlling rights to Zimbabwe's Arcadia mine [Prospect Lithium (Pvt) Ltd]; the Premier African Minerals Limited joint venture agreement with Li3 Resources Inc to acquire a 50% interest in Premier's lithium assets located in Mutare; the acquisition of a 100% stake in African Metals Management Services and Southern African Metals and Minerals by Hong Kong's Sinomine for US$180 million (Bikita Lithium Mine); and, more recently, the potential acquisition of a Zimbabwean lithium mine between China Natural Resources Inc, Feishang Group Limited and Top Pacific (China) Limited valued at approximately US$1.75 billion.

Just this week, Prospect Lithium's US$300 million spodumene, petalite and tantalite processing plant, widely regarded as the largest in Africa, was showcased as Chinese giant Hayou Cobalt expands its footprint in Zimbabwe.

The 4.5 million tonnes annual capacity plant has already shipped over 30 000 tonnes of lithium concentrates since commercial production began in April this year.

"Prospect Lithium Zimbabwe has so far earned about US$40 million from shipments of 30 000 tonnes of lithium since April and our quest is to become a market leader in the renewable and technologies market hence our commitment to ensure that Zimbabwe is on top of the sector," said Prospect Lithium Zimbabwe chairperson, George Fang.

Red Rock Resources, the UK exploration company, expects to commence test production of lithium in Zimbabwe this year, after acquiring prospects in Bikita and Arcturus last year.

What authorities are doing to boost earnings from lithium

The most significant recent development in the lithium mining space has been the ban on the export of unprocessed lithium imposed by the Zimbabwean government in December 2022. This ban came by way of Statutory Instrument 213 of 2022, otherwise known as the Base Minerals Export Control (Lithium Bearing Ores and Unbeneficiated Lithium) Order, 2022.

In terms of the regulations, no lithium-bearing ores, or unbeneficiated lithium whatsoever, shall be exported from Zimbabwe to another country except with a written permit from the minister of Mines and Mining Development

The government hopes that the ban will, in the long term, unlock more benefits from lithium extraction in the nation through value addition, as it may trigger the relocation to, and setting up of processing firms in Zimbabwe, especially in the manufacturing space.

Source - newshawks

Join the discussion

Loading comments…